Last week I sat in a small conference room with nearly a dozen real estate developers and investors planning a cool new project in Cleveland’s urban core. I was there to add my two cents on a transportation access component of that project. Seated in the corner of the room was another guy, representing a lending institution that provides equity from one of the many fast-growing Opportunity Zone Funds.

The developers began to discuss how tall the apartment building component of their project should be. They agreed to add that question to their yet-to-be-undertaken feasibility study. The guy from the O-Zone Fund lender said in so many words “Whatever you come up with, let me know. There’s going to be more than enough funding for your O-Zone piece of the capital stack.”

In recent decades, scraping together enough equity for projects in all but a few land uses in all but a few sub-markets in Greater Cleveland has been something akin to a scavenger hunt. The capital stack for projects usually ended up looking like a cross section of baklava. While capital stacks still contain multiple layers, the private equity layer is thicker than it used to be, with O-Zone funding representing a way to expand the private sector contribution.

For those who don’t yet know, under the 2017 federal tax overhaul, Opportunity Zones are designated census tracts with an individual poverty rate of at least 20 percent and a median family income no greater than 80 percent of the area median. These areas will be eligible for Opportunity Funds to invest in economic development to receive a 10-year federal capital gains tax break. Up to 25 percent of eligible tracts can be designated as O-Zones. Ohio recommended a maximum 320 out of 1,280 eligible census tracts.

Greater Cleveland’s O-Zones include many urban core tracts that are already experiencing high levels of investment. They were designated because the state wanted to maximize the investment in and near O-Zones within its 10-year window. But cities like Cleveland, which has some of its hot neighborhoods (downtown, Ohio City, Tremont, University Circle) included in O-Zones, want to make sure this program doesn’t neglect the low-income population it was designed to benefit. So it is encouraging that 20 percent of residential units in a given development be set aside as “affordable.” In Cleveland, developers are finding those rents aren’t all that much lower than market-rate rents.

Increasingly, real estate project meetings in Cleveland have an O-Zone guy sitting in the corner of the room, offering a pipeline to equity that simply did not exist before. A recent article at Cleveland.com noted that, thanks to the O-Zone program, “the floodgates are about to open.”

Now, projects that many Cleveland-based construction crane aficionados could only dream about before are now seeing movement. Like what? Consider these large-scale projects in Cleveland’s O-Zones (it is not known if all of these are or will directly receive equity via O-Zone funds):

Market Square (Ohio City – West 25th and Lorain): The Forest City will soon be home to the tallest wood timber frame building in the United States thanks to Harbor Bay Real Estate Advisors. A new 10-story office building will be flanked by a seven-story apartment building, built next to the Ohio City rail station on the Red Line linking the airport, downtown and University Circle. Construction is due to get underway this summer.

|

| Public and private financing, possibly including Opportunity Zone equity, is finalizing the capital stack for Stark Enterprises’ nuCLEus development in the Gateway District (Stark). |

NuCLEus (Downtown – East 4th between Prospect & Huron): Demolitions are slated to begin by fall by Stark Enterprises to prepare for the construction of two 24-story towers — one for residential and the other for offices. Although the project was scaled back from a 54-story tower, the increased liquidity of equity markets, thanks to O-Zone funding, will likely aid this long-planned project.

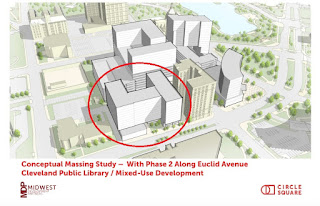

Circle Square (University Circle – 10601 Euclid Ave.): Plans for Library Lofts, representing the second phase of the multi-block City Square development by Midwest Development Partners, are now making their way through the city approvals process. If approved, construction on the apartment building, topping out at 8-11 stories, could begin by year’s end, a source says. The development includes a new Cleveland MLK Branch Library to free up its current library site for a future development phase. The first phase involved Orlean Co.’s $16 million renovation of the 13-story Fenway Manor apartments that began in 2018.

Cleveland City Club Apartments (Downtown – 720 Euclid Ave.): Two sources say this is going to be a high-rise apartment building in the 17- to 20-story range. The scale of this proposed development is comparable to that of City Club’s apartment projects in other Midwest cities. It is possible that construction on this project could start by the end of this year or early next year.

| An updated rendering of Akara’s Kenect Cleveland apartment building, sans movie theater, in the Wolstein Group’s Flats East Bank development downtown (Akara). |

Kenect Cleveland (Downtown – 1155 West 11th St.): When the Wolstein Group wraps up construction of several riverside restaurants in the first part of Phase 3 of its Flats East Bank development, look for it to proceed with construction of the second half of Phase 3. This includes a 12-story apartment building and shops in partnership with Chicago-based Akara Partners. That means construction should start early next year.

| In Cleveland’s fast-growing University Circle, a new apartment building up to 10 stories tall may rise on the current site of the Centers for Dialysis Care (Google). |

Infinium (University Circle – 11717 Euclid Ave.): A source says that the Finch Group seeks to build an 11-story 133-unit mixed-income apartment building with 32 townhouses, ground-floor retail and a parking deck at the site of the current home of the soon-to-be-relocated Cleveland-East facility for the Centers for Dialysis Care. The property is owned by University Circle Inc. There is no timeline for development yet but it could be in the next 12-18 months.

Thunderbird (Scranton Peninsula – 2000 Carter Rd.): This large, 22-acre site is being developed in 2- to 8-acre chunks and heavily marketed for O-Zone funding. Although Great Lakes Brewing Company’s expansion here was announced first, the first development will likely be the repurposing of a vacant industrial building at 1970 Carter with offices, called The Avian at Thunderbird. Also, the NRP Group of Cleveland is reportedly taking a 7.44-acre parcel to develop a parcel called Lot A with 300+ apartments. Lastly, Hemingway Development may be seeking to build offices, shops and waterfront parks here.

Bolivar-9th condos (Downtown – 2173 East 9th St.): A source says that a skinny residential tower, perhaps upwards of 10 stories tall, could be built on this site. Downtown Investment Group LLC, a Geis Companies affiliate, bought the former New York Spaghetti House and razed it for future development. Although there is not yet a timeline for this project, the city in 2015 gave Geis permission to use the property for a parking lot for up to five years.

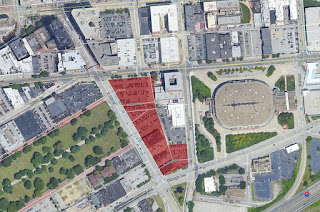

Prospectus 14 (Downtown – 1412 Prospect Ave.): Throughout its history, the Frangos Group has focused on parking as its core business. But the firm is widening its horizons by pursuing more real estate development opportunities, including on its 3.32 acres of land it has acquired in an angular block in the Campus District. Sources say a large development is in the works here, including possibly a high-rise apartment building.

Those are Cleveland’s largest developments not yet under construction which are benefiting or could benefit from Opportunity Zone financing. This doesn’t include two projects I wrote about just last week in my article Developers discover Midtown’s other axis. And, as with my opening example, there are more projects in the early stages of planning that might offer buildings about 10 stories tall, give or take a couple of floors, whose developers don’t yet have site control. Hopefully I’ll be able to share news about them soon.

END