In two years, construction may be underway in downtown Cleveland for as many as a half-dozen towers. And that doesn’t count all that are in pre-development. If you did, there would be at least 13 towers under consideration.

Starting this summer, construction is due to start on the City Club Apartments, followed by the new Sherwin-Williams headquarters, a probable Justice Center Courthouse tower and as many as three more towers that have yet to be announced but are in pre-development with significant financial backing.

And that doesn’t count major renovation projects that could also be occurring in the next year or two like the 21-story Union Trust Building to be renovated as The Centennial, the 22-story 55 Public Square, 16-story Rockefeller Building and 11-story Baker Building. All are subject to pending renovations and/or possible sales.

Lurking in the shadows of the half-dozen new-construction, potentially imminent towers are a pair of proposed buildings. Many people aren’t talking about these two proposed 24-story towers anymore. They are the towers in Stark Enterprises’ and J-Dek Ltd.’s nuCLEus development.

One reason why people aren’t talking about nuCLEus now is because people apparently have grown tired of talking about it in the future tense. It was on everyone’s hot-topic list 5-6 years ago and was considered for multiple public financing ideas. Each of those ideas ultimately fizzled.

During that time other projects came to the fore, including Stark’s own 29-story Beacon tower it finished last year, Playhouse Square’s 34-story Lumen that will be completed this year and all of the other planned towers mentioned above.

But nuCLEus shouldn’t be written off despite its many fits and starts.

Stark Enterprises created new intrigue about nuCLEus Feb. 7 with a Twitter exchange instigated by Sherwin-Williams’ headquarters news. Stark Enterprises congratulated Cleveland’s 154-year-old corporate citizen and its hometown.

“Great news! Congrats to @SherwinWilliams and @CityofCleveland. The future is looking very bright in CLE! #ItsAllHappeningHere” Stark’s official Twitter account tweeted.

In response, self-described Cleveland fanatic Mitch Rackovan tweeted to Stark “Your turn! #nuCLEus” which netted a cryptic reply from Stark Enterprises: “#StayTuned.”

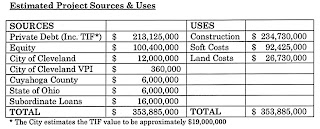

Maybe we should be talking more about nuCLEus. Or, at least, maybe we shouldn’t stop talking about this $354 million development on East 4th Street between Prospect Avenue and Huron Road.

That project, like the new Sherwin-Williams HQ or the City Club apartments, would do their civic duty by obliterating visual blights on our downtown cityscape — those hated, lifeless surface parking lots.

NuCLEus still has life because, among all the public financing schemes that Stark has floated, one of those schemes could be a couple of months away from becoming a reality. And it could help spark real estate developments in big and small cities throughout the state.

The Transformational Mixed-Use Development (TMUD) tax credit, or Substitute Senate Bill 39, is designed to encourage insurance companies to invest in Ohio real estate megaprojects.?It would do so by refunding to insurance companies up to 10 percent of their investments in TMUDs.

Backers say the credits are justified in this state which has skyscraper construction costs nearly as high as those of New York City and Chicago but lacks their high rents to offset those costs. More on that later.

Sub. SB39 is pending before the Ohio House of Representatives’ Economic and Workforce Development Committee chaired by State Rep. Paul Zeltwanger. His legislative aide, Josh Ferdelman, said that the bill is likely to move forward following recent agreements among committee members. Those agreements resulted in significant changes to the bill that were accepted at a committee hearing Feb. 5.

The committee has scheduled another hearing Feb. 12, to accept possible amendments, testimony and comments by interested persons. It will be the committee’s seventh hearing on the TMUD bill. Zeltwanger probably won’t ask the committee to refer it to the full House for a vote next week because there are too many changes to the bill to move it that fast.

But it is possible the bill may be referred to the full House for a vote the week after. The full House likely won’t vote on the TMUD bill until after the March 17 primary election, said a source who spoke off the record.

The substitute bill would authorize up to $100 million in credits in each state fiscal year ending June 30 in 2020, 2021 and 2022. It remains to be seen if the bill moves fast enough to authorize and implement the 2020 round of tax credits. Having three rounds of awards instead of just two would increase the chances for Stark and others to win a TMUD credit. The bill would allow credits of up to $40 million per application.

