Still the cheapest among USA’s 40 largest metros

Greater Cleveland led the nation in home price appreciation in March, but the metro area’s median prices are still far below the national benchmark. In fact, according to a new report, the Cleveland market has the lowest median sales price among the 40 largest US markets. But that might not be the case for much longer.

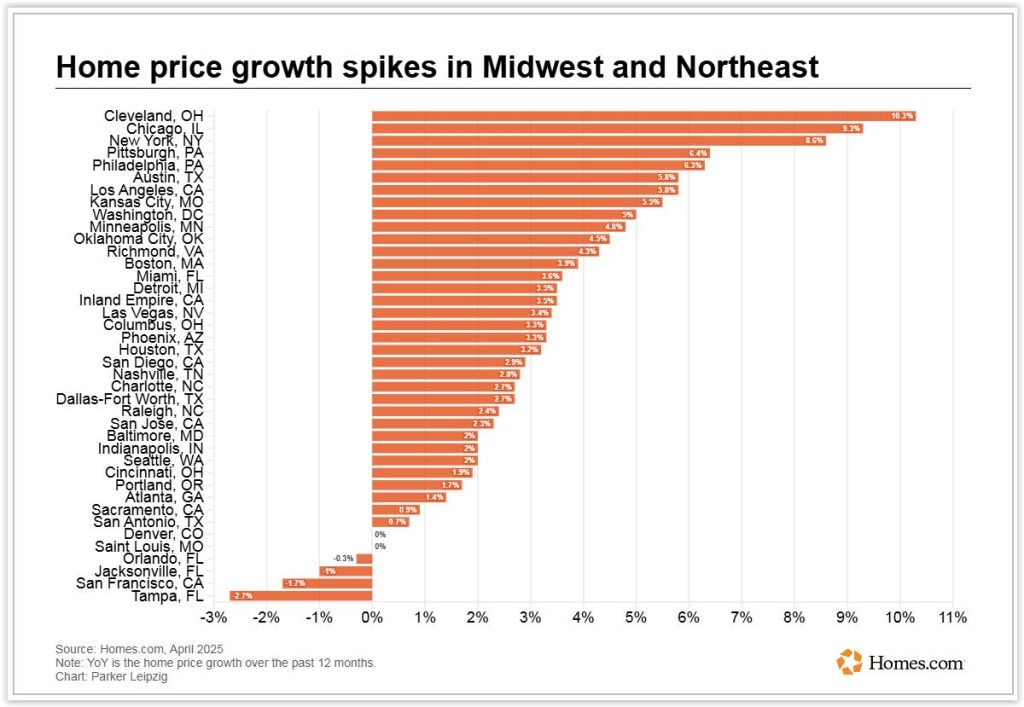

The median home price in Cleveland rose 10.3 percent yearly in March compared to a nationwide increase of 2.2 percent. Homes.com, a branded Web portal for the real estate brokerage and analytics firm CoStar group, just released a preliminary look at housing prices for the month of March based on information collected so far.

These numbers could change slightly once all home sales are accounted for, but give an early look at what is happening with prices, said Veronica Miniello, associate director of market analytics at CoStar Group and Homes.com. The preliminary data is compelling.

Greater Cleveland in March had the nation’s largest median housing price growth compared to March 2024. Yet it was still the cheapest housing market among these 40 largest metro areas in the nation (Homes.com).

Due to tight inventory, home prices have been rising for a while in Cleveland but rose at a faster pace in March. The median sales price in Cleveland increased by 10.3 percent year over year and was the largest March increase in three years. This growth follows a 5.9 percent rise in February and an 8.5 percent increase in January, the report noted.

The median home price in Cleveland was $225,000 in March — 41 percent below the US median of $380,000. In dollar terms, prices in Cleveland increased $21,000 in March compared to $8,000 nationally, placing Cleveland ninth among the largest 40 markets ranked by dollar increase.

Cleveland ranked first among the 40 largest US markets in percentage change of home prices. Our metro area joined many of its neighbors metro areas for price growth. Midwest and Northeast markets made up most of the top 10 cities for price growth in the nation.

