Region is well above national average

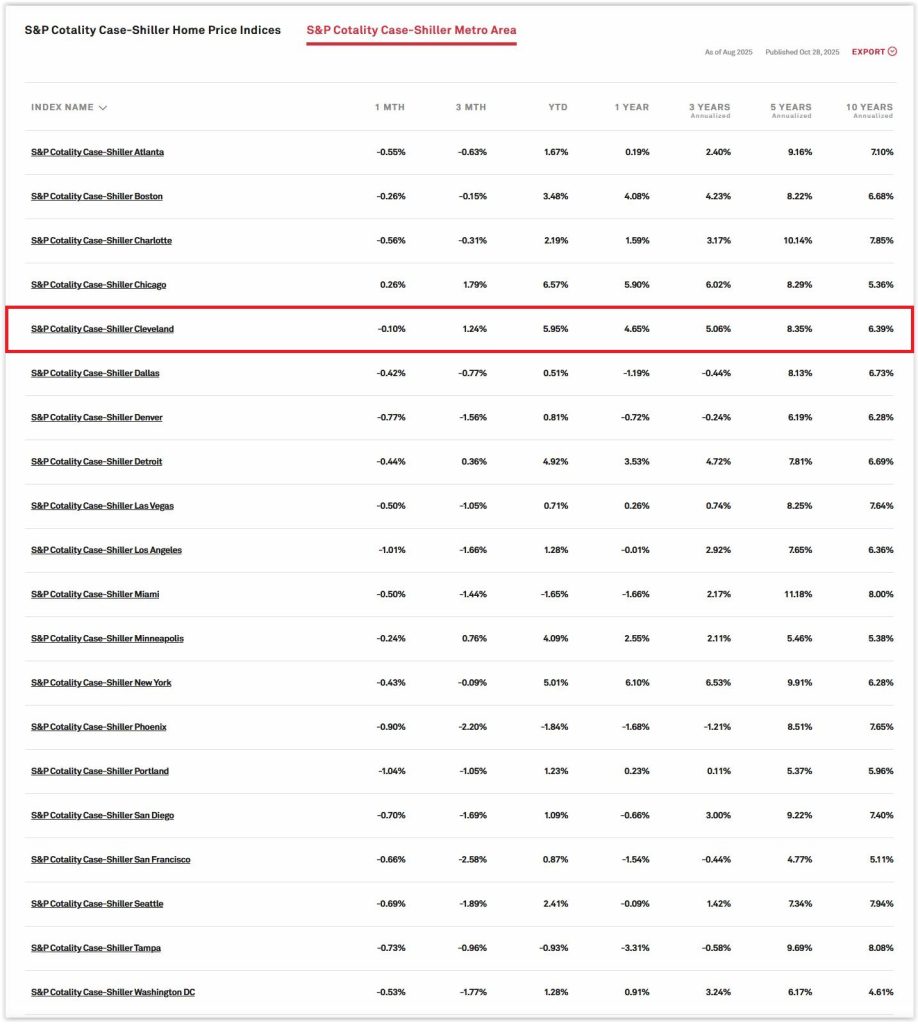

If it seems like housing prices in Greater Cleveland are rising at rates faster than they used to, there’s new data to back up your experience. Yesterday, the S&P Dow Jones Indices (S&P DJI) released the latest housing price changes in the S&P Cotality (formerly CoreLogic) Case-Shiller Index.

The index shows data from August 2025 compared to the immediately prior two months and to August 2024. The data reveals that Greater Cleveland’s housing prices are rising faster than those in most of the 19 other major metro areas that are included in the index. And they are faster than the national average, especially in the past year.

“The National Index rose 1.5 percent over the past year, with most of that gain coming in the recent six months (up 1.5 percent) while the prior six months were essentially flat,” said Nicholas Godec, head of fixed income tradables and commodities at S&P Dow Jones Indices, in a written statement.

He noted that the 20-City Composite gained 1.6 percent annually and a 10-City rose 2.1 percent, both continuing their deceleration from earlier in the year. But that, of course, wasn’t true of all metros with Cleveland being one of the exceptions.

“New York again led all metros with a 6.1 percent annual gain, followed by Chicago at 5.9 percent and Cleveland at 4.7 percent,” Godec added. “These Midwest and Northeast markets, which saw modest gains during the pandemic, continue to outperform.”

Those that underperformed from August 2024 to August of this year were in the south and west — Denver, Miami, Phoenix, San Diego, San Francisco, Seattle, and Tampa. All of them posted declines in housing prices of 0.7 to 3.3 percent, documented by sales data.

However, Greater Cleveland’s housing price index dipped from July 2025 to August by 0.1 percent which it tends to do each year because Cleveland’s housing and employment market is seasonal, with July being the typical peak.

Even so, Cleveland was the second-best performing metro area after Chicago which was the only metro area to see a gain, a mere 0.26 percent, from July 2025 to August, the report noted.

No metropolitan area did better than Greater Cleveland the month before, from June 2025 to July, when its housing price indice grew 0.94 percent. Chicago ranked second at 0.52 percent.

Not surprisingly, Greater Cleveland was the second-most affordable metro area on the 20-city index. Only Detroit was considered more affordable.

But if Cleveland continues to outrank other metro areas on housing price growth, it won’t be among the most affordable metro areas for long. That would dash one of its greatest selling points. But at the same time, rising prices make it easier for developers to finance new projects.

Why is this happening? There are several factors.

According to job and career search Web site Monster.com, Greater Cleveland was one of the nation’s fastest growing job markets in the third quarter of 2025. The Q3 2025 Monster Job Market Report ranked Greater Cleveland as the 11th-best hiring hot spot in the United States.

An ADP/Wall Street Journal analysis featured Greater Cleveland as one of the nation’s Top 20 hot jobs markets — and top five in Midwest — for young professionals, for the second straight year.

Cleveland’s affordability, improving economy and climate safety, like those of Detroit, Milwaukee and others in the Great Lakes region, are causing young people to “boomerang” after leaving home for the promise of coastal big cities.

“Cities like Cleveland, Ohio, and Buffalo, New York faced similar declines as industry left and young people followed,” wrote Strong Towns staff writer Asia Mieleszko in article titled “How Would Your Town Welcome 5,000 New Neighbors?“

“But the tides are shifting,” she continued. “Some communities are seeing their children return, ready to raise families where they grew up. Others are seeing renewed job opportunities, sparked by local entrepreneurship or policy success. Some neighborhoods are welcoming people relocating from places affected by hurricanes, wildfires, or floods—whether for the long term or just to get back on their feet.”

END