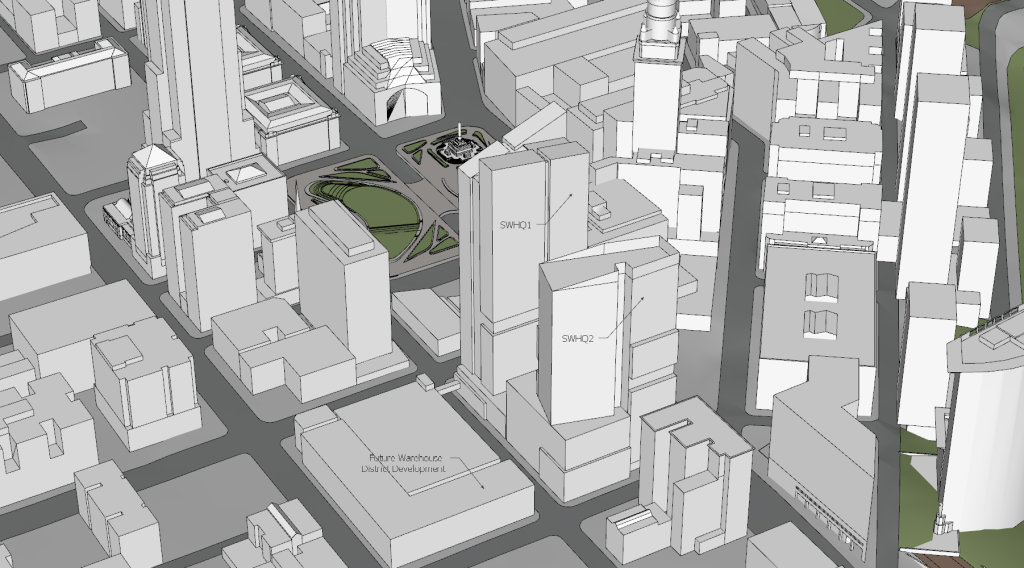

In this unofficial rendering, an HQ2 structure that includes all of Sherwin-Williams’ unaccommodated existing and future office and parking needs on the northeast corner of Superior Avenue and West 6th Street could require a significant skyscraper. These are the types of planning options Sherwin-Williams will reportedly consider over the next year (Ian McDaniel). CLICK IMAGES TO ENLARGE THEM.

Height may depend on parking deck perimeter uses

A COMMENTARY

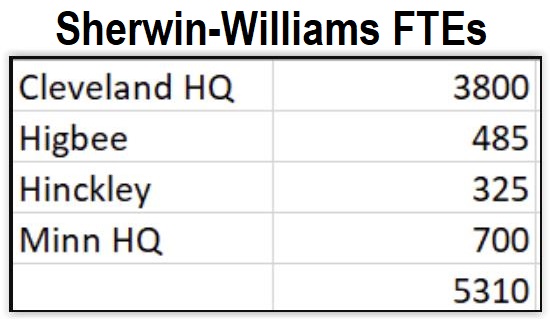

Just as NEOtrans was publishing breaking news Nov. 10 that Sherwin-Williams in 2024 would advance planning for the second phase of its headquarters, a trusted source responded with some remarkable data. That source provided employment data for Sherwin-Williams’ various office locations in Greater Cleveland and in Minneapolis which shows the company is dramatically expanding with new jobs that, if continued, shows the urgency in the company’s consideration of a second headquarters structure in downtown Cleveland, hereinafter referred to as HQ2. And based on that employment information and other insights, it is likely to be a significant structure or structures.

