One of the most impactful actions to boost downtown Cleveland in the New Year and beyond was made in recent weeks and months 125 miles to the south in our state capital. It culminated with Gov. Mike DeWine signing a piece of legislation last week. In a state legislature that has gained a reputation for harming Ohio’s largest urban centers, it actually helped them this time.

How do we know for sure? We don’t. We’re talking about the future. The great unknown. As many of you know, I hate making predictions. I possess no great insights on the future. If you saw my stock market picks, you’d agreed with me.

But some predictions aren’t hard to make. If you’re driving toward a cliff with no sign of slowing down, it’s easy to predict the outcome barring any changes. Conversely, with Ohio soon offering up to $320 million in tax credits available for megaproject developments in Ohio’s largest cities in the next three years, the odds are pretty good that quite a few big projects are going to move forward.

How many and where? Now we’re getting in tougher prediction territory.

On Dec. 29, NEOtrans broke the story that DeWine had signed into law the Transformational Mixed Use Development (TMUD) tax credit program. Property owners and insurance company investors supporting projects certified by the Ohio Tax Credit Authority (OTCA) as TMUDs are eligible to receive up to $40 million in tax credits as part of their project’s equity contributions.

| Stark Enterprises’ desire to fill a gap in its capital stack for the nuCLEus development became the motivation for Stark to seek the TMUD tax credit (Stark). |

In or within 10 miles of an Ohio city having a population of 100,000 or more, a TMUD is a $50+ million project that is either:

- At least 15 stories tall;

- At least 350,000 square feet of new building or a renovated previously vacant building on a single parcel;

- At least 350,000 square feet total of development among two or more buildings that are connected to each other, are located on the same parcel or are on contiguous parcels;

- Will be the site of employment accounting for at least $4 million in annual payroll;

- And must include any combination of retail, office, residential, recreation and structured parking.

Smaller developments that are more than 10 miles away from a city of 100,000 people may be considered TMUDs and eligible for up to $80 million in tax credits. The TMUD program is due to sunset June 30, 2023. Any tax credits not used may be carried forward for up to five years.

For details, see the legislation as an enrolled law here or read the Legislative Services Commission’s analysis of the final version of TMUD tax credit program.

|

| Although The Centennial project may get underway this year, additional subsidies will be needed to finish it (Millennia). |

But the program is likely to be highly competitive. That’s especially true for the urban portion that applies to Ohio’s six metro areas that have a 100,000+ population city at their core — Akron, Cincinnati, Cleveland, Columbus, Dayton and Toledo.

There are at least a half-dozen pending/emerging projects in each of Ohio’s 3-C cities that may be seeking TMUD credits. In the second tier of Ohio’s largest cities — Akron, Dayton and Toledo — each appears to have only 1-3 pending/emerging projects that might quality.

That’s 25-30 projects statewide right there. I think Greater Cleveland could account for 10 of them.

Consider that tax credit awards will be capped at 10 percent of a project’s cost and that the minimum project cost to qualify for the tax credit is $50 million. A price tag of $50 million is barely enough to afford a 15-story residential or office building with a reduced amount of structured parking.

But the TMUD tax credit program with $80 million per year could afford supporting 16 of those 15-story buildings annually — or eight 30-story buildings per year. And while Cincinnati and Columbus developers are planning buildings mostly in the 15- to 25-story range, Cleveland developers are considering TMUD-eligible projects even larger — and more numerous.

With the TMUD program, a lot of those projects that win credits are going to attract other funding and are going to get built.

Before I get into prognosticating and my methodology for doing so, it’s important to understand how the program will work.

The tax credit award process is two-tiered. A property owner/insurance company investor gets preliminary approval of a tax credit award by the OTCA. Awarding of the tax credit remains contingent upon completion of the TMUD as described in the development plan. The credit amount is subject to change based on actual development costs and on the increase in tax collections at the project site and in the surrounding area calculated upon completion of the project and in the years that follow.

