UPDATED JUNE 29, 2021

Extension of a new tax credit program intended to boost major real estate developments primarily in Ohio’s largest cities was included in the biennial budget bill passed by state lawmakers tonight. The extension was confirmed by Senator Kirk Schuring (R-29, Canton) who sponsored the original bill that created the tax credit.

The provision was included in a two-year, $74 billion state budget bill hashed out by a six-person conference committee comprised of four Republicans and two Democrats. Both the Ohio Senate and the Ohio House of Representatives passed House Bill 110 by significant, bipartisan margins.

The new Transformational Mixed-Use Development (TMUD) tax credit program offers up to $100 million per year in tax credits over four years to offset as much as 10 percent of a real estate project’s capital costs. Only projects of $50 million or more and that meet other conditions are eligible; no project can win more $40 million in tax credits.

The TMUD program was created by an earlier bill, Senate Bill 39 sponsored by Schuring. It was passed and signed into law last December. That law, which took three years to pass, offered four years of tax credits, from 2020-23. With Ohio’s fiscal year running from July 1 to June 30, the state’s 2020 fiscal year was already over by the time the TMUD law was passed, leaving only three years of tax credits.

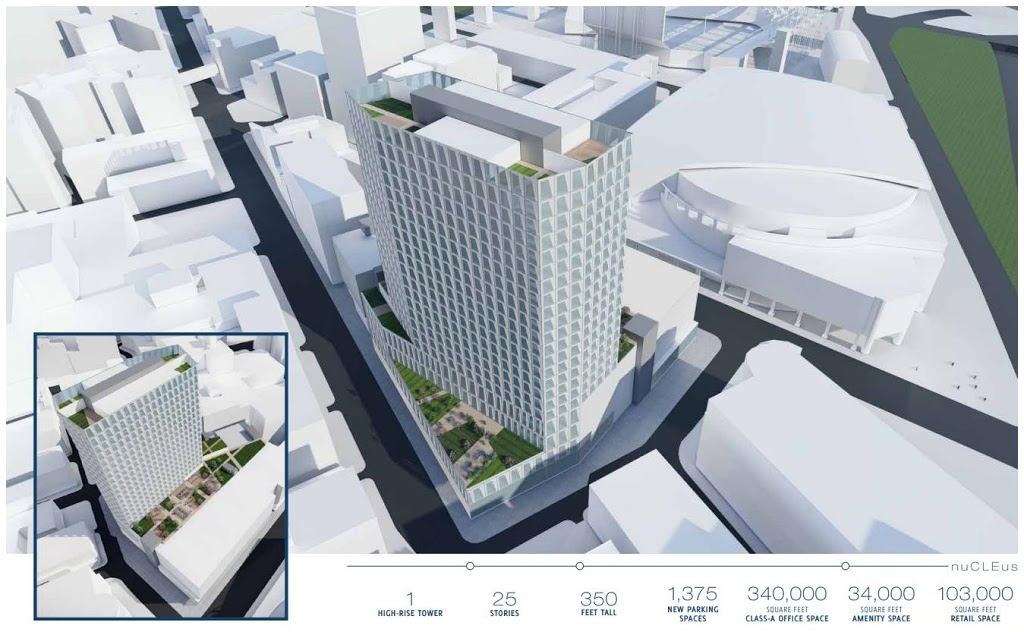

Stark Enterprises sought the TMUD tax credit program to boost its nuCLEus development as well as other new-construction projects in Cleveland’s urban core. With the program maximized per tonight’s vote by the Ohio General Assembly, it remains to be seen in what form this long-discussed project will be submitted for tax credits (Stark).

But in May, NEOtrans broke the news that rulemaking to implement the TMUD program would not be completed by the administering agency, the Ohio Tax Credit Authority, in time to award fiscal year 2021’s tax credits. That would leave only two years and half of the $400 million in tax credits remaining in the program.

In other words, up to $2 billion worth of complicated, costly yet beneficial real estate projects that couldn’t proceed without the TMUD probably wouldn’t happen — unless the law was amended. The new state budget bill passed tonight shifted the four authorized years of the program as starting in Ohio fiscal year 2022 which begins July 1, 2021. The final year of the program is 2025 which ends June 30, 2025.

“We expect the (TMUD) program will launch in the first quarter of fiscal year 2022,” said Todd Walker, chief communications officer for the Ohio Development Services Agency.

If that holds true, TMUD applications will probably start to be accepted by the Ohio Tax Credit Authority sometime between July and September. There are potentially dozens of projects just in Greater Cleveland that could be submitted for TMUD credits with dozens more statewide.

“So we now fulfilled the original goal of the original bill (Senate Bill 39) by offering the four years of credits,” Schuring said in an interview with NEOtrans. “The very nature of it is that it’s a new model, a new paradigm. It’s a partnership with business. Government should receive a return on its investment.”

The extension was hailed by real estate industry officials who said meeting the as-yet insatiable demand for urban core housing in Cleveland calls for access to the maximum amount of TMUD credits. This public funding will help investors and builders overcome Greater Cleveland’s relatively high construction costs and low rents.

“A lot of projects need to bridge gaps in their capital stacks,” said Zak Baris, president of Comprehensive Zoning Services, a real estate due-diligence firm. “There are investors sitting on the fence waiting for the chance to win a TMUD credit. More will have a better chance to win credits with the program extended to 2025.”

He noted that a number of major downtown Cleveland projects are more likely to happen with the expanded TMUD program. That includes nuCLEus whose developer, Stark Enterprises, came up with the idea for the TMUD tax credits several years ago and was based on the historic tax credit that allowed obsolete office buildings to be renovated with housing, hotels and retail.

“This (historic tax credit) program has encouraged our urban areas to preserve their historic buildings, which is what gave our cities their character, and now we need to complement that character with a program that will allow our cities to set the stage for their futures,” said Steve Coven, Stark Enterprises’ vice president of real estate development.

Even some historic renovation projects like The Centennial at 925 Euclid are candidates for the TMUD program. The massive scale of this project and its large amount of space that cannot produce revenues makes it difficult for private lenders to finance. Yet its redevelopment with 868 workforce housing units, retail and office space would be transformative for downtown Cleveland (Millennia).

The TMUD program will also help developers overcome Cleveland’s already high construction costs, made worse by recent rises in materials costs, namely lumber but especially steel.

“In Cleveland, as well as many Ohio communities, financial feasibility is typically difficult to achieve with our current lease/rent levels,” said Tim Jackson, director of Integra Realty Resources – Cleveland. “Add in the rise in construction costs and it’s really a double whammy for Northeast Ohio. These types of megaprojects can be a catalyst for surrounding development and really help improve the immediate area.”

Another provision that would help redevelopment of polluted land, called “Brownfields,” was included in the state’s budget. It has $350 million for clean up of vacant industrial properties in urban areas like Cleveland. Without the funding to clean up brownfield sites, developers might simply look to develop clean-and-green land at the outer edge of metro areas instead.

State Senators Sandra Williams (D-21, Cleveland) and Michael Rulli (R-33, Salem) were sponsors of the Brownfields funding. Similarly, the budget bill passed by both the Senate and House has $150 million for demolishing blighted or nuisance buildings in Ohio.

The state budget bill now goes to Gov. Mike DeWine for his signature. The governor has line-item veto power but he is not expected to remove the TMUD, Brownfields or demolitions provisions as they have enjoyed broad and bipartisan support.

END