NE Ohio wins nearly half of all statewide awards

Northeast Ohio did well in the latest round of Ohio Historic Preservation Tax Credit Program awards, garnering nearly half of all awards in terms of dollar amount and total number of projects aided today. By contrast, only one project in fast-growing Central Ohio was awarded historic tax credits by the Ohio Department of Development.

The largest award to a Northeast Ohio project was the maximum — $5 million toward a $50.4 million renovation of 177 units of student housing in the 22-story Fenn Tower, 2401 Euclid Ave., on Cleveland State University’s (CSU) campus in Downtown Cleveland. Last December, another CSU project, the conversion of Rhodes Tower to student housing, won historic tax credits to aid that $92 million project.

The 95-year-old Fenn Tower, built as the National Town and Country Club before closing in 1937, was acquired by Fenn College and later CSU to serve as classrooms, bedrooms, dining rooms and gyms.

“The rehabilitation will convert the building into updated student housing while preserving its historic character, offering a more modern residential experience within a celebrated architectural landmark,” according to a project summary provided by the state. This was the 34th Round of historic tax credit awards.

However, two adjacent buildings at 530 S. Main St. in Akron’s B.F. Goodrich Company Historic District, formerly part of the tire company’s headquarters and factories, won credits of $4.97 million and $4.38 million for a total project cost of $48 million. They will be converted into 128 market-rate apartments.

In total, 39 projects were awarded $66,145,922 in tax credits to preserve 47 buildings across the state. The projects are expected to leverage approximately $518 million in private investments. There were 18 Northeast Ohio projects that won $31 million worth of tax credits.

“As Ohio’s cities and neighborhoods continue to grow and modernize, it’s essential that we honor and preserve the legacy that already exists,” said Gov. Mike DeWine in a written statement. “These buildings are more than brick and mortar — they reflect the history of our communities and the generations of the past. Thanks to these tax credits, these buildings will contribute to Ohio’s future as well.”

Award winners in Greater Cleveland included the Midtown Building, 2728 Euclid, in Cleveland’s Midtown neighborhood. Located a few blocks east of Fenn Tower, this 1956-built modernist office building is to be renovated and converted into 33 market-rate apartments for $3.3 million.

A $250,000 historic tax credit was offered. Several other office buildings nearby from the same era, some also using “Midtown” in their names, were similarly converted to residential. Many of the other Cleveland awards are directed toward a cluster of building renovations to help reinvigorate their neighborhoods.

For example, several buildings near each other in Cleveland’s historic Buckeye-Shaker neighborhood won historic tax credits. These buildings reflected the area’s early 20th-century development as a hub for Hungarian immigrants. Today, these buildings are vacant, seeking a new use.

In 2021, a person could stand in the middle of Buckeye Road at East 120th Street and not get hit by a car. Since then, the street was rebuilt and so were several buildings. Much of the historic building stock in this stretch has survived in good enough condition so it can be renovated and reactivated with historic tax credits (Google).

One of those is the A. Vargo Building, 11914-16 Buckeye Rd. It won $250,000 to offset total project costs of $1.63 million. Local community development corporation Burton, Bell, Carr (BBC) Inc. plans to rehabilitate the two-story building into five live/work residential units.

Across the street, at 11905-11 Buckeye, the F. Smetana Building is to be renovated by BBC for $1.68 million thanks to a $250,000 historic tax credit. Built in 1915 by Frank Smetana for his hardware business, the vacant two-story structure will be rehabilitated by BBC into a brewery on the first floor and three apartments above.

Next door, at 12001-11 Buckeye, BBC aims to use $250,000 in credits to transform the vacant, 101-year-old Ruth Building into a mixed-use space with a live music event company on the first floor and seven apartments above. Project costs are estimated at $1.56 million. BBC has acquired all of these properties in recent years to preserve them.

“BBC, a longtime advocate for community-driven development in the Buckeye neighborhood, aims to use the project as a catalyst for further revitalization of the corridor,” an Ohio Department of Development spokesperson said.

The Broadview Savings & Loan Co., 4221 Pearl Rd., in Cleveland’s Old Brooklyn neighborhood, was a previous award winner of $180,000. This time, the $5 million renovation project won $916,000. The 106-year-old building is across the street from another big project, the Memphis & Pearl development.

“The bank was acquired and renovated in the 1990s, and many original features were removed or obscured, though two original bank vaults remain intact,” the spokesperson said. “The planned rehabilitation will convert the structure into 22 studio, one-, and two-bedroom apartments.”

Another prior award winner, next to and connected by underground tunnel to the previous building, is the South Brooklyn Savings & Loan Co., 4209 Pearl. This 95-year-old building won $250,000 in credits toward a project cost of $1.37 million. In 1963, Broadview Savings & Loan Co. acquired the building for additional space.

The rehabilitation will preserve the historic façade, including its signature pilasters and window openings, and convert this building into eight residential units — a total of 30 apartments among the two connected projects.