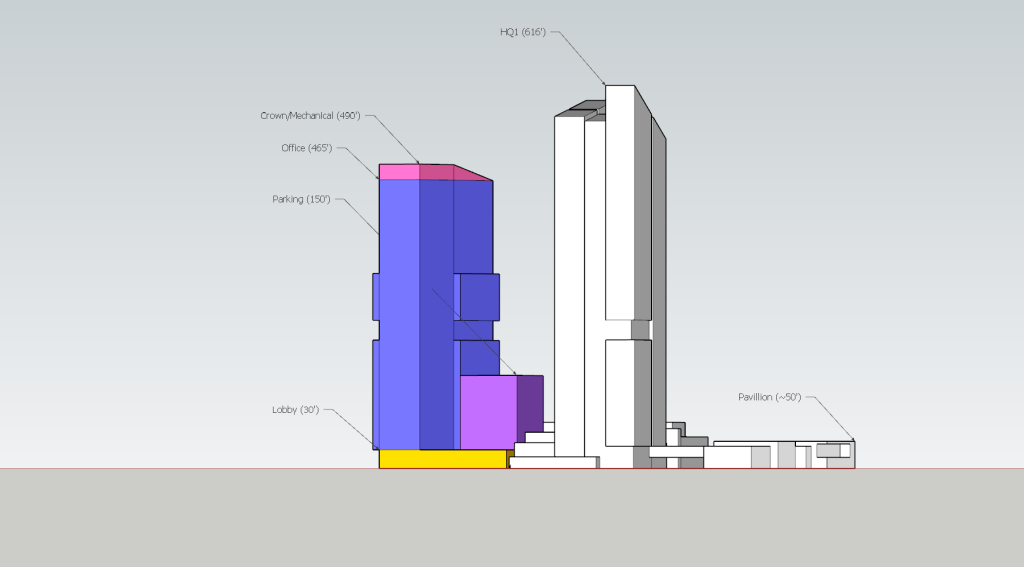

The new 616-foot-tall headquarters that’s near to topping out west of downtown’s Public Square is expected to accommodate upwards of 3,100 employees. Some estimates put the total as high as 3,500. HQ1 is scheduled to welcome those employees one year from now. But that 1.1-million-square-foot complex which includes a two-story pavilion fronting Public Square and a 920-space parking deck just north of the tower on West 3rd Street are already proving to be insufficient to accommodate Sherwin-Williams’ growth. That is why the company will reportedly spend the next year considering design options for HQ2.

Sherwin has the resources to move forward on HQ2. It sold a 90-percent stake in HQ1 to Florida-based Benderson Realty Development Co. for $210 million. If planning advances throughout 2024 to where it becomes public a year from now, as sources say it will, that positions financing and construction to move forward on HQ2 in 2025. That’s when interest rates are expected to come down below 6 percent and make big projects more affordable again. Sherwin-Williams’ staff has not responded to NEOtrans’ inquiries about the prospects for HQ2.

Stunning growth is driving this urgency to proceed with HQ2. Sherwin-Williams revenues are breaking its historical records which go back to the company’s founding in 1866. For the 12 months ending Sept. 30, 2023, companywide revenues moved above $23 billion, a 6.23 percent increase over the prior year. And that year was a record as well. Sherwin-Williams’ annual revenue for 2022 was $22.15 billion, an 11.05 percent increase from 2021. Sherwin-Williams annual revenue for 2021 was $19.95 billion, an 8.62 percent increase from 2020. Getting the picture?

That has translated into hiring growth as well which is supported by a city grant that reimburses Sherwin-Williams for 15 years at 50 percent of income taxes from new jobs created at its Cleveland headquarters. The maximum payout is $11.5 million. While Sherwin-Williams anticipated adding 140 new HQ jobs, the city’s grant has provided an incentive for the company to add even more jobs.

According to company records provided to NEOtrans, 3,800 jobs are assigned to its Cleveland headquarters. That doesn’t mean that all 3,800 employees actually work there, however. According to a source, about 310 of those employees are fully remote and work all over the USA, carrying out tasks such as training, quality control and the like. That puts approximately 3,500 employees at Sherwin-Williams’ 1930-built HQ, 101 W. Prospect St., plus the Skylight Office Tower just across West 2nd Street. With its existing HQ staff, the global coatings giant already has too many workers for its new HQ1, even as some people work hybrid jobs — part-time at home, part-time in the office.

Add to that about 100 office employees from Sherwin-Williams’ 388,766-square-foot Automotive Finishes Corp. global headquarters, research and development facility and training center, located at 4440 Warrensville Center Rd., Warrensville Hts. Those are accounted for at the Cleveland headquarters as well. The rest of the workers from that facility will move with the 330 employees from the John G. Breen Technology Center, 601 Canal Rd. in downtown Cleveland, to the new 600,000-square-foot research center under construction in suburban Brecksville. Breen and the old headquarters were sold to Bedrock Real Estate earlier this year.

