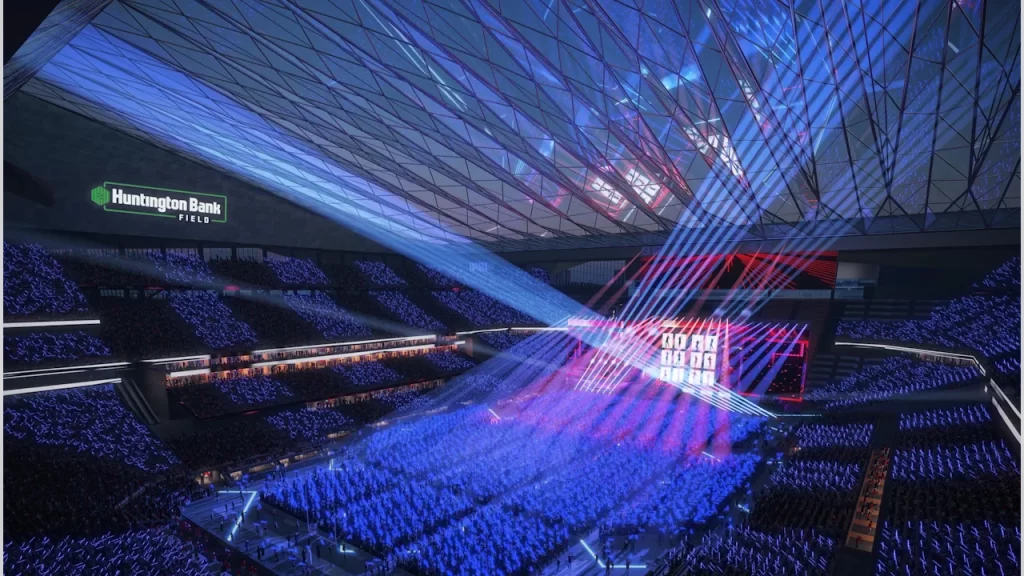

Concerns about being able to keep Cleveland’s existing stadiums in a state of good repair apparently prompted a poll of likely voters to assess their views toward extending or expanding a Cuyahoga County sin tax. According to the poll results, those concerns were justified (NEOtrans). CLICK IMAGES TO ENLARGE THEM.

Poll leaked day after GCP favors Brook Park

One day after the region’s chamber of commerce announced its support for the construction of an enclosed stadium in Brook Park, a poll of likely voters in Cuyahoga County was leaked to NEOtrans, showing most of those voters opposed the Cleveland Browns leaving downtown for the suburbs. The poll also said that opposition was putting at risk a county sin tax to repair facilities for all of Cleveland’s major sports teams.

The poll by EMC Research of Columbus, OH was conducted May 12-18 of 850 likely November 2025 voters in Cuyahoga County. In it, the poll asked several questions about the existing sin tax, a potential extension and/or expansion of the sin tax, and general voter attitudes toward the Browns football team. None of the poll results were favorable, including for an extension of the existing sin tax.

The reason for the last part, according to EMC Research’s findings, is that voters may be conflating the extension of the current sin tax with the move of the Browns to Brook Park.

Cuyahoga County Executive Chris Ronayne has fought to keep county taxpayer dollars from being used for the Brook Park stadium. And the Haslam Sports Group (HSG), owners of the Browns, said it is no longer counting on county support.

Voters in the poll were asked if they supported draft ballot language now pending before the Ohio legislature which has capped countywide excise taxes. The Ohio General Assembly’s approval is needed to exceed the cap.

The draft language proposes extending the sin tax “For the purpose of paying not more than one-half of the costs of providing a public sports facility together with related redevelopment and economic development projects.”

Some of the findings of EMC Research’s poll show that Cuyahoga County voters believe that Cleveland’s major sports teams — football Browns, basketball Cavs, baseball Guardians — have a positive impact on the region but are willing to only sustain the existing facilities for them.

The poll said 85 percent of voters consider those teams are either extremely important or very important to the region. Most voters also believe that Cleveland’s current professional sports venues need repairs – with 48 percent saying that minor repairs are needed and 16 percent saying major repairs are needed.

“When the poll asks about a tax that would only fund repairs and maintenance at existing taxpayer-owned stadiums and arenas, support for the sin tax increase jumps sharply, with a 20-point increase in support,” the ECP Research memo noted.

The poll asked voters “As you may know, the Cleveland Browns are pursuing plans to construct a new football stadium in Brook Park and move the Browns to the suburbs. Based on what you know about these plans, do you support or oppose the Browns moving to Brook Park?”

A majority of voters – 61 percent – said they opposed the Browns move, including 51 percent who strongly opposed it. Only 28 percent said they support the move and 11 percent are uncertain, according to EMC Research.

“The poll results show that a large majority of Cuyahoga County voters oppose the move of the Cleveland Browns to Brook Park, and that opposition is damaging support for the excise tax,” EMC Research’s CEO Molly O’Shaughnessy wrote in the memo. “If a portion of the excise tax were dedicated to funding a new Browns stadium in Brook Park, the tax would be likely to fail at the ballot box in November.”

The poll also asked Cuyahoga County voters to rate the Cavaliers, Browns and Guardians, and the results showed “a marked difference” in voter attitudes toward the three teams. Both the Guardians and Cavaliers were viewed favorably by 90 percent of respondents with only 9 percent unfavorable.

In contrast, the Browns were considered to be much more divisive. Only 49 percent of voters polled had a favorable opinion of the team, with 50 percent unfavorable, according to EMC Research’s May 19 memo which was addressed to “interested parties.”

Because of rising stadium facility repairs costs, county officials are considering a 10-year extension of the sin tax and increasing the tax on cigarettes from 50 cents a pack to $1.50 and increasing the cost of beer by about 5 cents.

But they’ve repeatedly said the Brook Park stadium project complicates their efforts to sustain the county’s existing sports and entertainment venues without further explanation. This and other poll data, such as likely polling being done for Ronayne’s re-election bid this November, may be that explanation.

NEOtrans reached out to Cuyahoga County Director of Communications Kelly Woodard for comment. She acknowledged receipt of an e-mail with questions but otherwise hasn’t replied. Neither has HSG’s Chief Communications Officer Peter John-Baptiste.

O’Shaughnessy did not respond to inquiries either, including who paid for the poll. The poll memo was sent anonymously to NEOtrans and apparently to other local media.

The sin tax was first enacted in 1990 to help pay for downtown’s Gateway sports and entertainment complex, and expanded in 1995 to construct a new stadium on the downtown lakefront for the Browns. It was extended further in 2014 to provide about $14 million per year for repairs at those facilities. The sin tax is not due to expire until 2034.

END