More than 4 million people live within a one-hour drive of downtown Cleveland. That population supports big-city amenities that are available at small-town prices. And to the north of downtown is one of the Great Lakes, an ecosystem that contains 84 percent of North America’s freshwater. If you want it, you have to come here to get it. And growing numbers of people are doing just that (ClevelandWater.com). CLICK IMAGES TO ENLARGE THEM.

Cleveland benefits from new Great Migration

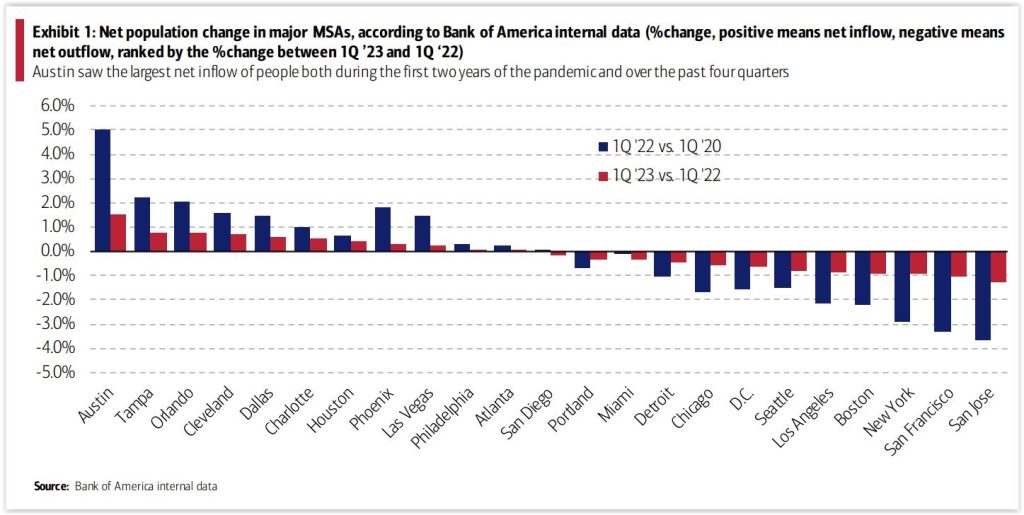

Another leading indicator of potential population growth in Greater Cleveland was published this week by Bank of America (BofA), one of the nation’s Big Four banking institutions, serving more than 10 percent of all bank deposits of the United States. In a BofA June report, it put Greater Cleveland among the top metro areas benefitting from pandemic-instigated domestic migration trends, with its positive inflow-over-outflow rate ranking up there with the likes of Austin, Tampa, Orlando and Dallas.

According to BofA, Greater Cleveland saw positive migration of about 2.5 percent between the first quarter of 2020 and the first quarter of 2023. Breaking that down further, the net migration rate from the first quarter of 2022 to the first quarter of 2023 was about 0.7 percent, making it the fourth-largest positive migration rate among major metropolitan areas. However, that doesn’t guarantee population growth as the BofA report doesn’t take into account births, deaths or international migration.

Austin had the highest positive migration rate in the country in the past year, followed by Tampa, Orlando, Cleveland and Dallas. Charlotte, Houston, Phoenix, Las Vegas and Philadelphia rounded out the top 10. At the opposite end of the spectrum were San Jose, San Francisco, New York, Boston and Los Angeles. They had the largest amount of negative migration, or larger outflows of residents than inflows, among major metros between the first quarters of 2020 and 2023. That trend showed no signs of slowing in the past year, as well, BofA’s report showed.

“Notably, we find pandemic migration trends are not reversing and we continue to see faster population inflow into sunbelt cities like Austin and Tampa,” the BofA report said.

BofA touted its data over the Census’ because theirs offers “near real-time” estimates of migration flows among the nation’s largest Census-designated metropolitan statistical areas (MSAs). The Cleveland MSA includes Cuyahoga, Geauga, Lake, Lorain and Medina counties. An MSA differs from the Census’ combined statistical areas which, for Greater Cleveland, includes the Akron and Canton areas with a total population of 3.6 million people.