Office employment has grown at other locations as well. At Sherwin-Williams’ flex office space at 4770-4780 Hinckley Industrial Parkway in Cleveland, employment has grown from 250 employees to 325, according to data supplied to NEOtrans. That 151,830-square-foot space was leased in 2017, shortly after the Fortune 500 company bought rival Valspar, based in Minneapolis. A small number of former Valspar employees were moved from Minneapolis to Hinckley Industrial after 2017. Another 700 workers remain in Minneapolis, including about 300 office workers and 400 research staff.

There is disagreement among NEOtrans sources as to how many Valspar HQ employees will move to Cleveland when the space is available to accommodate them. One source argues that all of the office employees will move and only the research staff will remain. Another source says there is a strong benefit to maintaining a Valspar HQ legacy presence in Minneapolis, including sales, government and public relations staff, but some additional workers may ultimately move.

Perhaps the most notable and surprising indicator of Sherwin-Williams job growth can be found across the street from its old headquarters. Last year, at the 10-story Higbee Building, in the office spaces above the two-story Jack Casino, Sherwin-Williams sub-leased the sixth floor from Key Bank to handle its growing staff. This isn’t a typical office floorplate of 20,000 to 30,000 square feet. Instead, it’s roughly triple that. The floorplates in the former department store measure 70,000+ square feet. In that space, according to the records supplied to NEOtrans, 485 Sherwin-Williams employees now work there.

Add ’em up and you’ve got yourself enough people — perhaps 1,200 to 1,500 workers — to fill another office tower. And that doesn’t include leaving space for future growth among HQ1 and HQ2 whose staffing count totals approximately 4,560 full-time equivalents, if about 150 Valspar workers relocate from Minneapolis. Assuming a 10 percent growth factor, which may be conservative based on the company’s recent growth, that’s another 456 employees. HQ1 has about 300 square feet per employee. Multiply that by 1,600 to 2,000 employees and we’re looking at a lot of new office space.

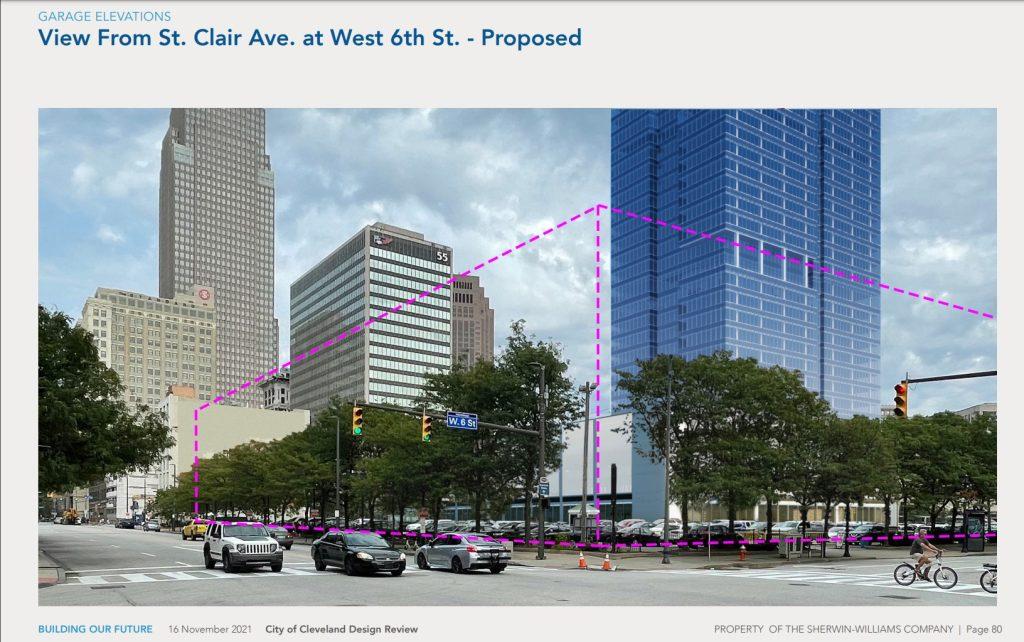

Future development of the west side of Sherwin-Williams’ headquarters site has been demonstrated merely by the simple outline of future buildings, as seen from the intersection of West 6th Street and St. Clair Avenue. A rendering of the HQ1 tower and its parking garage is also shown (property of the Sherwin-Williams Co.).