Thus, applicants will likely seek the maximum tax credit allowed and force the OCTA to divvy up the annual $100 million TMUD tax credit pie based on the aggregate dollar amount among all applications and the available tax credits. And, as noted, $80 million of the total tax credits per year will go to Ohio’s six largest metro areas.

|

| Under construction in 2019, The Lumen apartment tower may not be the last mostly residential build- ing of 30 stories or more constructed in down- town Cleveland (APPhotoshopman). |

Of course, not every project is going to win tax credits. And some projects are going to win most if not all of the credits they requested. Those projects with a larger projected economic impact are likely to fare better. And, as noted above, just because a project promises big impacts doesn’t mean it’s going to get what it asked for or what it was preliminarily awarded.

If a project wins $20 million in tax credits based on promised economic impacts (as measured by local tax revenues generated) but its projected economic impact is actually less, the final tax credit award will be smaller than $20 million. The excess can be awarded to other projects.

So, for simplicity’s sake, let’s consider this example to imagine the potential scale of how many TMUD? projects could benefit. And remember, a TMUD is by its very definition is a big project. It’s going to be hard to miss in our city’s skylines.

If 25 applicants from among the six metros win tax credits in the first year, that’s an average of $3.2 million in tax credits per project. That probably won’t be enough to move some projects forward. But since not every project is going to win funding in the first year, that average dollar amount will probably be higher — perhaps double or triple or quadruple.

| Looking west on Front Street at the East Bank of the Flats, new towers adding 1,500+ residential units, co-working spaces and restaurants/retail qualifies as a TMUD (HSB). |

Thus, let’s consider things over the life of the TMUD program. If 25 applicants win tax credits over three years of the program, that’s $9.6 million per project. If OCTA determines that the fiscal year 2020 (ended June 30, 2020) should be part of the program, 25 winners could average $12.8 million per award.

Given those assumptions, I think the average amount awarded per project over the next three years could be in the neighborhood of $10 million.

It should be noted that $12 million was the amount of a forgivable loan that Stark Enterprises sought from the city of Cleveland to fill the gap in its capital stack for the $350 million nuCLEus project. That fell through, as did a previous idea for a tax increment financing arrangement with the Cleveland Metropolitan School District. After that, Stark officials in 2018 came up with the TMUD tax credit.

It isn’t known if Stark is still looking for $12 million to complete its capital stack. Perhaps it’s more since $12 million is just 3.4 percent of the overall project’s cost and the TMUD program allows the state to award up to 10 percent of a project’s cost. Stark’s project has changed since it sought the city loan.

|

| Outlined in red, the Lutheran Hospital parking lot in Ohio City is proposed for development, if someone can come up with the money to put the 530 parking spaces into a deck (Google). |

As noted above, let’s assume the average award will be about $10 million. With that assumption, and based on my prediction that 10 Cleveland-area projects could win TMUD tax credits by the time the program is wrapped up in 2023 (assuming no unused tax credits are left over or the program isn’t extended), I present the following stabs in the dark, or at least in the pre-dawn light.

They are (in alphabetical order):

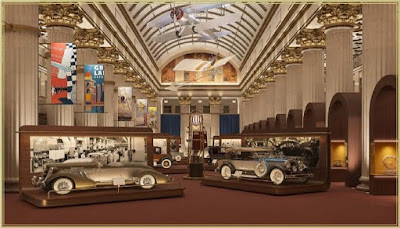

THE CENTENNIAL — The Millennia Companies anticipate starting the renovation of the 1.36-million-square foot former Huntington Bank at 925 Euclid Ave. this year with the incentives it has in hand. But later phases of the project might need a small- to medium-sized TMUD tax credit of about $10 million.

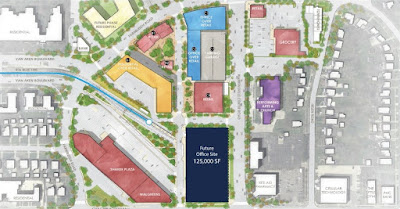

CIRCLE SQUARE — Midwest Development Partners’ creation of a second downtown between Euclid and Chester avenues at Stokes Boulevard is due to start this spring without the TMUD program. A building in the later phase — namely a proposed office tower — could benefit from a small TMUD credit of about $5 million.

