|

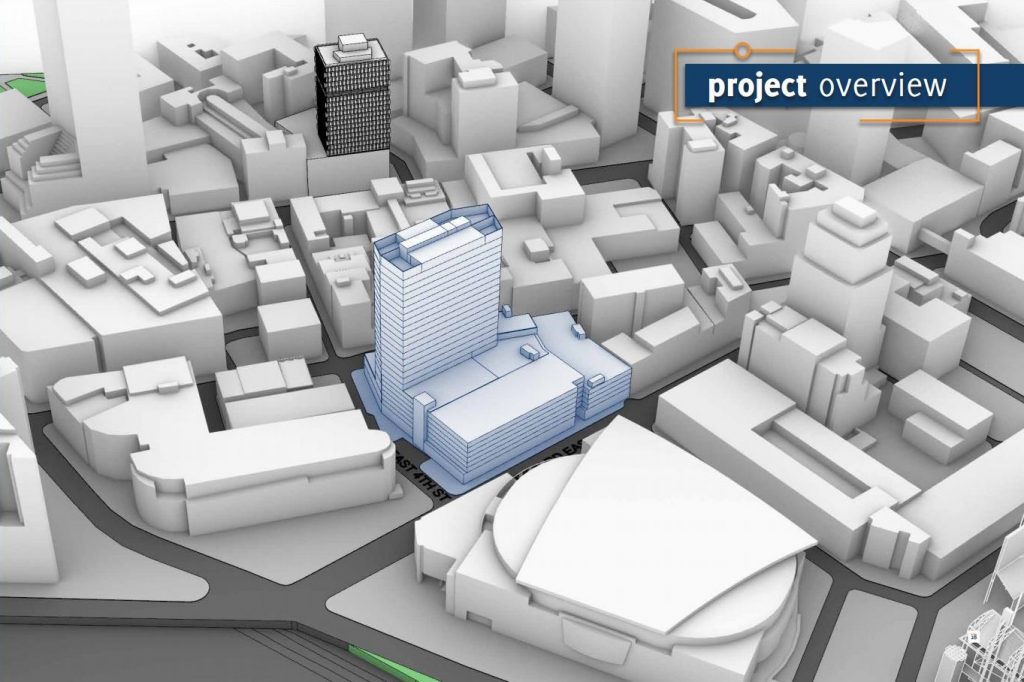

| NuCLEus was proposed by a partnership of Stark Enterprises and J-Dek Investments five years ago, but appears no closer to seeing construction (KJP). CLICK IMAGES TO ENLARGE |

The latest word on the proposed $350 million nuCLEus development is that its partnership appears to be waiting on the Ohio General Assembly’s passage of a new financial incentive. That’s according to a source with the City of Cleveland. Others in the real estate investment community confirm that the project is on hold.

The apparent decision to wait on the State of Ohio by the partnership, called Gateway Huron LLC, comprised of Stark Enterprises and J-Dek Investments Ltd., means that the project could be on hold for two to three years. The project was first announced in 2014.

That financial incentive is a so-called transformational tax credit, Senate Bill 39. It would create a new tax credit to incentivize the construction of transformational mixed-use developments (TMUD) in Ohio. NuCLEus would likely qualify, but it’s not that simple.

NuCLEus is proposed to feature two 24-story buildings, one for residential and the other for offices, atop a muli-story pedestal of parking and retail between Prospect Avenue and Huron Road at East 4th Street.

According to Thompson Hine LLP, which helped draft the bill at the request of Stark, for a development to be considered a TMUD it must include a mix of land uses, have a development cost of more than $50 million and be 15 or more stories in height or at least 350,000 square feet.

The bill authorizes a nonrefundable insurance company tax credit of up to 10 percent of total eligible project costs for contributions of capital to eligible projects. The legislation still has to pass both the Ohio House of Representatives and the Ohio Senate in the same legislative session, then be signed into law by the governor.

Assuming that happens, it still doesn’t guarantee that nuCLEus would be one of the certified TMUDs. Ohio’s next biennial appropriations (budget) bill would have to authorize the number of TMUD credits the state will allow per year. Ohio just passed a biennial budget law this summer. The next one won’t be passed until June 2021. A “budget corrections bill” is often passed in the intervening years, however.

So even if the number of credits is authorized in the budget corrections bill next year, nuCLEus would have to be one of the limited number of projects certified months later by the state’s Director of? Development Services. Just because Stark staff thought of the TMUD credit, doesn’t guarantee that nuCLEus would be among those chosen to receive one.

Ask developers John Carney, Bob Rains and David Goldberg who urged the creation of a $25 million Catalytic Historic Tax Credit to help finance their planned renovation of the May Co. building in downtown Cleveland. But their development project got passed over twice for the credit and ended up having to resort to a special earmark three years later?at the conclusion of the program.