That also doesn’t account for Sherwin-Williams’ desire to bring to Cleveland some sales functions and other offices of many of its major business partners and suppliers. Sherwin-Williams’ Director of Corporate Real Estate Timothy Muckley told the Cleveland Planning Commission in 2021 he doesn’t just want them somewhere in the Greater Cleveland area. “We’ll urge them to locate next door,” he said, pointing to an architectural massing for what appeared to be a 20-story, roughly 300,000-square-foot tower at the northeast corner of Superior Avenue and West 6th Street.

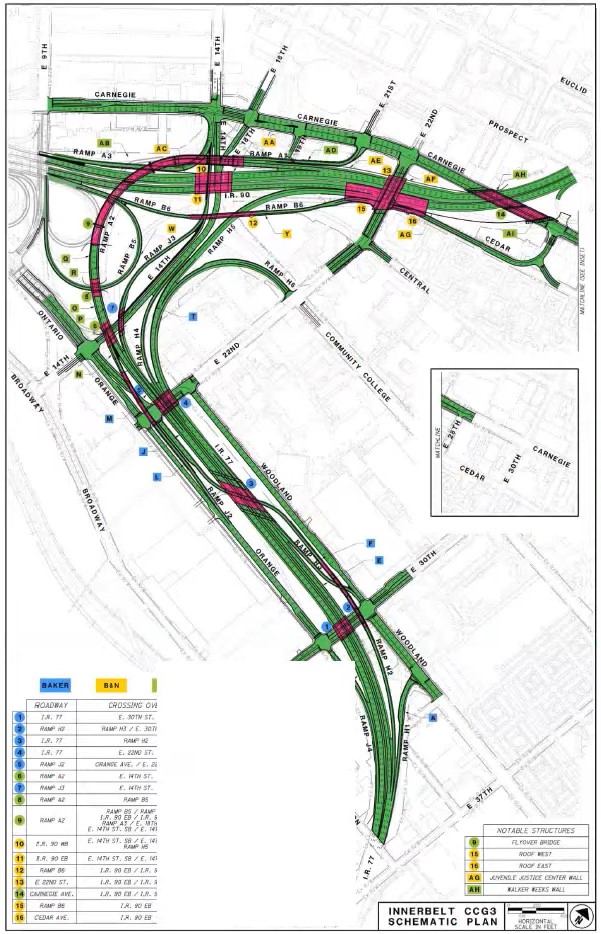

That site, plus the space-available perimeter around the HQ1’s parking garage along West 6th and St. Clair Avenue, are where Sherwin-Williams plans its HQ2. Among company executives, it’s referred to as “the west side” of the HQ site. That west side has ground space for about 55,000 square feet of building footprints south of Frankfort Avenue and 75,000 square feet north of Frankfort, including the historic but modernist-clad Gilman Building, 1350 W. 3rd St.

The company’s conservative planning for the future and its progressive, actual growth have already made its two-year-old 300,000-square-foot HQ2 massing insufficient. That conservatism also applies to its parking situation which, according to sources, is grossly insufficient. The 920-space garage now under construction north of Frankfort will accommodate fewer than one-third of HQ1’s employees and none of HQ2’s. While executives point out that many employees take the bus or train to work, several sources said they’ve heard gripes from some workers who have had a guaranteed parking spot for a decade or two at the old headquarters but aren’t guaranteed a spot at HQ1.

In this unofficial rendering, a Sherwin-Williams’ HQ2 tower could approach 500 feet tall if all of the company’s existing unaccommodated and future office needs were included in this skyscraper, along with more parking to compensate for the lack of spaces in HQ1. Mixed-uses includes hotels, offices, retail and restaurants are shown as a featureless massing surrounding the HQ1 parking deck in the Warehouse District (Ian McDaniel).

Exclusive of the quality of construction of the five-level parking deck, while being built to code, the structure was not designed so it could be expanded vertically. Even if it was, it is doubtful Sherwin-Williams would have the confidence to do so. Concrete vendors have made errors in construction, including pouring concrete over drains and other mistakes which forced a pause in construction a month ago to address them, sources said.