But time is of the essence. If the House passes this substitute bill, it will be significantly different than the one the Ohio Senate passed last year 32-1. Yet the source said there would be a conference committee only if the Senate rejects the new House amendments.

Since the House leadership is already working with the bill’s lead sponsor Senator Kirk Schuring (R-29, Canton), there apparently is little chance of a conference committee, the source added. That will save weeks or possibly months of time.

The legislation can be effective by June 30 if it goes to Gov. Mike DeWine for his signature before April 1 and he promptly signs it, according to the source. But the Ohio Tax Credit Authority, which would administer the tax credits per the substitute bill, still has to issue application rules before inviting requests for the credits.

So the clock is ticking if Stark and other developers hope to tap into the first $100 million worth of credits before the end of the current fiscal year.

Ezra Stark, Chief Operating Officer of Stark Enterprises, did not wish to comment on the pending bill or if his firm supports the significantly amended version now pending in the committee.

Rep. Mike Skindell (D-13, Lakewood) sought the addition of the $100 million cap on annual credit awards and a June 30, 2022 termination date of the TMUD tax credit program. He noted that, without the cap, the TMUD credits could incur as much as a $500 million hit to the state’s budget per year.

And without the termination date, the TMUD credits would have no sunset to them or lack the possibility of review if the General Assembly wishes to continue the program beyond 2022 in some form. Skindell is a member of the Economic and Workforce Development Committee.

| This rendering of nuCLEus shows the layout and location of the proposed development, looking southward (Stark). |

“We (at the state level) have $9 billion worth of tax credit incentives available right now,” Skindell said. “There’s no review or sunset to them and no accountability as to whether they’re doing what they’re supposed to being doing.”

In response to questions by House committee members after his testimony Oct. 23, 2019 in support of the TMUD bill, Millennia Companies CEO Frank Sinito rattled off a list of public incentives his firm is receiving or expects to receive to help facilitate development of The Centennial in downtown Cleveland. Those include historic tax credits, Opportunity Zone financing and others. Millennia also may be seeking low-income housing tax credits to provide workforce housing.

One might ask is: how are other Cleveland skyscrapers getting built without the TMUD credit?

Stark put the Beacon apartments on top of an existing 524-space parking garage that was built in 2005 for $25 million but was bought by a partnership of Stark and investor Reuven Dessler in a post-recession, post-bankruptcy sale for $8 million, saving the partnership more than $17 million from having to build its own parking deck for Beacon.

Playhouse Square tried getting for-profit real estate developers to build The Lumen. None would touch it due to Cleveland’s big-city construction costs and its mid-market rents. So the nonprofit Playhouse Square Foundation, which has real estate development experience in renovating and augmenting theaters, decided to take on the project itself, saving many millions of dollars.

Sherwin-Williams will build a new office tower for itself. It’s not going to be leasing it out to anyone. And sources say the global coatings firm is probably going to limit the building’s height to save construction costs. Building higher than 30 stories means having to dig caissons about 200 feet down to bedrock to support a larger tower’s weight.

Meanwhile, the City Club Apartments, like Beacon, will share an existing parking garage that’s filled with office workers’ cars during the day but is mostly empty at night. City Club Apartments is proposed to be built at 720 Euclid Ave.

Additionally, the City Club Apartments tower is proposed to have lower ceilings to save on construction costs. The tower might max out at less than 230 feet although decorative elements on the roof may push it above that.

For NuCLEus, Stark and J-Dek propose to build its own parking garage with an estimated 1,300 parking spaces, costing potentially $40 million or more based on similar garages elsewhere. Built below the garages would be 80,000 square feet of ground-floor retail, restaurants and entertainment for the Gateway District.

Atop the garages, Stark and J-Dek propose two 16-story towers — one with 400,000 square feet of offices and the other tower with 250 apartments. Nine floors of the office tower are reserved for announced tenants like Benesch Friedlander Coplan & Aronoff LLP and Stark’s own offices.

While it’s way too early to know how successful nuCLEus’ apartment component might be, 50 percent of Stark’s new Beacon tower is leased, commanding rents of $2 to $4 per square foot. Its grand opening was just three months ago.

END

Another GREAT ARTICLE KEN!! THANKS for the INPUT!

By the way how many stories is the City Club Apartments supposed to be?

Larry

Thanks Larry. City Club Apartments will be 23 stories.