New firm to focus on multifamily properties

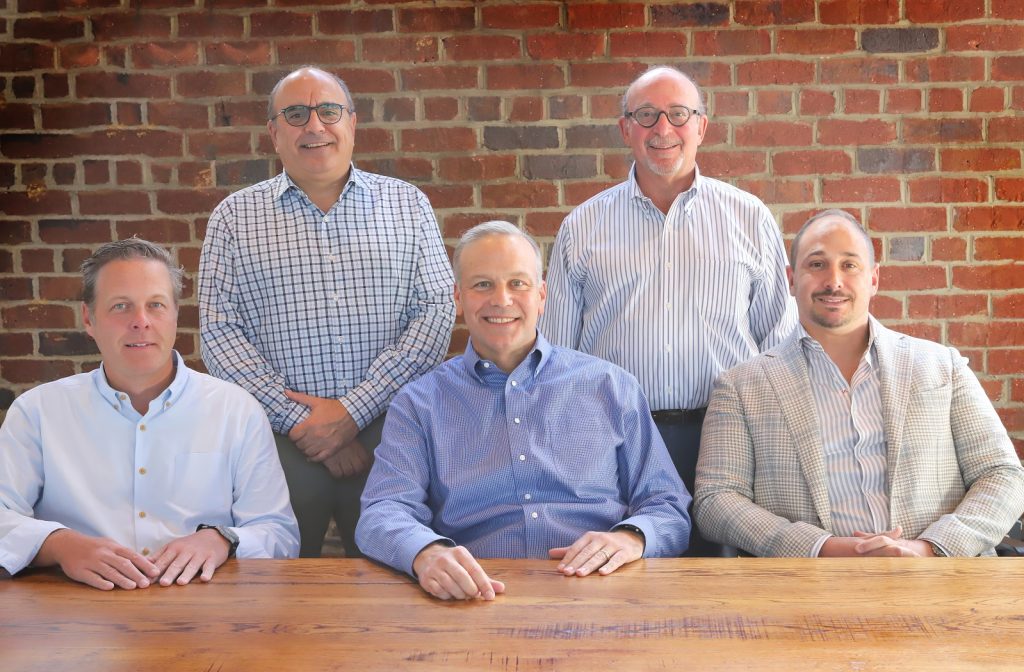

Legacy RHM Capital, a fully integrated real estate investment platform focused on acquiring, operating and enhancing institutional-quality multifamily properties, announced its formation through the strategic merger of Legacy Capital Partners and RHM Capital Group.

Legacy Capital Partners was founded in 2004 by David St. Pierre and Mitchell Schneider. Over 21 years, the firm raised capital through multiple funds and invested in 78 real estate assets across 19 states. St. Pierre will serve as president and CEO as well as a managing member of Legacy RHM Capital.

RHM Capital Group was formed in 2023 by John Joyce, Ned Huffman, Jim Doyle, Preston Hoge and Andrew Iarussi — leaders with deep expertise in real estate operations, capital markets, and investment strategy. Over the last two years, since its inception, RHM Capital Group closed six investments.

Based at the former offices of Legacy Capital Partners at Legacy Village, 25333 Cedar Rd., in Lyndhurst, the combined firm plans to continue expanding throughout the Midwest and the Southeast, in markets where strong fundamentals support long-term rental demand.

“Our goal is to create a firm that combines deep industry experience with operational precision,” said St. Pierre in a written statement. “Legacy RHM Capital is a fully integrated platform that combines the capital discipline of an institutional investor with the execution capability of an experienced owner-operator.”

Legacy RHM Capital combines a 21-year track record of disciplined real estate investments and decades of experience in capital markets with extensive hands-on

property and construction management experience to offer a comprehensive approach to real estate investing.

The result is a firm that is uniquely structured to identify, capitalize, acquire, and manage institutional-quality real estate investments to maximize value for investors.

“We couldn’t be happier to combine forces with such a dynamic organization,” said Mitchell Schneider, also a managing member of Legacy RHM Capital, co-founder of Legacy Capital Partners.

He also is founder of First Interstate Partners, Ltd. which helped develop Legacy Village and Steelyard Commons. First Interstate, which continues, also partnered with others in developing multifamily properties in Greater Cleveland such as One University Circle and 121 Larchmere.

“With the expertise and energy within our combined team we are positioned to move quickly, execute effectively, and deliver results for our investors,” Schneider added.

The firm’s operational backbone is supported by its strategic relationships with RHM Real Estate Group, especially in property management, and its wholly owned subsidiary, University Heights-based Noble General Contractors, notably in construction management, both of which will provide key support across the asset lifecycle.

The leadership team includes seasoned professionals with institutional experience at Legacy Capital Partners and RHM Real Estate Group of Landerbrook in Lyndhurst, as well as Bellwether Enterprise Real Estate Capital, which is located in Downtown Cleveland.

“We believe the synergy will be outstanding,” said John Joyce, another managing member of Legacy RHM Capital, co-founder of RHM Capital, and founder and CEO of RHM Real Estate Group.

“Not only are we combining two highly successful organizations, we have built-in strategic relationships that strengthen our fully integrated model — helping us to create value for our investors, our residents, our partners, and our team,” Joyce added.

By combining flexible capital strategies, strong relationships, and in-house capabilities, the firm is well-positioned to act decisively when opportunities arise — even in uncertain market cycles.

END