A quick-look summary of the Homes.com housing market report and how the Cleveland market fared in it (Homes.com).

“I would say we’ve remained a great place for investment; we’re still moderately priced compared to other major cities,” Angela Foster, an agent with Classic Realty Group Inc. in the Cleveland suburbs, said in a written statement. “Starting in 2022, we’ve seen about an 8 percent increase in values for homes each year, even without doing any work on a house.”

The data from CoStar and Homes.com is backed up by other real estate firms and their analyses. At the end of last year, Redfin studied the 50 largest metros and found that Cleveland’s median home sale price saw the third-highest increase in 2024, edged out by only Philadelphia and Milwaukee.

“Cleveland may still have a reputation as an affordable-housing haven among out-of-staters, but not so much among locals,” said Bonnie Phillips, a Redfin Premier agent in Cleveland, who was quoted in the study.

When this Streetview was captured in August 2024 on Berea Road in Cleveland’s Jefferson neighborhood, the middle house was in between its own sales. It had sold in February 2024 for $217,500 and was about to sell again in March 2025, this time for $243,000. That 10.6 percent annualized appreciation was indicative of the price growth in the overall Cleveland housing market (Google).

“Many families have been priced out, and those who can still afford to buy have to move to neighborhoods they don’t really want to live in,” she said.

Only Los Angeles, CA and Austin, TX intruded on the Midwest-Northeast’s real estate party, the Homes.com report added. Elsewhere in Ohio, Greater Columbus saw a 3.3 percent price increase in last month while Cincinnati saw its median price grow 1.9 percent, below the national average.

Denver, CO and St. Louis, MO saw no price growth while San Francisco and three of Florida’s (Jacksonville, Orlando, Tampa) four largest metros all saw price decreases. Only Miami saw its residential real estate prices increase in the Sunshine State.

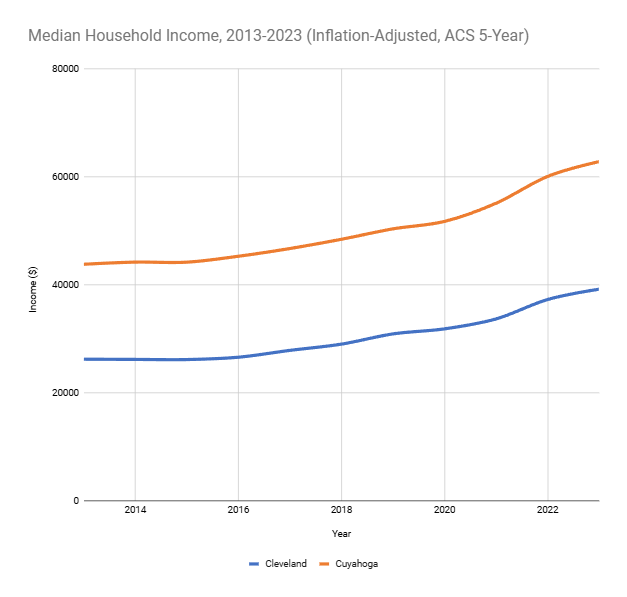

While population growth may be stagnant in Cleveland and Cuyahoga County, household income is not. One of the factors driving the growth in housing prices is that higher-income professional singles and couples without children are buying urban homes from lower-income families. So while the population for a given household drops, the income grows (ACS).

To develop its findings, Homes.com tracked hundreds of thousands of transactions to identify real-time housing trends. the Homes.com Network reached an audience of 110 million average monthly unique visitors in the fourth quarter ending Dec. 31, 2024.

CoStar Group’s major brands include CoStar, a leading global provider of commercial real estate data, analytics and news; LoopNet, the most trafficked commercial real estate marketplace; Apartments.com, the leading platform for apartment rentals; and Homes.com, the fastest-growing residential real estate marketplace.

CoStar Group’s industry-leading brands include STR, a global leader in hospitality data and benchmarking, Ten-X, an online platform for commercial real estate auctions and negotiated bids and OnTheMarket, a leading residential property portal in the United Kingdom.

END