|

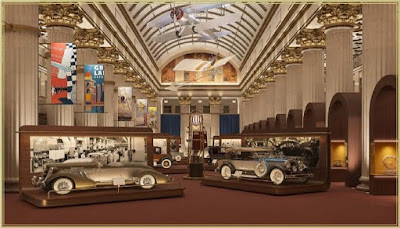

| This scene could become much more common in Ohio’s largest cities thanks to a megaproject tax-credit program signed into law today by Ohio Gov. Mike DeWine (MBN). |

In the coming decade, the state bird of Ohio may well be the construction crane.

That’s especially true in Ohio’s six largest metropolitan areas where more than two-thirds of Ohioans live. That’s because Ohio cities of more than 100,000 population, and places within 10 miles of them, will be the sites of megaprojects receiving anywhere from $240 million to $320 million in Transformational Mixed Use Development (TMUD) tax credits in the next few years.

The reason is Ohio Gov. Mike DeWine today signed into law Substitute Senate Bill 39, authorizing the creation of the TMUD tax credit program. Now it will be up to the Ohio Tax Credit Authority (OTCA) to formulate rules for the administration of the program and offer the first issuance of tax credits possibly by summer 2021.

There are literally dozens of major real estate development projects just in the city of Cleveland that could be eligible for the TMUD tax credit. If they’re awarded credits, the projects could create tens of thousands of new jobs and help bring many more residents and commercial tenants into the city. An inventory of these potential Cleveland-area projects was covered recently by NEOtrans.

The Ohio General Assembly passed Sub. Sen. Bill 39 earlier this month.

Property owners pursuing a TMUD can request a tax credit equal to 10 percent of the estimated development costs for the project. Also, an insurance company can request a tax credit equal to 10 percent of its capital contribution to the TMUD project.

In either case, the amount cannot exceed $40 million per TMUD. If both a property owner and an insurance company investor seek a tax credit for the same project, the property owner will receive a tax credit minus any estimated credit amounts that have been preliminarily approved for insurance companies contributing capital to the project.

There will be at least three years of tax credits and $80 million of tax credits authorized per for year for Ohio’s six largest urban areas, or $240 million total. Another $20 million per year will be available for development projects in smaller cities. The program is due to sunset June 30, 2023.

The bill’s lead sponsor, State Sen. Kirk Schuring (R-29, Canton), notified NEOtrans that the governor had signed the bill. Schuring said the law can always be extended past 2023 if the TMUD program proves successful.

“It’s called the Ohio Revised Code, which means we can make changes to it,” Schuring said.

It is also possible that the bill’s entire four years of tax credits totaling $400 million could be issued, including those in the program’s first fiscal year 2020 that ended June 30, 2020, Schuring said. There are at least two reasons why.

First and foremost, Sub. SB 39 states that “unused tax credits can be carried forward for five years.” Second, the Ohio Constitution allows for it, despite Article II, Section 28 which states that “The general assembly shall have no power to pass retroactive laws, or laws impairing the obligation of contracts.”

But Section 28 goes on to say that lawmakers “may, by general laws, authorize courts to carry into effect, upon such terms as shall be just and equitable, the manifest intention of parties, and officers, by curing omissions, defects, and errors, in instruments and proceedings, arising out of their want of conformity with the laws of this state.”

| Projects the scale of Flats East Bank’s future phases might now go from the drawing board to groundbreaking thanks to the passage of the TMUD program (DCA/Wolstein). |

This was enforced in 1988 when, in Van Fossen v. Babcock Wilcox Co., the Ohio Supreme Court said a statute is presumed to be prospective in its operation unless expressly made retrospective. Sub. SB 39 is a substantive law (ie: not remedial) in that, when unused tax credits are carried forward from an earlier fiscal year. It does not impair or take away a vested or substantive right or impose new or additional burdens, duties, obligations or liabilities as to a past transaction. The tax credits will all be new transactions.

“I think your assumptions are right,” said a NEOtrans source who is a practicing attorney on real estate matters but chose to stay off-record. “But I also think this will lead to some litigation that may clarify.”

“We’ll be watching the (OTCA’s) rulemaking,” Schuring pledged.

The originator of the TMUD tax credit, Bob Stark, CEO of Stark Enterprises, said he didn’t have the legal expertise on this matter to offer an opinion, although he received a juris doctorate at Case Western Reserve University School of Law.

