Legislation that would aid Ohio real estate megaprojects and create thousands of jobs could advance in the Ohio House of Representatives next month, according to a spokesman for State Rep. Paul Zeltwanger, chair of the House’s Workforce & Economic Development Committee.

The committee is scheduled to meet again on Feb. 5 to vote on whether to accept a substitute Senate Bill 39 which contains multiple amendments. News and details about those amendments were exclusively reported here at NEOtrans in December.

Six amendments to a proposed Transformational Mixed-Use Development (TMUD) tax credit bill were accepted Dec. 11, 2019 by the House’s Workforce & Economic Development Committee. The committee then adjourned for the holidays.

“The plan is to accept a hopefully final substitute bill for SB 39 on the 5th (of February) that will make all parties reasonably happy,” said Josh Ferdelman, legislative aide to Rep. Zeltwanger. “I can?t make any promises, but we hope to have a final committee vote Feb. 12.”

He added that the committee might not accept testimony at the committee’s Feb. 5th meeting. But if the committee votes to accept the substitute bill, it could take testimony on that amended legislation on Feb. 12 before deciding whether to refer it to the full House for a floor vote.

If the House votes to pass a Sub. SB 39, it sets up a possible conference committee to iron out differences with the Ohio Senate that already passed an earlier version of the TMUD tax credit legislation by a 32-1 vote on June 25, 2019. A still-older version of the bill unanimously passed the Ohio House in 2018 but the legislative session expired before the Senate could act on that version.

Stark Enterprises’ law firm, Thompson Hine LLP, drafted the first TMUD legislation two years ago at Stark’s request. It did so after Stark had attempted other methods of loosening up public-sector capital funding for its mixed-use?nuCLEus development?project in downtown Cleveland.

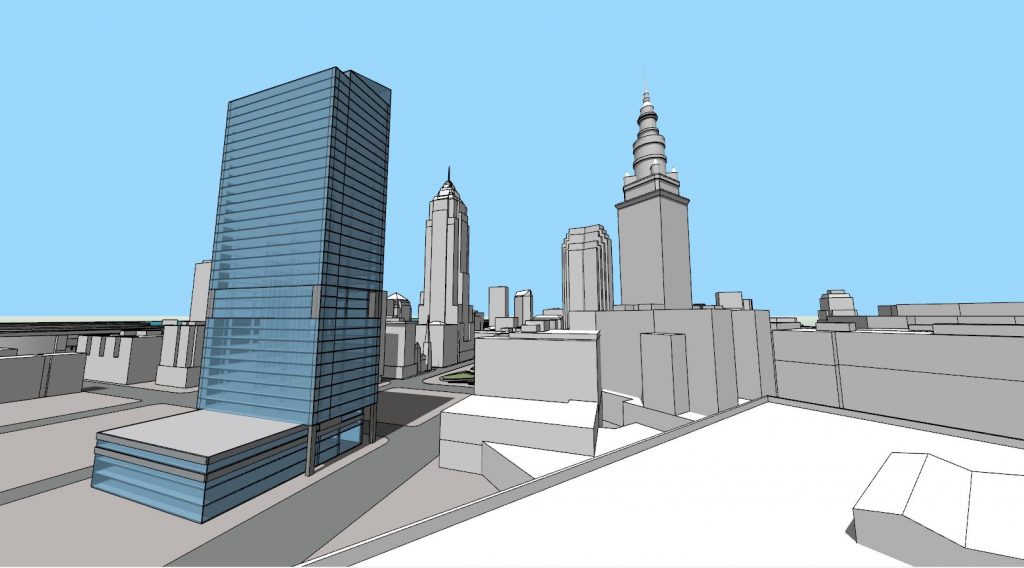

Six years after nuCLEus was first announced, Stark continues to pursue the megaproject that would consist of two 24-story towers. One of those would feature 250 apartments and other 400,000 square feet of offices. They would be built atop a pedestal of 1,300 parking spaces and 80,000 square feet of commercial/retail space.