EAST 9TH-BOLIVAR — A residential or mixed-use tower is under consideration for the former New York Spaghetti House property. This 0.314-acre property, which also has a neighboring parking deck that needs to be replaced, is owned by an affiliate of the Geis Companies. It is possible that a small tax credit of about $5 million might be enough to move the needle on whatever Geis has in mind here.

FLATS EAST BANK — The Wolstein Group and Akara Partners have big plans for the Flats, requiring more structured parking and complicated site preparation to accommodate the addition of 1,500 to 2,000 units. In the absence of significantly more daytime workers to keep the parking decks full around the clock, the project might need a small- to medium-sized tax credit of about $10 million.

LUTHERAN HOSPITAL PARKING LOT — The Weston Group and the Kertesz family want to develop the hospital’s 5-acre parking lot on West 25th Street. But building a parking deck to densify its 530 spaces won’t financially benefit the developers or Cleveland Clinic. The answer might be a medium-sized tax credit of about $15 million.

MAGELLAN-WESTON PROJECT — Another partnership involving the Weston Group, this time with the Chicago-based Magellan Development Group, could feature two buildings over a pedestal of parking in the Warehouse District. One would be a skyscraper with apartments and a five-star hotel. The other would be an office building of unknown height. If the Marion Building and historic tax credits are a part of the development, it might require a small- to medium-sized TMUD tax credit of about $10 million.

NAUTICA WATERFRONT/1250 RIVERBED — Both developments as well as the removal of parking atop Superior Viaduct to avail a Highline-type linear park could benefit from a multi-story parking garage with a green roof, level with the roadway deck of the adjacent viaduct. The parking deck might cost $25 million with roughly half funded by a medium-sized tax credit of about $13 million.

NUCLEUS — The TMUD program’s mother project will be seeking a tax credit to fill a gap in its capital stack. While the amount is unknown, Stark Enterprises sought a forgivable city loan in the amount of $12 million. If that is still the gap, then adjusted for inflation a medium-sized tax credit of about $15 million might be needed.

VAN AKEN DISTRICT PHASE 2 — RMS Corp. seeks an office building at the corner of Warrensville Center Road and Chagrin Boulevard in Shaker Heights. While the office building would be too small to be called a TMUD, a proposed 15-story apartment building on Farnsleigh would be eligible for a tax credit, possibly a small one of about $5 million.

WESTINGHOUSE PLANT — The amount of costly remediation and partial demolition has kept this waterfront property from being redeveloped. While it probably needs more TMUD tax credit help than it might be able to muster, it can get some more financial assistance from historic tax credits after the unsalvageable structures are removed and developed with some vertical structures. A medium-sized TMUD tax credit of about $12 million might move a redevelopment forward.

There are at least 20 other potential TMUD projects just in Greater Cleveland whose developers could tap into this program to help make them become a reality. And there are certainly others flying below the radar that could swoop in unseen until the last moment to scoop up a preliminary TMUD award. And who knows what projects may emerge in Ohio’s other cities?

So that’s why I don’t like making predictions. But I thought it might be fun showing people how bad I am at making them. So hold on to this article and check back with me in a few years to have a nice laugh at my expense.

There are three more predictions I’m fairly confident in making. First, there are going to be a lot more cranes in the skies over Ohio’s downtowns, perhaps one dozen or two dozen more as a result of this program. Second, Ohioans in each of the 3Cs are going to be keeping a running, competing tally of how many TMUDs and cranes each city will get. And, third, expect the unexpected.

END

- New downtown park with basketball court fast-tracked

- Michael Symon joins River Roots’ move to Flats

- Tenant ID’d for big new industrial development near Hopkins airport

- $119M Lakewood Common project goes vertical

- CWRU to renovate, expand one of its most historic buildings

- Master Chrome coming down, cleaning up