Downtown Cleveland Inc. reported that numerous metrics of office and residential occupancy, foot traffic and other activities show Cleveland’s central business has had one of its best months since the depths of the pandemic in 2020. This is the food truck scene at Perk Park along East 12th Street, between Walnut and Chester avenues (DCI). CLICK IMAGES TO ENLARGE THEM.

Metrics for office, residential, foot traffic are up

While it seems like foot traffic is up in Downtown Cleveland since the pandemic four years ago, different organizations that measure the city’s central business district’s economic performance have numbers backing up that perception. And that’s also reflective of increased numbers of workers returning to their offices and more residential conversions and occupancies as well. But those numbers are still far from robust.

In a 2023 study by the University of Toronto, it found that Downtown Cleveland’s recovery from the pandemic ranked in the middle of the pack, or 31st of 66 North American downtowns measured. The worst-recovering downtowns were in the Midwest — St. Louis, Louisville and Minneapolis. Columbus’ downtown recovery ranked fifth worst. Chicago’s was seventh worst and Cincinnati’s 10th worst.

The reason why Downtown Cleveland performed better than roughly half of North America’s downtowns was because it converted or had active plans to convert the most office space to residential or other uses of any central business district in the USA, according to real estate firm CBRE. That was backed up in a new report issued today by a competing firm, Newmark.

“Though far from robust, the Cleveland office market has avoided catastrophe during the economic downturn as a result of over 5.5 million square feet of office space being removed over the last 10 years for conversion, and another 2.1 million square feet of inventory that is either proposed or rumored to be conversion candidates,” today’s Newmark report said.

The Newmark report highlighted four office market achievements in the second quarter of this year for Downtown Cleveland. All of them were stories first reported by NEOtrans.

One was the Cuyahoga County Board of Elections leasing 223,000 square feet of space at the former Cleveland Plain Dealer building, 1801 Superior Ave. Another big office market deal was Cleveland Cliffs committing to keep its headquarters at 200 Public Square for another 10 years.

US Bank Centre, 1350 Euclid Ave., is being renamed for longtime tenant Cohen & Co., which renewed its office lease for 10 years, too. And Newmark reported CHN Housing Partners is leasing 42,500 square feet for its new headquarters at 3711 Chester Ave. The latter is actually in Midtown, but Newmark considers it as part of the central business district.

“Despite showing a flicker of life in the second quarter with a small amount of positive absorption, the Cleveland office market is still in the negative for the year,” Newmark’s report continued. “Shifting sentiment toward smaller spaces continued to dominate, while limited new rentable construction has enabled lease rates to generally remain on an upward trend. Uncertainty will persist until economic conditions become more favorable.”

The central business district’s ever-optimistic community development corporation was more bullish in citing the latest statistics on Downtown Cleveland’s recovery, released just this week.

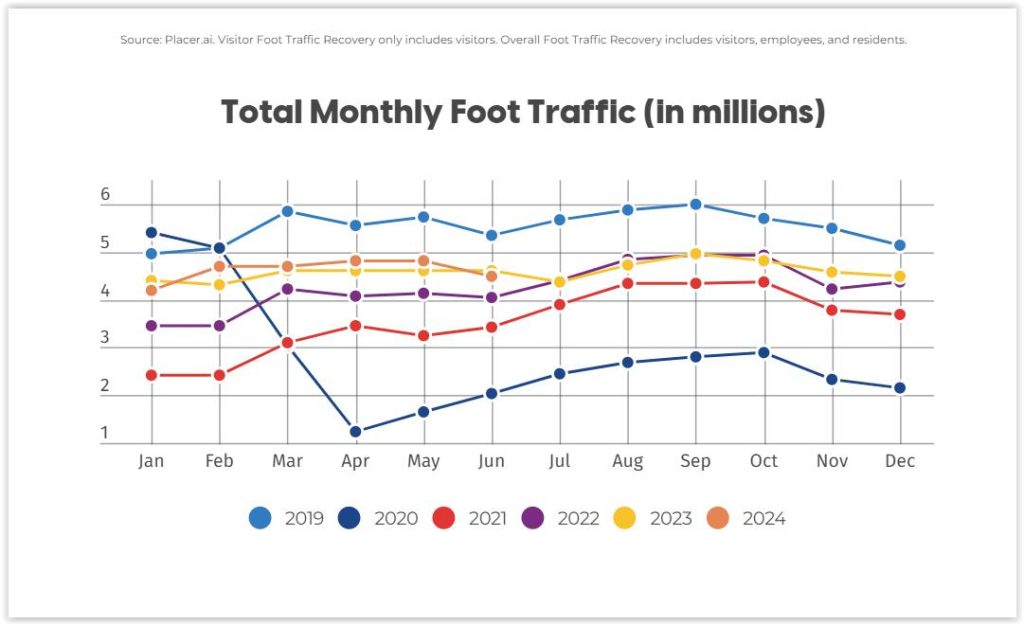

“Downtown Cleveland continues to rise!” Downtown Cleveland Inc. (DCI) proudly announced on social media. “June marked the highest return-to-office rate since the pandemic, reaching 71.9 percent recovery compared to 2019! Overall Foot Traffic (residents, visitors, employees) in June was also up at 85 percent.”