Sherwin-Williams may over-compensate for the lack of parking in HQ1 by adding more spaces per employee in HQ2. Given the lack of remaining open ground space on the overall HQ site, a second parking garage will probably be more vertical than the first. It may have to be incorporated into the superstructure of an office building, thereby increasing its weight and necessitating the costly digging of caissons to bedrock 200 feet down to support such a heavy structure. For that reason, Sherwin-Williams may do one of two things: scatter its HQ2 offices in multiple low-level buildings throughout the west side of the overall headquarters site or go tall with an HQ2 tower.

Both options have their benefits and drawbacks. Scattering the offices may mean limiting building heights in the Warehouse District, which was designated in 1982 by the city and the U.S. Dept. of the Interior as an historic landmark district. To prevent overwhelming the historic, four- and five-story Warehouse District buildings near the intersection of West 6th and St. Clair, HQ2 buildings might have to be kept to a similar height. Even if all of HQ2’s four- and five-story buildings were entirely offices, leaving no ground-floor spaces for retail and restaurants, those structures would absorb about 300,000 to 350,000 square feet of office space.

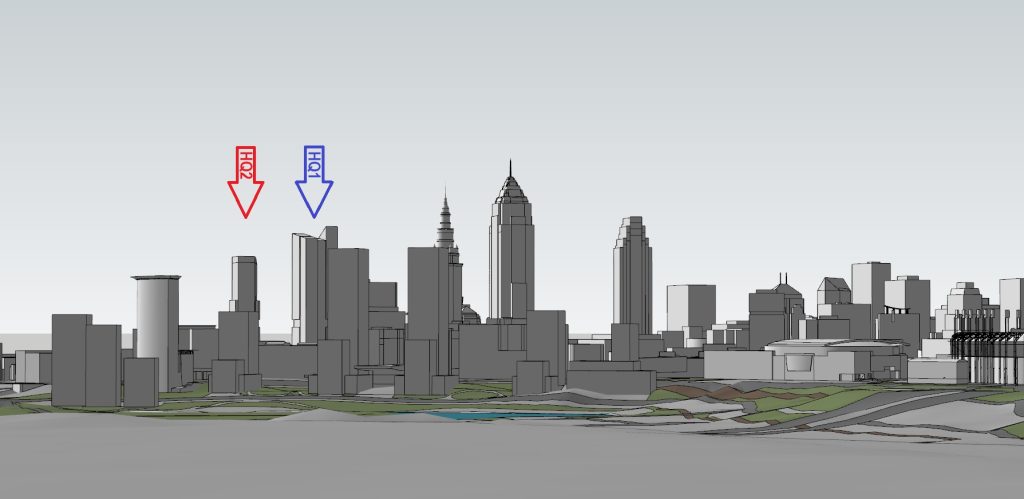

This unofficial rendering shows how an HQ2 skyscraper for Sherwin-Williams could look in the Downtown Cleveland skyline when viewed from the south. Also shown in this sketch are future towers proposed by Bedrock Real Estate for its Tower City-Riverview development. Bedrock purchased Sherwin-Williams’ old HQ and its Breen Technology Center for its Riverview development (Ian McDaniel).

Another 200,000 to 250,000 square feet of HQ2 offices would still need to be added in a tower at Superior and West 6th. And with perhaps 1,000 parking spaces included in that tower, it’s still going to be a big building, approaching 20 stories and more than 250 feet in height based on 12 feet between parking levels and 15-foot office floor heights. Even though towers 250 feet tall don’t usually require caissons to bedrock to support their weight, this one might with so much parking needed to overcompensate for the HQ1 garage. “It all depends on the structural load paths and bearing capacity of the soils,” a source said.

That’s why Sherwin-Williams may go big with HQ2. If you need to spend for caissons for a mid-rise, why not accommodate all of the offices in a skyscraper to defray the costs? Then the perimeter of the garage along West 6th and St. Clair can be affordably developed with low-rises and mixed uses — extended-stay hotels, boutique hotels, active and/or E-sports venues, restaurants and retail including a flagship Sherwin-Williams store, plus a few offices for company vendors and partners.

If the company wants a mixed-use perimeter for its HQ1 parking garage, then that points to a soaring HQ2 skyscraper. With 10 levels of parking above a lobby, topped by another 20 or more floors of offices, depending on floorplate sizes, Sherwin-Williams’ HQ2 could approach 500 feet in height. But given Sherwin-Williams’ conservativism, it remains to be seen if this is the approach they would take. One would hope they would learn their lessons from HQ1.

END