Bedrock’s downtown riverfront development isn’t just about new buildings, it’s also about new infrastructure that make those new buildings possible. But funding for the infrastructure is coming from tax revenues captured from the new buildings, requiring an incremental approach for both unless future funding is pledged to move more quickly, which is what Mayor Justin Bibb’s administration wants to do (Adjaye Associates). CLICK IMAGES TO ENLARGE THEM.

Amendment IDs infrastructure improvements

Mayor Justin Bibb’s administration is requesting an important amendment to the city’s riverfront tax increment financing (TIF) district that would do two things. One spells out exactly what infrastructure work would be done. A second would extend the 30-year TIF to 42 years. And the third and perhaps most controversial is that it would pledge undefined future TIF revenues to start infrastructure work now.

A large-scale tax increment financing (TIF) district is a bit like the chicken-and-egg dilemma. You can’t have all of the TIF-funded infrastructure unless you have built the buildings to produce the tax revenue to service the infrastructure’s debt financing. But you can’t construct new buildings without the infrastructure to support them.

In Bedrock’s planned 35-acre riverfront development, the proposed 3.5 million square feet among more than a dozen buildings requires a phased approach that is to be achieved over two decades. But some of the new infrastructure cannot be achieved in phases and is needed now. So Bibb Administration officials said they need to pledge TIF revenues from future new development to construct infrastructure now.

The pledge is “to induce and enable the developer to engage in the redevelopment of the Cuyahoga Riverfront area of Downtown Cleveland, including, without limitation, certain public infrastructure,” the administration said in its proposed amendment to a 30-year, $1 billion TIF agreement that City Council passed in August 2024.

City Council President Blaine Griffin said he has “a lot of questions” about that proposed amendment clause. If additional buildings are not constructed, the city would be on the hook for the infrastructure costs. Or if not enough TIF revenue was generated, it could jeopardize funding promised to the neighborhoods as part of the TIF agreement, he said,

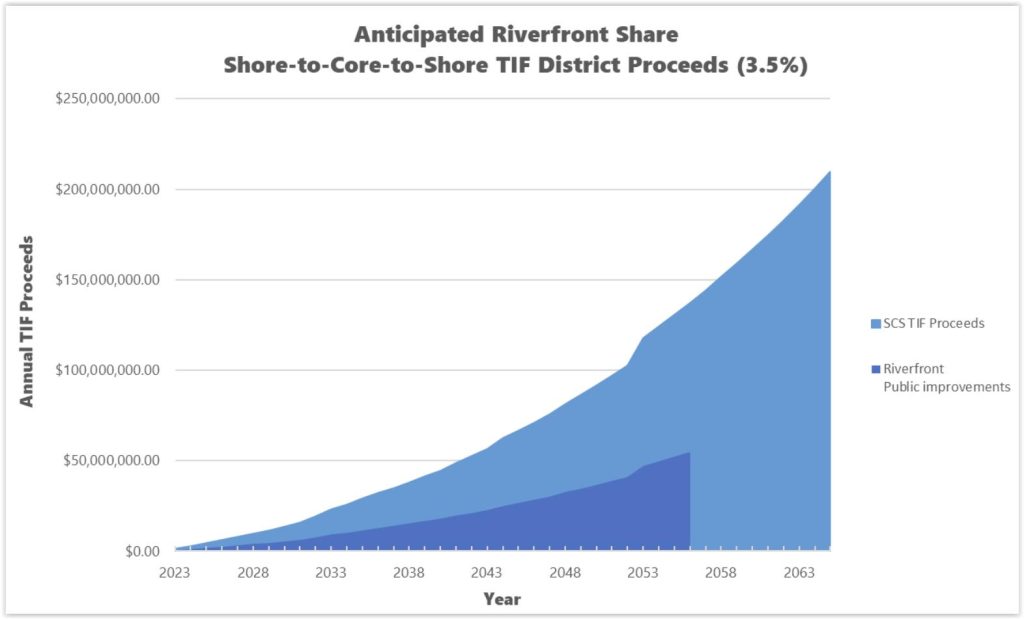

This graph shows the current 30-year riverfront tax increment financing agreement in dark blue and the overall Shore-to-Core-to-Shore (SCS) tax increment financing revenues in light blue. Under the proposed amendment City Council is considering, the dark blue area would be extended beyond 2056 (City of Cleveland).

