Pre-pandemic office conditions returning

Although the occupancy of Sherwin-Williams’ new 1-million-square-foot headquarters downtown has caused a brief boost to Greater Cleveland’s office market, a new report showed that longer-term, structural changes to the market are causing it to return to more pre-pandemic conditions.

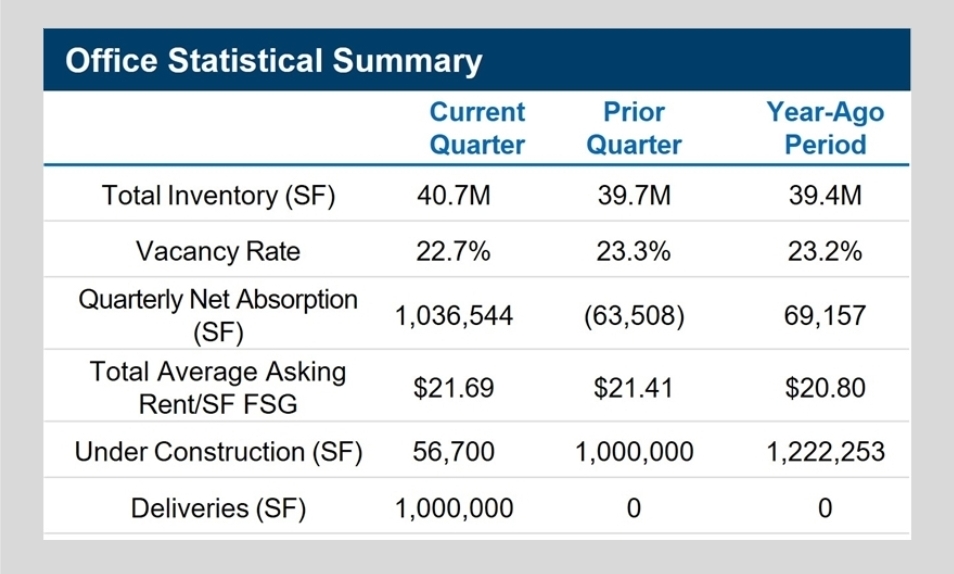

Real estate brokerage and analytics firm Newmark said Greater Cleveland office market posted over 1 million square feet of positive absorption — the leasing of available office space — in the fourth quarter of 2025.

That absorption was driven entirely by the delivery and occupancy of the Sherwin-Williams HQ in Cleveland’s central business district starting last fall. The global coatings giant’s new HQ is located across several blocks off the northwest corner of Public Square.

Sherwin-Williams’ staff continues to transfer from other buildings, including the old headquarters that’s spread among the Landmark and Skylight office towers along Prospect Avenue in the Tower City complex. The Landmark Building, acquired by Bedrock Real Estate from Sherwin-Williams several years ago, is not available for lease. It will likely be converted to mixed use.

Occupancy of the new Sherwin-Williams HQ, which is due to be finalized by March, along with the conversion of older office buildings are among the most significant influences on the region’s office market. Those factors have pushed office vacancies down 60 basis points to 22.7% quarter over quarter.

Absent of the Sherwin-Williams outlier, the overall market in the fourth quarter stayed relatively flat. For the year 2025, the average vacancy rate was 23 percent, lower than both 2023 and 2024.

“For leasing going forward, the market enters 2026 on a stable trajectory,” Newmark’s report noted. “Though many Class B office buildings in the central business district face financial headwinds, and are either in the process of a partial or full conversion to other uses or our strong contenders, as a result, the tenant pool will have to navigate a supply recalibration.”

The report continued that, in the coming years, “well-managed buildings with active lobbies and rich amenities within or nearby will rise to the top. Additionally, with office attendance, achieving a measure of steadiness. Leasing decisions should look more like they did in the pre-pandemic environment.”

More companies are advancing return-to-office policies. Sherwin-Williams was among the first to announce such a policy in 2025. PNC Bank announced its employees including those at PNC Plaza, 1900 E. 9th St. downtown, would return to the office five days a week starting May 4, said Lynn Sexton, PNC’s director of regional communications, in an email to NEOtrans.

“Office is not dead,” said Terry Coyne, vice chairman in Newmark’s Cleveland office. “It took a while to come back — but people like to be with people. Most of the US has been back from the pandemic. It just took us a bit longer. But office buildings with good owners have strong demand.”

On the property-sale side, the market has seen anemic transfer amounts and volume through all of 2025. Office sales averaged $74 per square foot across the market. In fact, the fourth quarter’s average of $25 per square foot brought the previous year-to-date average down as the year ended.

Half a dozen buildings in the central business district were categorized as special servicing, which opens up opportunities for new investors but keeps current owners with loan distress in jeopardy.

As Class B buildings increasingly become targets for conversion and a flight to quality mentality persists, lease rates should continue to rise. The tenant pool will have to navigate a supply recalibration.In the coming years, as the conversion trend will continue to reshape the market.

END