Now is a good time for homeowners to sell

Spring time is the busiest time of the year for home shopping. That’s when most prospective buyers are out looking for new places to live and, under normal circumstances, it’s when most homeowners list their properties for sale. But these are not normal times in the housing market, especially in Greater Cleveland.

“It’s a war zone out there,” said a west-suburban realtor who was not authorized to speak publicly for his realty company. He told NEOtrans that the for-sale inventory is at or near all-time lows. “It’s a seller’s market, that’s for sure.”

According to multiple real estate research firms and their indices, Greater Cleveland is experiencing a unique trend on a national scale. Ironically, it appears it has little to do with anything that our region is doing, such as when it comes to new jobs or a sudden lack of new housing construction. But it does have a lot do with us versus other major markets nationwide, and it is affected by the types of housing transactions occurring locally.

These influences are having profound effects that can be experienced anecdotally as our realtor source noted, or in data. According to realtor.com, in April 2024, the median listing home price in Cleveland was $134,900, trending up 19.9 percent year-over-year. The median listing home price per square foot was $97. The median home sold price was $144,500. And that’s just in the city of Cleveland.

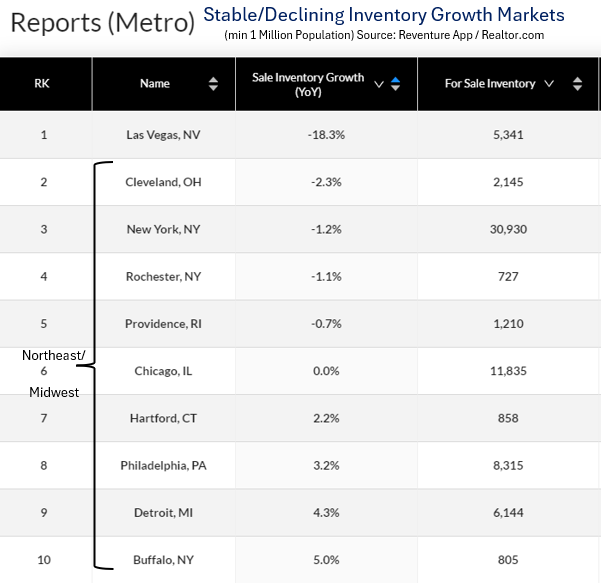

It’s a stunning change. But why is it happening? The reason is good old-fashioned supply and demand. If it wasn’t for the anomaly of Las Vegas, NV (which may not stay anomalous after new housing starts shot up 107 percent in the fourth quarter of 2023 compared to the year before), Cleveland would be leading the nation in a reduction in housing inventory listed for sale.

“The inventory trends on the US Housing Market are very bifurcated right now,” wrote Nick Gerli, CEO of Reventure Consulting in Nashville on social media. “Lots of supply coming online in the Sun Belt. But not as much in the Northeast/Midwest. Inventory is actually down year-over-year in markets such as Cleveland, New York, Rochester and Providence.”

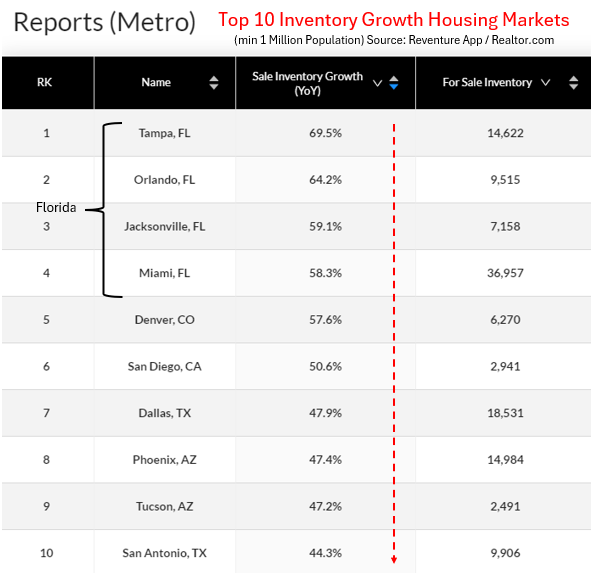

But what is causing the inventory to fall to nationally significant numbers? According to the data and to Nathan Kelly, president and managing director at the Cleveland office of real estate brokerage analysis firm Cushman & Wakefield, it’s not anything that Cleveland is doing special. Instead, much of it has to do with other major markets getting too expensive for residents and investors while Cleveland stays cheap.