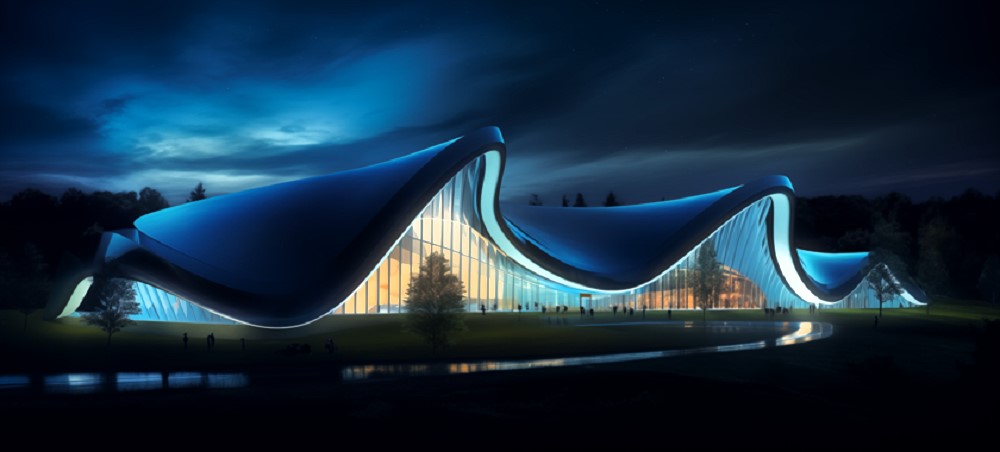

| Stark Enterprises says it needs the TMUD tax credit before it can afford to start construction on its large nuCLUS develop- ment in downtown?Cleveland’s Gateway District (Stark). |

In its promotional materials, Stark says nuCLEus would “serve as a significant connector to other key developments while acting as a catalyst that ‘connects the dots,’ creating a vibrant network of urban energy.” That’s why Stark contends its project should win a TMUD tax credit if Sub. SB 39 is passed.

Ezra Stark, chief operating officer of Cleveland-based Stark Enterprises, acknowledged receipt of an e-mail seeking more information for this article but did not comment.

Stark Enterprises and other real estate developers said in their testimony to House and Senate committees that major developments in Ohio’s larger downtowns cost nearly as much to build as those in larger cities like New York and Chicago. However, Ohio developments command rents that are one-half to two-thirds less.

To offset the cost of “transformational” developments in Ohio, the proposed tax credit would refund to insurance companies up to 10 percent of their investment in TMUDs, as defined by the bill.

TMUDs include projects whose new or to-be-renovated connected buildings are at least 15 stories tall, measure at least 350,000 square feet and contain any combination of retail, office, residential, recreation, structured parking or similar uses.

Numerous business and civic groups testified in support of the bill. They included the Ohio Municipal League, Ohio Mayors Alliance, Ohio Chamber of Commerce, City of Hamilton, Ohio Insurance Institute, NAIOP of Ohio (Commercial Real Estate Development Association) as well as The Millennia Companies of Cleveland and Stark Enterprises.

The only group to testify in opposition to the bill was Policy Matters Ohio, a left-leaning non-profit policy research institute with offices in Cleveland and Columbus.

“Substitute Senate Bill 39 is designed to provide a unique tax credit that will foster mega-development projects that will transform Ohio’s downtowns with new and robust economic development,” said State Sen. Kirk Schuring (R-29, Canton), in recent testimony on the bill.

Sen. Schuring is the bill’s original sponsor. He also submitted the six new amendments that were accepted by the House’s Workforce & Economic Development Committee last month.

Most of the legislation’s changes would link the release of tax credit awards more closely to the amount of state and local taxes generated by the credit, according to a?summary explanation?on the?committee’s Web page.

Specifically, the new provisions in the TMUD bill would limit the director of the Ohio Development Services Agency (DSA), which would administer the tax credit, to approving only four TMUD tax credits per fiscal year. If fewer than four TMUD applications were made or approved, the unused credits would carry over to the next year.

If more than four applications are submitted, they would be ranked by their economic value and transformational impact. The proposed change would give consideration to the new state and local taxes generated from the project and its surrounding area.

A project that has the most significant transformational impact and has a pro forma (or forward-looking financial statement) that shows the most expeditious schedule for the new state and local taxes to exceed the amount of the tax credit, would be the one that is approved.

After the TMUD credit is approved by the DSA director, the project must go into construction no later than one year after it is approved. If it does not, the approved tax credit will be rescinded, according to another amendment.

Another change wouldn’t allow the state to release the 10 percent tax credit to recipients all at once. Instead, the first 5 percent credit would be issued upon the completion of construction. The remaining 5 percent would be issued as evidence is submitted showing the new state and local taxes that were caused by the project and its surrounding area.

If the evidence shows that, after the construction of the project was completed, it already generated new state and local taxes that exceeded the amount of the 10 percent credit, then a certificate for the full 10 percent would be issued.

But if the new taxes do not exceed the amount of the tax credit immediately after the completion of the construction, then the remaining 5 percent will be issued incrementally on an annual basis as evidence is shown that the new state and local taxes generated from the project and its surrounding area exceeds the amount of the additional credit. The incremental increases in the credit will be for a period of up to 5 years.

Lastly, the accepted amendments would increase the existing historic renovation tax credit percentage from 25 to 35 percent for projects in rural areas. And the bill would enhance a variety of rules stipulating how DSA will administer the TMUD program.

END

Thanks Ken for another great article!