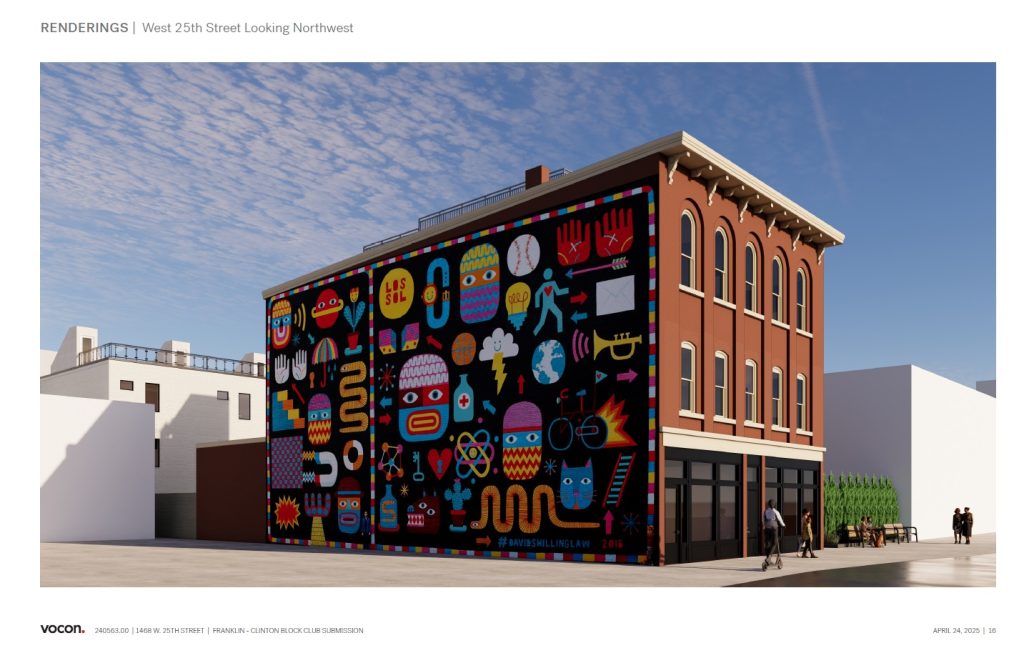

Beachwood-based TurnDev’s $13.4 million plan to renovate the Case Building and Nelson Block, 1450-72 W. 25th St., in Cleveland’s Ohio City neighborhood, got two awards — one each for Case and Nelson. The Case Building got $682,540 while the Nelson Block got $660,000. NEOtrans was first to report on this project in May.

The Case Building has housed a wide array of commercial tenants over the decades — from showrooms and rug sellers to utility companies and an auto parts distributor. The new owner will rehabilitate the building as law offices for Flannery Georgalis, LLC, while retaining the historic windows and constructing a compatible new storefront that respects the building’s architectural character.

The 1868-built Italianate-style commercial building was constructed for by S.N. Nelson. Its renovation will convert the upper floors into five residential units and the ground floor into commercial space. Three new townhouses will also be added to the parcel in back, off West 26th Street.

Some of the oldest buildings still standing in Downtown Cleveland, the Chamberlain/Johnson/Jobbers Building Block, 1352-1388 W. 6th St., won a $2 million historic tax credit to offset total renovation costs of $17 million. The Warehouse District structures were built between 1851 and 1854 as industrial space. Over the years, the buildings transitioned to commercial restaurant space with the upper floors serving as offices.

The upcoming rehabilitation will convert the second through fourth floors into 54 market-rate apartment units while retaining the active ground-floor commercial tenants. The project includes exterior restoration and interior improvements to ensure their long-term use.

A short distance away to the north, at 425 W. Lakeside Ave., the Stone Block will be updated for $3 million thanks to a $250,000 credit. This mid-rise masonry structure underwent historic rehabilitation with historic tax credits more than two decades ago.

While the building currently houses businesses, cafes, restaurants and residential units, aging interior finishes are no longer aligned with current market expectations. The proposed rehabilitation will include light interior updates to preserve the building’s appeal and ensure continued occupancy.

The two-story Flatiron Building once housed the Winking Lizard restaurant and second-floor Kent State University Cleveland Urban Design Collaborative offices but now is vacant except for the Bank of America branch. The building will be renovated for an Urban Meyer’s Pint House in the former Winking Lizard space and the second-floor offices will be updated (Google).

The Flatiron Building, 800-850 Prospect Ave., will be renovated for just over $4 million after it was awarded a $400,000 historic tax credit. Named for its distinct triangular shape, The Flatiron Building, now 85 percent vacant, has a prime location between Downtown Cleveland’s sports and entertainment venues in the Gateway District and Playhouse Square.

The building will gain Urban Meyer’s Pint House in the former Winking Lizard restaurant space on the first floor with second-floor offices updated. The remaining commercial tenant, Bank of America, will continue operations on the first floor.

Other Northeast Ohio projects to win historic tax credits today were the Akron Soap Company and Federal Warehouse Buildings in Akron, the Home Savings & Loan Co Building in Canton, the Bloomberg Building in Massillon, and the YMCA Building in Warren.

“Historic buildings tell Ohio’s story – with these tax credits we’re writing the next chapter,” said Lydia Mihalik, director of the Department of Development. “Through the Ohio Historic Preservation Tax Credit Program, we’re preserving what makes Ohio’s communities unique while supporting modern needs like housing, small business, and the arts.”

The Ohio Historic Preservation Tax Credit program is administered in partnership with the Ohio History Connection’s State Historic Preservation Office. The State Historic Preservation Office determines if a property qualifies as a historic building and that the rehabilitation plans comply with the United States Secretary of the Interior’s Standards for Rehabilitation.

END