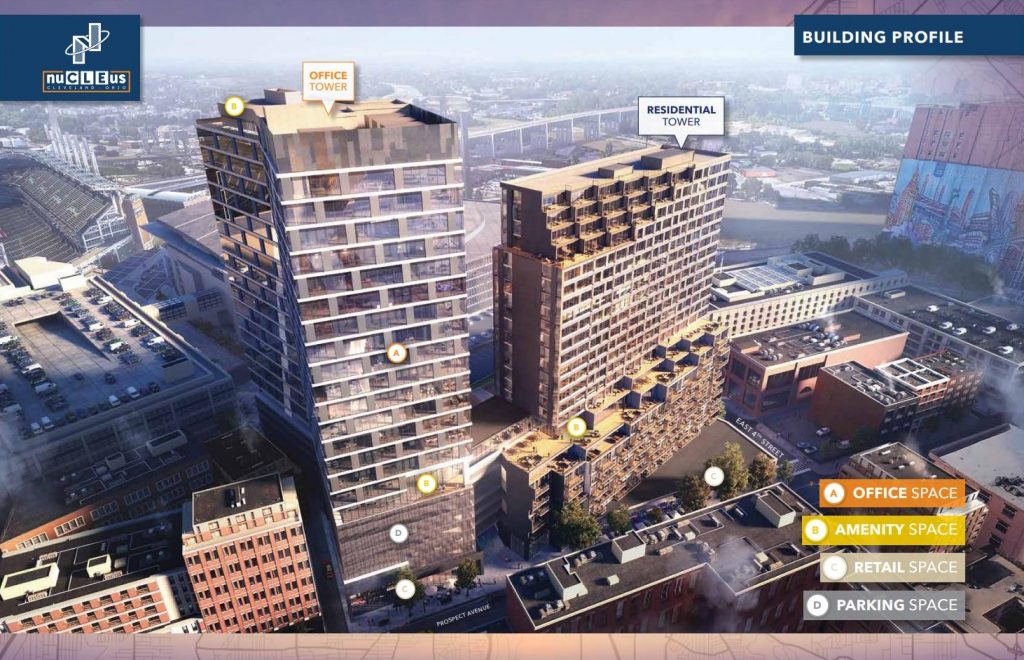

Stark sought the TMUD tax credit to fill a gap in his firm’s capital stack for the roughly $300 million nuCLEus project, proposed to rise in Downtown Cleveland’s Gateway neighborhood. The project has gone through several revisions, the most recent of which would offer a 25-story office tower over a pedestal of parking and retail.

Between now and June 30, 2023, hundreds of millions of dollars worth of public-sector capital investment will be directed to Cleveland, Columbus, Cincinnati, Toledo, Dayton and Akron and their immediate hinterlands. Those are Ohio’s cities with populations of 100,000 or more and the suburbs within 10 miles of each.

Projects like the 26-story North Market Tower in Downtown Columbus, the 20-acre Cincinnati Innovation District in the city’s Walnut Hills neighborhood and potentially dozens of projects in Cleveland and its inner-ring suburbs could all see significant investment from the TMUD tax credit program.

These and other projects and their backers look to public subsidies to overcome stagnant rents and high land development costs on vacant or underutilized properties in Ohio’s largest cities where everyone from public officials to private investors want to attract jobs and residents.

“Our public-sector clients in Ohio are often presented with challenging sites that have immense potential for catalytic redevelopment, but are inhibited by physical constraints and market forces beyond their control such as aging, antiquated infrastructure, environmentally contaminated parcels, and a loss of manufacturing employment,” said Emil Liszniansky, principal, Envision Group LLC in his SB 39 testimony last year to the Ohio House of Representatives’ Economic and Workforce Development Committee.

“Redevelopment projects of this magnitude require not only an ambitious developer with foresight and committed financing, but also government assistance at multiple levels,” he added. “Our experience is that transformative projects in Ohio, especially in aging industrial cities, do not generally occur without layered public subsidy. In the absence of government assistance, these sites often sit vacant for years.”

“Having more tools in the tool kit will help,” said MidTown Cleveland Executive Director Jeff Epstein. “I’d have to see the details in the final version (of the TMUD bill) but it certainly could help with some things that are on the drawing board.”

“It (the bill) offers a 10 percent tax credit to development projects that will be catalytic and truly transformational to the area where they’re located,” Schuring said. “To that end, the House added some of amendments that I think are beneficial to that endeavor because we want it to be a net tax gain.”

“It’s a new paradigm in doing tax credits,” Schuring continued, “so that when we have a developer who says that he or she is going to do a megaproject, we’re asking them to show, demanding that they show to a pro forma that they’re actually going to generate more new taxes and is reflected in the (tax credit) certificate.”

Rather than getting an automatic 10 percent tax credit upon the completion of the project, the developer or the insurance company investor will get 5 percent at the outset. Then, the investor may receive the remaining 5 percent incrementally as the new taxes come in from the project. The investor will have to document a gain in local tax revenues in order to secure the remaining tax credit.

Ohio’s unfortunate urban-rural/exurban divide briefly reared its ugly head at a Dec. 9th Senate session, verbalized by Sen. William Coley II (R-4, Liberty Twp.). The Senate voted at that session to concur with an Ohio House-amended version of the bill and forward it on to the governor for his signature.

“I regretfully cannot support this bill as the the project definitions with the bill are so specific as to exclude anything in my district in fact anything in most of your districts,” Coley said. “While I appreciate the intention of the bill, I believe that by making it so prescriptive as to help certain projects and certain people’s districts if it works to the detriment of the rest of Ohio and thus defeats the very purpose of the bill.”

The Southwest Ohio lawmaker was joined by Sen. Kristina Roegner (R-27, Hudson) as the only two senators to vote against the bill. Before that vote, Sen. Matt Dolan (R-24, Chagrin Falls) quickly rose up on the senate floor to speak in defense of the TMUD tax credit.

“In some respects, he (Colely) is right about this bill,” Dolan said. “This bill is not designed to be in most of our districts including mine. This bill is designed to bring massive projects into our urban areas.”

He said it would be erroneous to suggest that the benefits to Ohio will go no further than its largest cities if they get a TMUD project as a result of the new tax credit program. New residents, businesses and jobs would come to Cleveland, Columbus, Cincinnati, Dayton, Toledo and Akron, he explained.

“We’re not really understanding how economies grow and how states grow,” Dolan continued. “This is designed for a specific type of project, not for a particular project, but a type of project which will not only pay for itself thanks to the good work of Senator Schuring but will drive the economy of our urban areas which will benefit all of Ohio.”

END

- New downtown park with basketball court fast-tracked

- Michael Symon joins River Roots’ move to Flats

- Tenant ID’d for big new industrial development near Hopkins airport

- $119M Lakewood Common project goes vertical

- CWRU to renovate, expand one of its most historic buildings

- Master Chrome coming down, cleaning up