“This is not going to be fast-tracked until we weigh in,” Griffin said.

Apparently the City Planning Commission’s Design Review Committee didn’t get that memo. It was asked by City Council to weigh in on the amendment. Instead, it was the last item on today’s committee meeting agenda that was already running more than 2½ hours long. The matter was dealt with in 24 seconds and without discussion, passing unanimously.

“The last one is just the one administrative approval,” said committee Chair Lillian Kuri. “Take a quick look at it and then we need a motion.”

“My bigger issue is there was a significant amount of TIF revenue pledged for neighborhood development,” Griffin said. “I want to make sure that would not be jeopardized.”

As part of a community benefits agreement negotiated by the city and Bedrock for the $3.5 billion riverfront master plan, the developer is to make a total of $25 million in neighborhood contributions at certain project milestones starting this year.

That includes $15 million to a Neighborhood Investment Fund, $5 million in a Minority Business Credit Fund, $3 million in workforce development contributions, $1 million in city resident contributions plus $1 million for mentorship and training.

City officials have shared charts and graphs showing that revenue from the riverfront TIF, which was pulled out of a larger Shore-to-Core-to-Shore (SCS) TIF to fund downtown improvements including the lakefront, can still be funded by the SCS. The funding doesn’t go the other way, however, from the riverfront TIF to the SCS TIF. The SCS TIF is projected to generate between $3.3 billion and $7.5 billion over 42 years.

The riverfront TIF is due to begin in 2027, coinciding with the expected completion date of the 210,000-square-foot Cleveland Clinic Global Peak Performance Center in partnership with the Cleveland Cavaliers. Construction on that facility is already underway. When complete, it will start generating revenues to the TIF.

As a non-school TIF, no taxing entity like the city or the school district will receive less property tax revenues than they do today. The riverfront TIF currently is for 30 years with an option to extend it by 15 years.

But the proposed amendment to the TIF agreement is to instead extend it 42 years. A maximum of 60 years is allowed under state law. The extension would allow the TIF to generate more revenues over a longer period, thus increase the amount of debt that can be financed and at a lower interest rate.

The last amendment to the TIF agreement not only specifies locations of infrastructure improvements but notes that the city would enter into construction management contracts with Bedrock through a direct award for public improvements consistent with the city-approved master development plan.

The city would invest in “public streets and roadway improvements in public rights-of-way including, but not limited to, streetscape, sidewalks, multi-modal facilities, transit amenities, road reconfiguration and related utilities and grading,” the proposed amendment noted.

Promenades, public spaces, riverfront retaining walls, a roadway partially visible at right and sewers below are all parts of the infrastructure package that Bedrock and the city are supporting through a riverfront tax increment financing agreement that the city and the developer would like see amended (Adjaye Associates).