“Florida has been building like crazy,” Kelly noted. “They also have tons of condos that are of a vintage that the potential for huge assessments should scare some people away from buying existing inventory. Then there’s the insurance…”

Affordability is one of the things that is unique about Greater Cleveland’s housing market. A study by Construction Coverage, use data collected by Zillow, the U.S. Census Bureau and Freddie Mac to calculate that Cleveland is 44.6 percent cheaper than the national average. Only Greater Detroit was more affordable.

Because of their cheap housing, both metro areas are susceptible to house flippers — people who buy up the cheapest homes, often those in the worst condition, make a small amount of improvements, if any at all, and then rent or resell them for a higher price. Sometimes, much higher. Cleveland has been a house-flipping hotspot since the pandemic, taking inventory off the for-sale market.

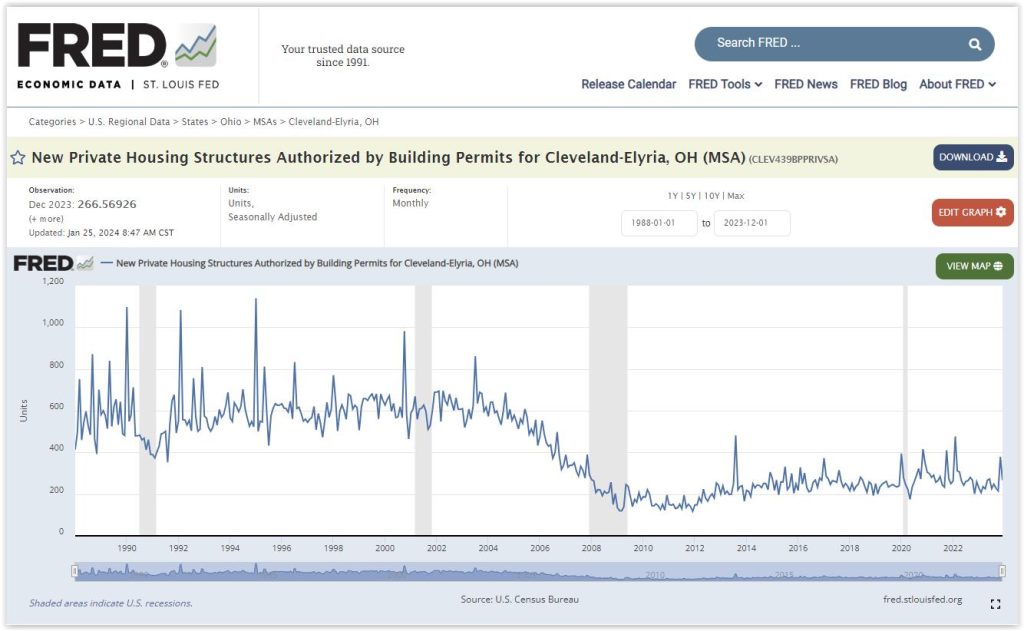

And it doesn’t appear to have anything to do with a change in job growth or even a reduction in new housing construction in Cleveland and its suburbs. All the indices are showing life is pretty much as it has been for at least a decade, despite the brief oddity of a global pandemic.

While Greater Cleveland’s unemployment rate was its lowest in 23 years in November 2023 when it dipped to 2.8 percent. It since jumped up to 4.6 percent in February, seasonally one of Cleveland’s highest unemployment months. It settled back to 4.1 percent in April, according to the Bureau of Labor Statistics. The region’s employment continues to grow, just not spectacularly.

Similarly, federal data shows that the construction of new housing units continues a “steady as she goes” approach in the Greater Cleveland market. The Federal Reserve Bank of St. Louis, which tracks national housing construction data, indicates that our region continues to add about 200 to 400 housing units per month. Although that’s fewer than half as many that were added before the Great Recession of 2008-10.

Interest rates are coming down a bit, thus making financing a home purchase more affordable. It is another factor making things worse for for-sale housing inventories. But they would have to fall a lot farther to get more people with existing, low-interest mortgages begun years ago to want to take on a new mortgage with a new home.

As long as Greater Cleveland continues to build new homes at the same pace, employment stays steady and house flippers keep removing less desirable homes from the market, expect it to remain a seller’s market.