“While data from the Census Bureau is broken down by metropolitan statistical areas (MSAs), it is only updated annually and can be outdated for real-time analysis,” the BofA report said. “Using Bank of America internal data we construct near real-time estimates of domestic migration flows, giving us almost one year of extra insight over Census Bureau data.”

Some relocations were noticed early on in the pandemic but were based mostly on anecdotal evidence. Now, as several years have passed since the depths of the pandemic, more data and experiences can be recorded and be considered as part of a larger context. Because of BofA’s large number of depositors and thousands of branch locations around the country, the volume of data it provides based on the opening and closing of accounts in different geographic areas may be more reliable than those with fewer data points. And, the personal commitment of opening and closing of accounts in different cities may produce data that is more meaningful than, for example, Reddit searches, LinkedIn data, or Zillow searches.

“The Census numbers are slow, a single point in time, and terribly underrepresents people that are mobile and/or don’t want to be counted,” said Nathan Kelly, president and managing director of Cushman & Wakefield-CRESCO Real Estate. “Because I’m heavily biased (in favor of freshwater cities like Cleveland), I’m not surprised that BofA customers are smart enough to move to Cleveland. I’d like to know more about the demographics of their customers for the study, but assume that there’s integrity in the message. I think the study has the same weight — perhaps a little bit more so because of the friction of moving banking — as the other reports (i.e. Reddit, LinkedIn, Zillow).”

BofA’s report also addressed the dichotomy of housing prices falling in metros like Greater Cleveland that are also experiencing positive migration. At the same time, apartment rents are rising faster in Greater Cleveland than in any other urbanized region in Ohio and it ranks as one of the fastest growing rental markets in the nation, per Realtor.com.

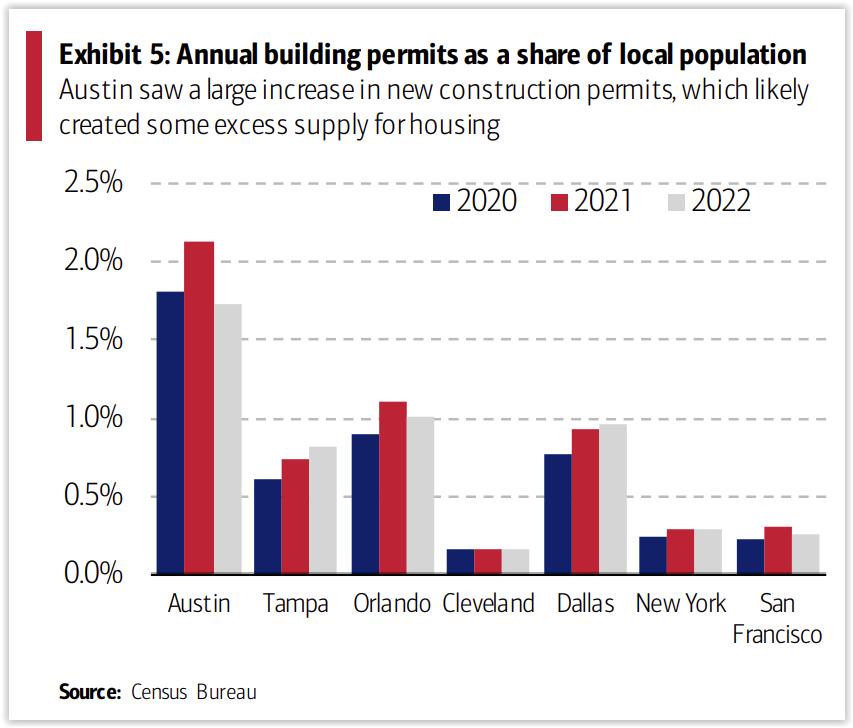

“In addition to high mortgage rates that are dampening demand in the near term, demographic composition also matters,” the report explained. “For example, our data shows that population inflows into Austin skew younger, which might be putting more upward pressure on rents instead of on home prices.”