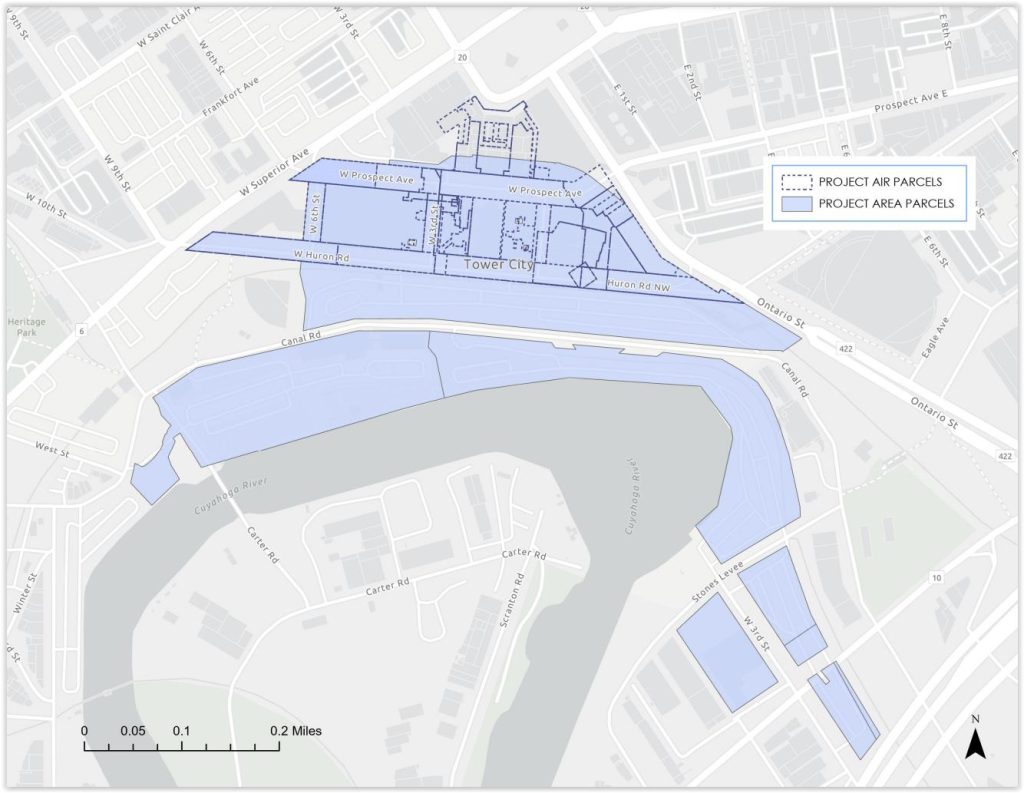

Specific locations of infrastructure improvements include:

- Prospect Avenue between Superior Avenue and Ontario Street;

- West Huron Road between Superior and Ontario ;

- West 6th Street between Prospect and Huron Road;

- West 3rd Street between Prospect and Huron;

- West 2nd Street between Prospect and Huron;

- West 3rd between Eagle/Stones Levee and the West 3rd Lift Bridge;

- Rebuild Canal Road between Old River Road and Eagle Avenue as a service road;

- Restore Eagle Avenue ramp between Ontario Street and West 3rd;

- Central Avenue between West 3rd and the CSX railroad easement;

- Designing and constructing a new public roadway between Old River Road and Eagle;

- Relocating a sewer pump station owned by the Northeast Ohio Regional Sewer District into a public right-of-way; and

- Designing and constructing a kayak launch located on city-owned property.

Bedrock’s riverfront development envisions 12 acres of public spaces to give more access to Cuyahoga River waterfront. The near buildings represent the next phase of development in the plan — a 17-story hotel and entertainment complex for which Bedrock is seeking state tax credits (Adjaye Associates).

About $75 million in anticipated riverfront infrastructure investments will be Bedrock’s responsibility. However, city officials said additional state and federal grants will reduce the city’s TIF District contributions as well as Bedrock’s commitment. For example, $10 million in state funds were pledged to the Bedrock riverfront development in the state of Ohio’s $4.2 billion capital budget.

That includes nearly $10 million worth of infrastructure work begun in August 2023 for the Cleveland Clinic Global Peak Performance Center next to Collision Bend in the Cuyahoga River. That came from a mix of public and private sources for replacement of riverside bulkheads.

Bedrock is also seeking $40 million in Transformational Mixed Use Development tax credits from the state for a 17-story, $488 million, 560,017-square-foot hotel and live music/theater entertainment complex dubbed Rock and Roll Land. It is planned near the southwest corner of Ontario and West Huron. The brand names of the hotel and theater venue were blacked-out in Ohio Department of Development records.

“The hotel, theater and related amenities will deliver a multi-sensory experience purpose-built to immerse guests in the mindset of the music genre,” Bedrock said in its tax credit application to the state, first reported by NEOtrans. “The hotel and theater will share a ‘central lobby’ that will be the vortex where guests and fans will be able to dine, socialize and see performances. From arrival to departure, guests will be treated to a full rock and roll experience.”

END