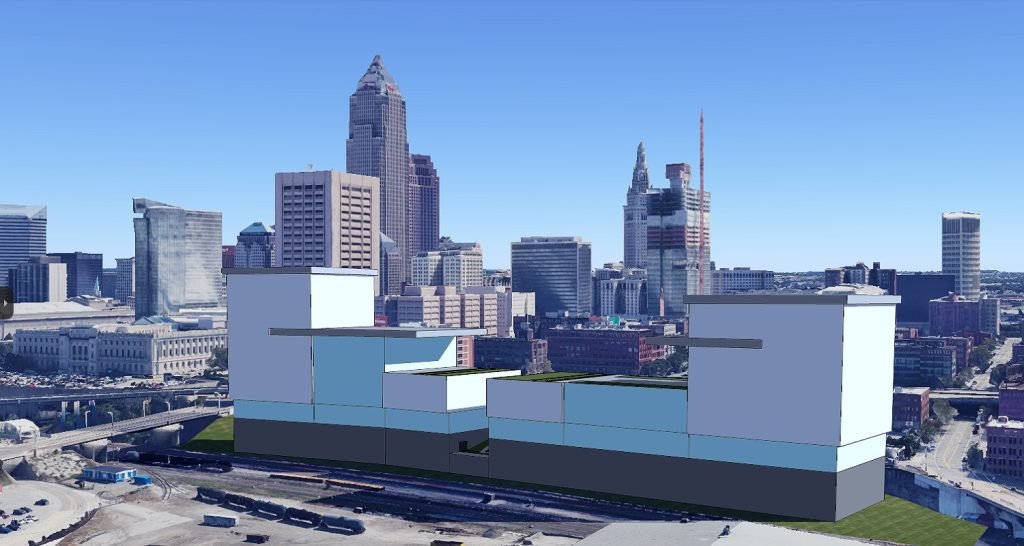

About 4,000 people are employed at the Anthony J. Celebrezze Federal Building in Downtown Cleveland. The Trump Administration has proposed to close and/or sell the 59-year-old building without identifying where the federal services and the employees who provide them would be located (Google). CLICK IMAGES TO ENLARGE THEM.

Mayor also said building may be closed

Earlier this month, the Trump Administration offered hundreds of federal buildings and properties for sale or other disposition but quickly withdrew the list in the face of national criticism. Now, the General Services Administration is issuing a new, much smaller list of eight federal buildings to be cast off in an “accelerated disposition.”

While Downtown Cleveland’s Anthony J. Celebrezze Federal Building, 1240 E. 9th St., was on the first list but not on the second, Cleveland Mayor Justin Bibb issued a statement today expressing concern over the future of the 33-story, 1.2-million-square-foot office tower.

“My administration is aware of discussions regarding the potential closure and sale of the Anthony J. Celebrezze Federal Building,” Bibb said in the written statement. “We are actively working with the U.S. General Services Administration (GSA) and our local, state, and federal partners to understand the timeline.”

The tower was built in 1966 and renovated for $121 million in 2016. Funding for the renovation came from the American Recovery and Reinvestment Act of 2009, an economic stimulus amid the Great Recession of 2008-2009. The renovation included the addition of an outer-glass casing to improve the building’s energy efficiency and its security to withstand an Oklahoma City-type terrorist bombing.

“While it seems GSA is early in the process of determining next steps for the building, it is concerning nonetheless,” Bibb added. “At this time, we have received no indication that the federal government plans to reduce staffing levels for these agencies. However, should any Cleveland workers be impacted, we stand ready to support them through our Rapid Response Hub in partnership with Greater Cleveland Works.”

Bibb launched the Rapid Response Hub several weeks ago in reaction to the challenges faced by federal employees residing in Cuyahoga County. That includes layoffs, funding eliminations and the termination of remote work options urged by the Trump Administration and without the consent of Congress. Court actions have slowed or halted many of Trump’s efforts.

Bibb also said that, if the Celebrezze Building is offered for sale or closed, he wanted to make sure that the large number of federal workers and services provided at the federal building not be relocated outside of Downtown Cleveland where they may be less accessible.

“The city’s priority is ensuring that the 4,000 federal workers in the Celebrezze Building remain employed in Downtown Cleveland,” Bibb said. “Our urban core is a vital economic and civic hub, and we stand ready to collaborate with our federal partners to ensure that these agencies remain downtown.”

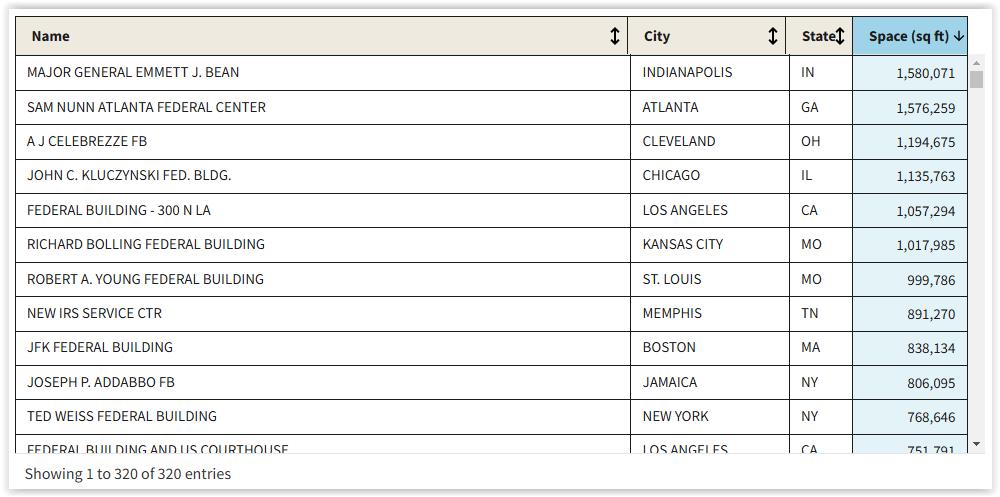

In the first list of 320 buildings announced but rescinded in early March, the Celebrezze Building was the nation’s third-largest on the chopping block, as measured in square feet. Only the 1.58-million-square-foot Major General Emmett J. Bean Federal Building in Indianapolis and the 1.57-million-square-foot Sam Nunn Federal Center in Atlanta were bigger.

“GSA is focused on rightsizing the federal real estate portfolio to reduce the burden on the American taxpayer while also delivering space that enables its agency customers to achieve their missions,” the GSA said in announcing its asset disposition list this week. The GSA is the authority which oversees federal properties.

“This initiative aims to engage the market, attract interested parties and inform strategies that will expedite the disposition of federal assets,” the GSA added, calling its latest, eight-building list “Assets identified for accelerated disposition.”

But critics said that many of these buildings, like the Celebrezze Building, are older, designed specifically for federal use and thus unlikely to be attractive to investors in a real estate market that already has a glut of office properties in the wake of the pandemic.

Furthermore, if the federal office properties are sold to private investors and leased back to the federal government, or federal offices relocated to other private properties, it would likely do so at higher expense to taxpayers than if the federal offices stayed rent-free.

END