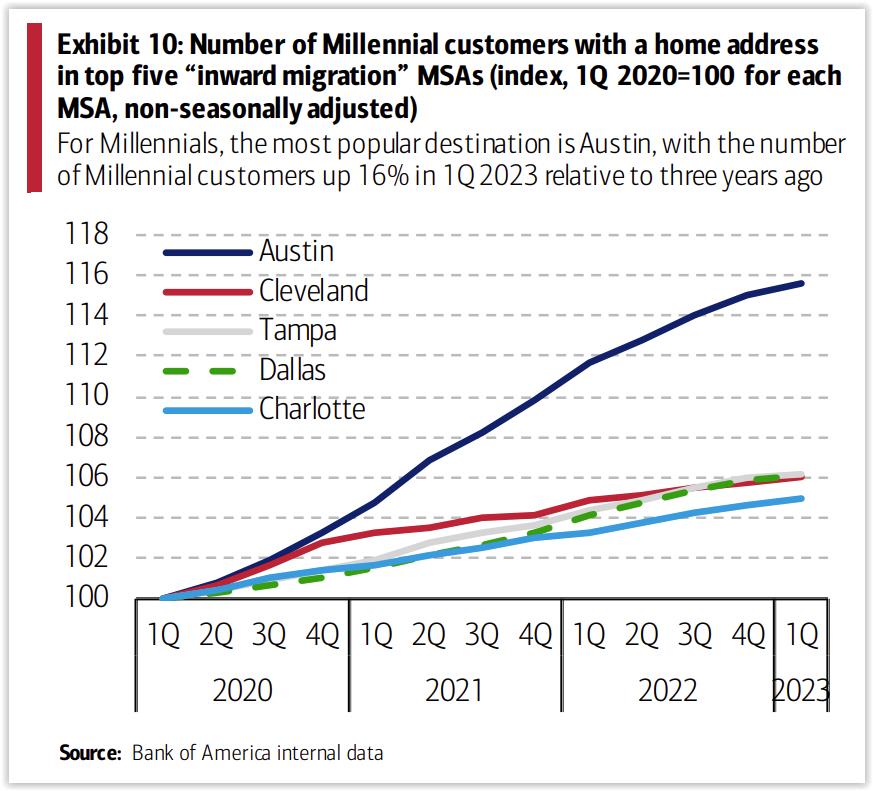

Cleveland’s population inflow is also heavily influenced by younger people, notably Millennials. Cleveland, Tampa and Dallas each saw a 6 percent increase in Millennial population over the past three years, all ranking second to Austin’s 16 percent growth rate, BofA said. The bank said affordability continues to be the biggest factor affecting Millennials’ home buying decisions due to their lack of net worth. However, compared to other cities seeing the largest positive migration rates, the number of new building permits as a share of local population in Greater Cleveland pales compared to those in other metro areas.

Migration of young professionals, called “Brain Gain,” is a new phenomenon for Cleveland. Last month, the New York Times published data from the U.S. Census’ American Community Survey for dozens of urbanized areas large, medium and small showing migration patterns. Data for Greater Cleveland showed that, since about 2017, more people with college degrees were moving into the region than moving out, an inverse to the experiences of coastal metro areas. And it was the inverse of the experience from recent decades which saw Cleveland lose out to star-studded cities on the East and West Coasts.

“Cleveland has grown into one of the top towns for college-educated millennials,” said Peter Grealis, a senior associate at real estate brokerage Colliers International, in a recent interview with NEOtrans. Grealis is a member of the Cooper MultiFamily Team, a division within Colliers that focuses on the buying and selling of workforce apartment housing across the Midwest.

END