Ironically, the TMUD tax credit legislation has passed both the Ohio House and the Ohio Senate. It just hasn’t done so in the same legislative session. House Bill 469 was passed by the House?91-0 in June 2018. But the term of the 132nd General Assembly expired at the end of 2018 before the Senate could pass it.

So in the 133rd General Assembly, Senate Bill 39 was introduced by Sen. Kirk Schuring. The Senate passed the nearly identical TMUD legislation by a 32-1 vote in July. The legislation was then introduced in the Ohio House and referred to the?its Economic and Workforce Development Committee. No committee hearings have been scheduled for the remainder of the year?but that can and probably will change.

Even if SB39 becomes law by year’s end, the number of TMUD credits per year still has to be authorized by a budget bill sometime thereafter. Then, hopefully nuCLEus would win one of the TMUD credits perhaps as early as 2021 — seven years after the project was first announced.

NuCLEus’ prospective anchor tenant,?Benesch Friedlander Coplan & Aronoff, has been remarkably patient. In 2015, it agreed to occupy 66,500 square feet in nuCLEus’ office building, estimated to measure 400,000 square feet. A 250-unit residential building also is proposed.

Stark has attempted different public financing schemes to help pay for nuCLEus’ construction costs. They included a tax-increment financing scheme involving the school district in 2017 when nuCLEus was proposed as a 54-story tower. Earlier this year, Stark sought a $12 million forgivable loan from the city. Neither scheme won acceptance.

| These are the proposed uses in the two towers, representing Stark Enterprises’ current plan for nuCLEus (Stark). |

Ezra Stark, chief operating officer, of Stark Enterprises did not respond to two e-mails seeking comment for this article. But he recently chided the City of Cleveland for its “localism” and “stubbornness” in not embracing innovations in?a recent blog.

As an example, Stark cited the city’s blocking of the introduction of Bird electric scooters which had chosen Cleveland among its first 100 cities for its e-scooters. Despite that the scooters would improve the city’s quality of life, Stark said “bureaucratic red tape, political posturing and a very unfortunate accident” kept Bird from introducing them here for many months.

Earlier this summer, Stark said he would not comment on the status of demolitions involving nuCLEus, citing a “delicate” political matter involving the city.

In related news, on Sept. 6, the City Planning Commission unanimously tabled a request by Stark Enterprises to demolish its vacant Herold Building,?310 Prospect Ave., next to the proposed nuCLEus site.

It did so a day after the commission’s Design-Review Committee voted 7-3 against the demolition. The committee’s vote was only advisory whereas the commission’s vote would have been binding.

Stark asked the commission to table its request following the committee’s negative recommendation so that it could work with the Historic Gateway District?on seeking tax credits to renovate the building. The demolition was proposed in response to the city’s condemnation of the Herold Building due to its many building code violations.

Rebecca Molyneaux, vice president of development at Stark Enterprises, told the committee it would cost $6 million merely to address the code violations. It could cost another $1 million to mothball the structure or millions more to renovate the building into a marketable property.

The committee on Sept. 5 offered to table Stark’s demolition request but Stark initially refused. The committee then advised the Planning Commission to deny the demolition at its meeting the following day. At the Planning Commission meeting, Stark finally agreed to table its request.

Stark inherited the Herold Building as part of a larger portfolio of properties it acquired in 2014 from L&R Group of Companies for $26 million. L&R also tried to demolish the Herold Building but was rebuffed by the city. It discovered that it is extremely difficult to demolish a building in a designated Cleveland historic district.

That portfolio not only included the 3-acre parking lot where nuCLEus is proposed to rise, but also a 2.33-acre parking lot at West 9th Street and St. Clair Avenue. The latter site is reportedly involved in discussions for a possible high-rise residential development.

Stark also has experienced delays in Downtown Pittsburgh in trying to develop the $63 million?Smith & Fifth project, previously called the Icon on Smithfield. The project would renovate the former Frank & Seder department store into apartments over restaurants. Stark bought the property nearly three years ago.

The start of construction has been postponed further, now expected to start in early 2020. The delays in developing the vacant building have become a source of impatience for some, according to an August article in the Pittsburgh Post-Gazette.

END

Just give it up already sell the land to someone who's going to get something built there ?

Who's to say the next developer wouldn't take many years to make a project happen? With Cleveland rents trying to offset Chicago/NYC construction costs, it probably will take many years and lots of public financing. But they don't have to announce their intentions and create expectations upon purchasing the property…

Why are Cleveland construction costs as high as New York and Chicago? Is it something with the State of Ohio?

Prevailing wages.