Insurer FM Global is the latest to move its offices downtown

In its latest Skyline Report, real estate services firm Jones Lang LaSalle (JLL) said downtown Cleveland’s office market is far healthier than some had feared. Its report had some interesting data to share, showing that downtown is quietly waiting for the all-clear from pandemic-related restrictions to resume its renaissance.

The report also suggests that downtown Cleveland is in need of more Trophy Class or Class A multi-tenant office space either by renovating older buildings or, more likely, building new ones. With Ohio’s passage of the Transformational Mixed Use Development tax credit program, developers may soon have the resources to add high-end, competitive office spaces downtown.

JLL reported that, even with some employees working remotely, “the purpose of the office will transform from a place to complete routine tasks into an environment that encourages collaboration, innovation, and social interaction.”

Sherwin Williams (SHW) continues to press ahead with development of its 1-million-square-foot, single-tenant global headquarters in downtown Cleveland. A groundbreaking by the end of this year is reportedly the goal. SHW has signaled no plans to scale back the size of its project in any way.

“Driven by our continued need to serve our customers at the highest level and retain and attract top talent, we intend to build a next-generation headquarters in downtown Cleveland that ignites creativity, collaboration and industry-leading innovation,” said SHW Chairman & CEO John Morikis in a written statement.

In fact, pre-development activity for SHW’s HQ suggests two skyscrapers just west of Public Square along Superior Avenue. The office tower may rival the height of its Public Square neighbors. However, some are speculating that the second tower may not be an office building but a hotel built atop a parking garage.

Increasingly, downtown’s new or existing offices will be built or redesigned to obtain a Healthy Building designation by providing superior standards for air quality, ventilation and natural light. Healthy buildings also help reduce the spread of bacteria and viruses by leveraging touchless technologies in high-traffic areas, JLL said.

Despite some media reports saying downtown buildings will see a significant increase in sublease space due to the economy and remote working, JLL’s research team has not seen this yet.

“Through the first nine months of the year though, this has not been the case. The amount of sublease space on the market is relatively unchanged from the end of 2019,” JLL’s report said.

Over the past decade, tenant demand has been disproportionally skewed towards Trophy and Class A inventory. Because of historic tax credits, 23 obsolete office buildings have been redeveloped since 2010, eliminating more than 6.1 million square feet of downtown office space.

The only multi-tenant office tower built downtown in the last decade was the 2013-built, 470,000-square-foot Ernst & Young Tower, 950 Main Ave. As a Trophy Class property, it has the third-highest rents in Cleveland yet is 97 percent leased, according to JLL.

The real estate services firm points out that a significant number of tenants have migrated from the suburbs to downtown Cleveland “to take part in the renaissance of the urban core.” With the recent challenges of downtown, from COVID-19 to remote employment to civil unrest, some are speculating that companies will move back to the suburbs.

|

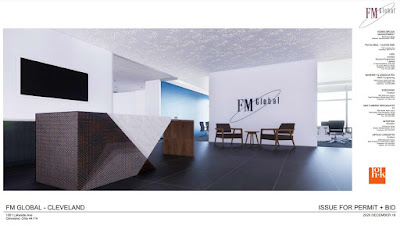

| A rendering of FM Global’s proposed reception area at its new downtown Cleveland offices in the North Point Tower (HOK). |

This is not likely to be the case, JLL said. It conducted a survey which found a resounding 93 percent of business leaders who currently have offices downtown have no intention of relocating to the suburbs.

Instead of offices moving to the suburbs, the exact opposite appears to be occurring.

FM Global, a Providence, RI-based commercial property insurer, will be relocating more than 100 employees from the Great Northern Corporate Center in North Olmsted to downtown Cleveland. It is leasing 32,915 square feet in the 19-story North Point Tower, 1001 Lakeside Ave., according to plans filed with the City of Cleveland. Those plans show an office layout accommodating 138 seated workers.

Last year, sources said FM Global was destined for the proposed One Lakewood Place mixed use development to give its employees a more connected, urban setting. But when Carnegie Management & Development walked away from the project, FM Global resumed its search for a more urbanized location to attract young talent.

It will spend nearly $2 million to white-box and renovate the 11th floor and part of the 12th floor of the North Point Tower, built in 1989. FM Global will also be adding new data infrastructure, an employees cafe and other amenities, plans show.

This follows news that NEOtrans broke in 2020, that Fathom marketing and Goldwater Bank N.A. Mortgage Division are relocating their offices and about nearly 150 jobs total from the suburbs to downtown.

And the biggest relocation of all is that of CrossCountry Mortgage, LLC. It intends to bring its headquarters and more than 500 employees from Brecksville to downtown Cleveland. It will renovate for $40 million the former Tap Packaging (previously The Chilcote Co.) complex in the 2100 block of Superior Ave.

Sources said the fast-growing company will likely add another 200 jobs at its new headquarters. And, in the near future, company officials reportedly anticipate increasing its headquarters workforce to 2,000 employees. Long term, one of the buildings they’re looking at expanding into is the former Plain Dealer building, 1801 Superior Ave., a source said.

END

- Cleveland, Bedrock seek $1 billion for riverfront development

- CRE industry lauds Bibb’s construction permit overhaul

- Bridgeworks design evolves again – minus hotel

- Cleveland Kitchen wins $10M in tax credits

- Welleon gets an ‘A’ in testing Cleveland’s market

- EPA gives Greater Cleveland $129.4M for five solar arrays, reforestation