The June 2024 data was released this week on DCI’s on-line Data Dashboard. The data was gathered by Placer.ai which develops market intelligence and trends for numerous clients including non-profit development groups like DCI plus commercial real estate firms, retailers, restaurants, entertainment companies and more.

While nearly 72 percent of office workers have returned to their downtown offices, 81.9 percent of available Class A and Class B office spaces are leased. In other words, the average office building in downtown Cleveland has office workers in them only 59 percent of the time. And that doesn’t take into account Class C office spaces like what are found in older buildings with far fewer amenities, technology and occupancies.

Additional metrics were measured including downtown’s workforce recovery rate which counts office, service and hospitality workers. That number shows that 72.5 percent of workers have returned to their places of employment downtown. Among all people returning downtown — workers, residents and visitors — DCI says that figure has improved to 84 percent compared to pre-pandemic data.

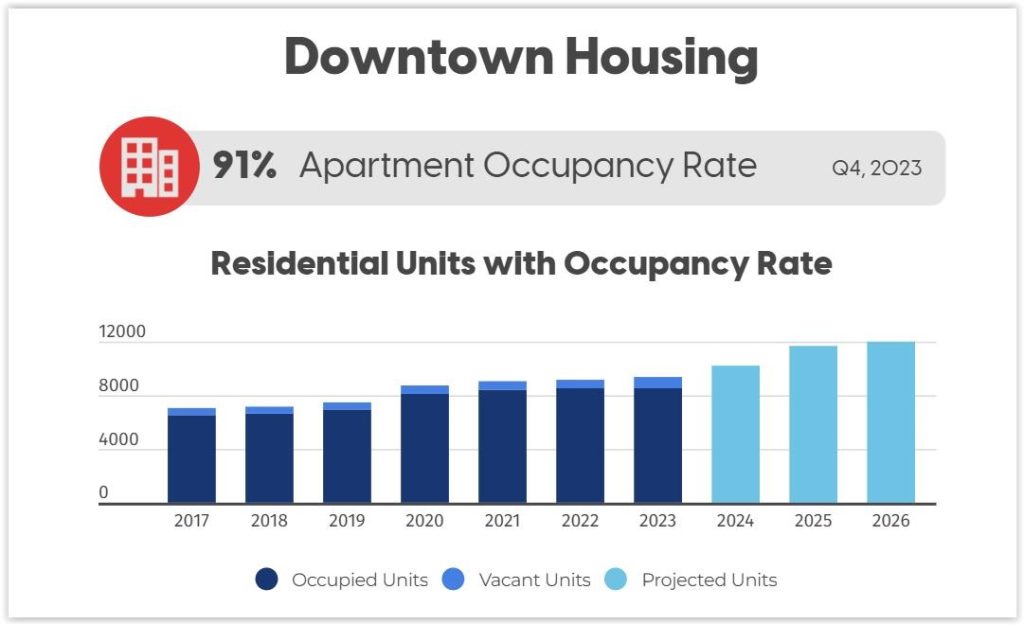

The growing residential population has kept downtown’s pulse up, although it doesn’t fill buildings as densely as office uses do. Downtown’s residential population has grown from 12,000 in 2012 to 21,000 in 2023, according to DCI. Despite that growth, DCI says fourth quarter 2023 occupancy remains solid at 91 percent with rents for a one-bedroom apartment averaging $1,442 and $1,995 for a two-bedroom apartment.

That occupancy rate may take a dip as two large new residential buildings are just now coming online and are adding 671 apartments to the downtown market. One is the new-construction, 23-story City Club Apartments, 776 Euclid, and the other is the converted 16-story office building The Bell, 45 Erieview Plaza. Based on average occupancies, these two buildings alone could increase downtown’s population by nearly 1,000 residents.

Several more office building conversions are in the works, all of them along the office-tower canyon of East 9th Street. In total, they could deliver another 800 apartments and tighten up the office market. Just yesterday, the Cleveland-Cuyahoga County Port Authority provided gap financing for the provision of 227 Marriott-branded residences in the Erieview Tower, built in 1964 as an office building.

Last month, NEOtrans reported that the Rose Building, Medical Mutual’s former headquarters, is proposed to be turned into several hundred apartments and a boutique hotel. And dealmakers are trying to acquire and convert, all in one step, the 333,592-square-foot Ohio Savings Plaza into roughly 250 apartments over ground-floor commercial.

END