This is one of two office buildings for Hyland Software in Westlake that’s on the market. And it’s just one of multiple office buildings that are either for sale or for sub-lease. The peaceful, bucolic-like setting belies the turmoil in the local, regional and national office markets that isn’t limited to downtown central business districts. Suburban areas are taking equally big hits (CBRE). CLICK IMAGES TO ENLARGE THEM.

It’s not just downtowns that are suffering

The numbers are downright ugly. High office vacancy rates and even higher availability rates exceeding 20 percent owing to a big jump in office spaces available for sub-lease. Numerous Class A office buildings are for sale with few if any interested buyers. For those in a buying mood, their lowball interest may be only for the land to hold for a possible conversion to new uses or for the hopes that better days may return to the office market — someday.

But this isn’t post-pandemic Downtown Cleveland being described here. It’s suburban Westlake where the Scott Fetzer Company’s headquarters is about to join an ice-cold office market along with the HQs for Hyland Software and a big chunk of American Greetings’, according to a source familiar with Scott Fetzer’s situation who spoke on the condition of anonymity.

Those are just Westlake’s notable vacancies. There’s plenty more in the West office submarket that has pushed the availability of office space to 21.7 percent, according to CBRE Group’s fourth quarter 2023 market data. Scott Fetzer’s 23,800-square-foot office building at 28800 Clemens Rd. is not included in those numbers from last fall. That 1984-built headquarters, its 20,268-square-foot parking structure and dozens of acres of land are about to go on the market, the source said.

By contrast, Scott Fetzer’s manufacturing buildings and land on Ranney Parkway, just east of Bassett Road, as well as those on Madison Avenue in Cleveland are reportedly not part of the pending offering. An e-mail sent to Scott Fetzer Company seeking more information was not responded to prior to the publication of this article.

For Westlake, the post-pandemic office doldrums hit first and most notably in 2022 when American Greetings put up for sub-lease up to 250,000 square feet of its 625,000 square-foot headquarters at the south end of the Crocker Park lifestyle center. The eight-year-old office building with floorplates of up to 147,766 square feet is owned by Midwest Real Estate Partners of Cleveland.

The space remains available but it has to be for the right tenant and in the right situation, said real estate broker and Cresco Vice President David Leb. “The reality is that American Greetings is not willing to split up the space they are willing to sub lease,” he said.

An adjacent, 93,552-square-foot office building called Tech West that is leased by American Greetings was partially subleased prior to the greeting card and personal expressions maker’s 2022 HQ sublease announcement. Another 25,000 square feet remains available in the Tech West building. It shares the 1 American Blvd. address with American Greetings’ headquarters.

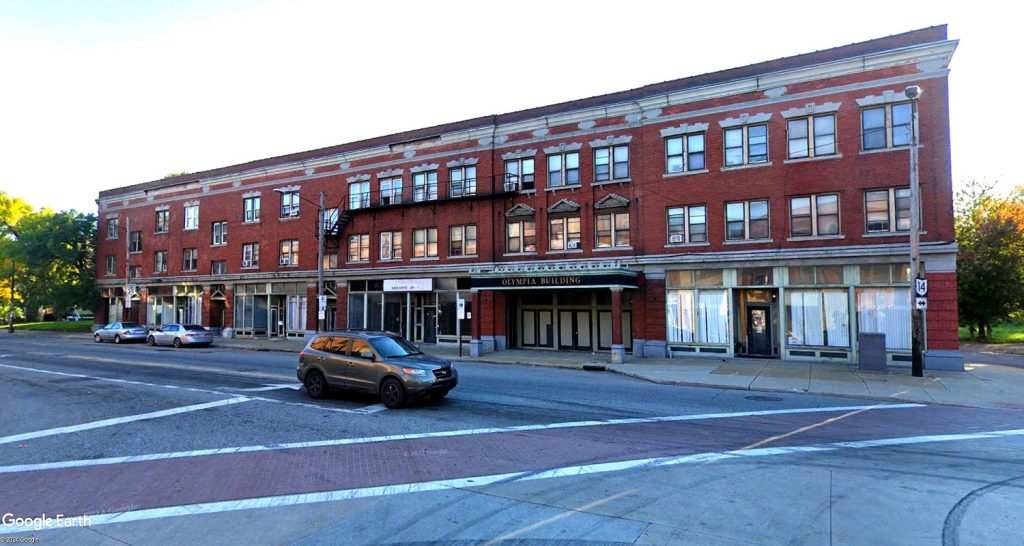

Then, last year, Hyland Software announced it was selling its two 1982-built Class A office buildings totaling 203,856 square feet and 36.5 acres on both sides of Clemens, next door to Scott Fetzer’s HQ. Building 1, located at 25800 Clemens, measures 134,298 square feet while across the street is Building 2, a 69,558-square-foot structure at 25801 Clemens, according to an offering memorandum from CBRE.

Built brand-new in 2016, American Greetings’ 625,000-square-foot headquarters at Crocker Park in Westlake is as modern and as filled with creature comforts as any office can be, including a central courtyard and a Starbucks coffee shop inside the building. But that wasn’t enough to keep the greeting card maker from putting 40 percent of its offices up for sub-lease (Cresco).

Hyland is retaining the 1999-built former Five Seasons Sports Club, 28105 Clemens, that the software company acquired and renovated as offices in 2013, county records show. That 24.4-acre property contains three office buildings totaling 184,174 square feet.

“I think the interesting thing you see is that many people think the suburbs are going to be saved from the office meltdown and this indicates that this is not the case,” said Terry Coyne Newmark, a vice chairman in brokerage Newmark’s Cleveland office. “Downtown is suffering but it’s not alone. This is the indicative of the trend of work-from-home and it’s affecting every place. But Westlake is becoming a bloodbath.”

It’s certainly not the only suburban submarket to get bloodied. In fact, CBRE data shows the South submarket is getting crushed the worst; its availability (for lease and sub-lease) is 30 percent. Within that submarket, the high-profile Rockside Corridor in Independence is getting hit with a nearly 25 percent availability rate.

The only office corridor worse off is the Lander Corridor in Beachwood-Mayfield Heights where it saw a 25.4 availability rate last quarter. Although the East submarket as a whole was doing better at 17.4 percent, thanks to the high-performing Chagrin Corridor’s 15.6 percent availability rate.

By comparison, downtown’s central business district Class A and Class B office properties were both about 24.3 percent available. Downtown’s Class C properties were not listed by CBRE, but most of those are candidates for getting to converted to residential or hotel uses anyway. Such conversions are not likely for most suburban office buildings.

With so much office inventory on the market and so little demand for it, Coyne said it was difficult to envision them staying as offices. Possible conversions to new uses are similarly difficult but not impossible to attain.

“The small space (office) market might be protected,” he said. “I could see co-working being a possibility. And I could see full or partial demolitions and reuse as data centers, light industrial use or warehouses since some of these offices have high ceiling heights.”

Michelle Boczek, the city of Westlake’s economic development manager, didn’t respond to an e-mail from NEOtrans seeking more information about Westlake’s office market or how its office inventory could be filled or repurposed.

END