Of 21 statewide applicants, 9 win, 2 from NEO

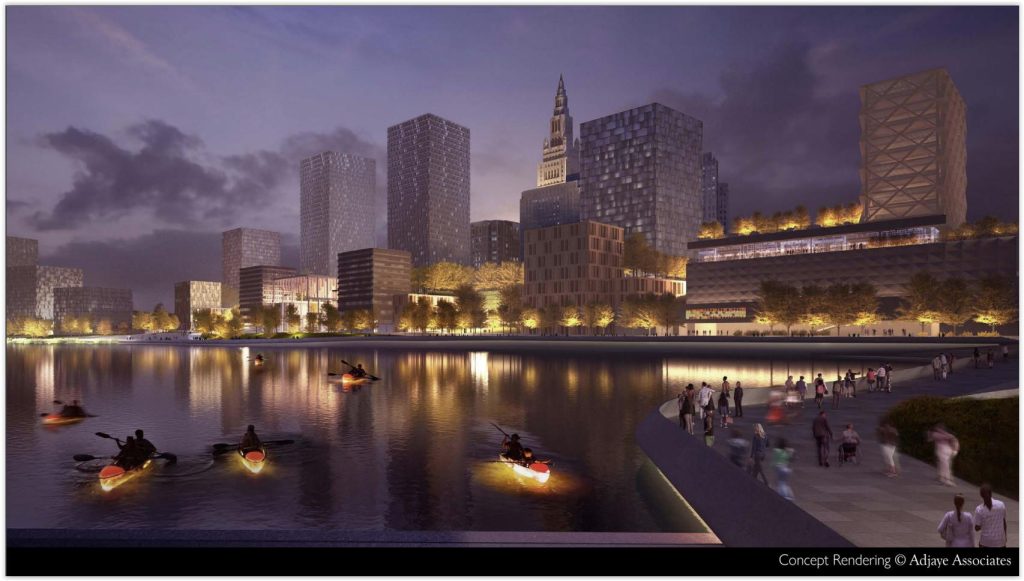

It seems $100 million doesn’t go as far as it used to. At least it didn’t today when the Ohio Tax Credit Authority awarded $100 million in Transformational Mixed Use Development (TMUD) tax credits to just nine projects statewide. Northeast Ohio won two — Greater Cleveland got just one of those. And that was the last of four rounds of TMUDs authorized by the Ohio General Assembly unless some previous awards aren’t used and are made available.

Greater Cleveland’s lone winner was the next phase of Bedrock’s Downtown Cleveland Riverfront $3.5 billion development. That phase is a 17-story entertainment complex topped by a hotel. Dubbed Rock and Roll Land, it won $9.1 million in TMUD credits, despite requesting the maximum $40 million award from the Ohio Department of Development.

Bedrock officials said the $488 million Rock and Roll Land entertainment complex, to be located at the southwest corner of Ontario Street and West Huron Road, will create 3,000 new construction jobs and 400 new permanent jobs. Part of the 560,017-square-foot structure includes a 268,452-square-foot parking garage for approximately 800 cars. NEOtrans was first to report this proposed project.

The brand names of the hotel and entertainment venue were redacted, or blacked out by the Ohio Department of Development before releasing the TMUD applications to NEOtrans. Local real estate experts have speculated that the hotel will be a Shinola brand, with whom Bedrock has partnered in downtown Detroit. The redacted word in the application is about seven letters long.

“The hotel, theater and related amenities will deliver a multi-sensory experience purpose-built to immerse guests in the mindset of the music genre,” Bedrock officials said in their TMUD application. “The hotel and theater will share a ‘central lobby’ that will be the vortex where guests and fans will be able to dine, socialize and see performances. From arrival to departure, guests will be treated to a full rock and roll experience.”

The city is seeking to accelerate development of the riverfront by pledging undefined future tax increment financing (TIF) revenues to start more infrastructure work now at Bedrock’s riverfront site. Work includes rebuilding riverside bulkheads, relocating sewers and streets, and constructing boardwalks and other public spaces.

The pledge is “to induce and enable the developer to engage in the redevelopment of the Cuyahoga Riverfront area of Downtown Cleveland, including, without limitation, certain public infrastructure,” the administration said in its proposed amendment to a 30-year, $1 billion TIF agreement that City Council passed in August 2024.

TIF revenues won’t start flowing until the first phase, Cleveland Clinic’s Global Peak Performance Center, is completed in 2027. Bedrock says its requested TMUD will allow it to open the Rock and Roll Land complex by the end of 2028. It remains to be seen if the smaller TMUD the state awarded, plus the city’s TIF pledge, pending City Council’s approval, will be sufficient to get the entertainment complex under construction soon.

“As our state grows, it’s more important than ever that we are creating communities where current and future Ohioans can live up to their fullest potential,” said Ohio Gov. Mike DeWine in a written statement. “By prioritizing developments that transform neighborhoods, we’re making Ohio a place where people will want to be — now and in the future.”

The Bedrock entertainment complex was the largest of seven Northeast Ohio projects to seek a TMUD tax credit in this round. But it wasn’t the only winner. Redevelopment of the Mahoning County Bank in Downtown Youngstown won $1.39 million toward its $16.5 million cost.

An affiliate of the DiGeronimo Companies in partnership with the Haslam Sports Group, owners of the Cleveland Browns, did not win a state tax credit for its Berea mixed-use development next to the Browns’ practice facility. It’s the second time the project missed out on state financial assistance for a community recreation center at the south end of the site. This view looks southeasterly above Lou Groza Boulevard and Front Street (AODK Architecture).

A development team of 22 Market Street Ohio LLC, including Sruly’s Management and Lock 39 Capital LLC, want to renovate the 115-year-old, 13-story, 135,085-square-foot downtown office building into a mixed-use building. The first four floors will remain as offices while the upper floors will be converted to 71 apartments.

“With new development and growth comes new possibilities for Ohioans,” said Lydia Mihalik, director of the Ohio Department of Development, which administers the TMUD program. “Mixed-use developments create lively communities that attract residents and visitors, transforming empty lots into places where people can connect and thrive.”

Five Northeast Ohio projects didn’t win. They were the Berea Mixed Use Project, dubbed District 46, which sought at $2 million TMUD, Cain Park Village in Cleveland Heights wanted $5.11 million, NASA Park in Fairview Park requested $4.77 million, Van Aken District phase two in Shaker Heights sought $1 million, while the Jefferson Medina Redevelopment in Medina Township applied for $2.5 million in TMUD credits.

Just over half of the $100 million worth of awards in this round went to Central Ohio projects. Two applicants in Downtown Columbus, one at Polaris in Delaware County and another in Health in Licking County won $50.7 million in TMUD credits.

END