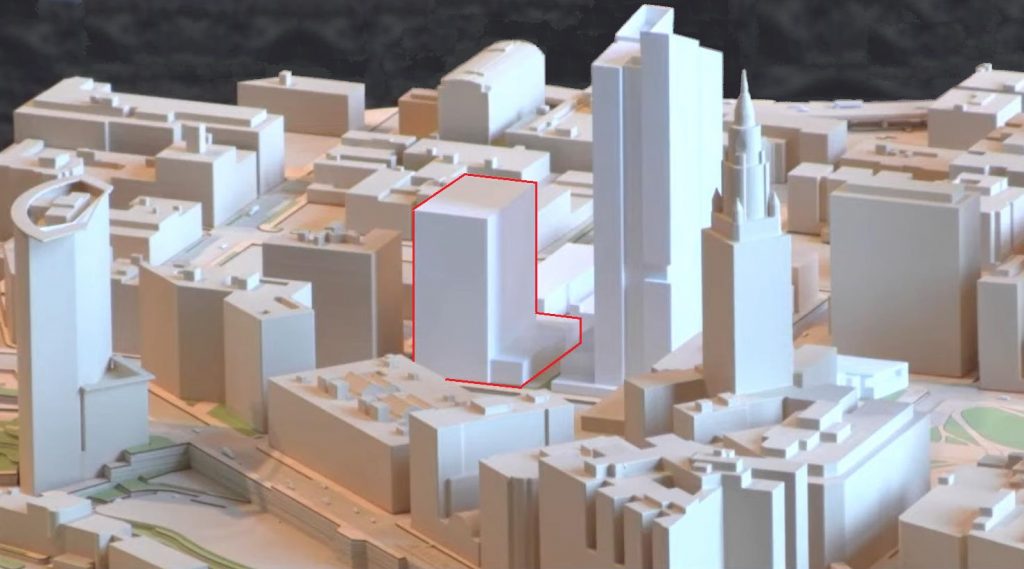

It may look like Sherwin-Williams’ new headquarters tower and a potential concept for a phase two tower in Downtown Cleveland. But it’s actually the Texas Tower in Downtown Houston. Perhaps Sherwin-Williams could build a similar tower for its expected second phase to accommodate its growing office employment (Comprehensive Zoning Services). CLICK IMAGES TO ENLARGE THEM.

Projects on hold due to poor financial liquidity

While the nation’s employment is high and incomes are rising, in many respects, the slowdown in new real estate construction projects is the worst the nation has seen since the credit crunch of 2008-10. Back then, everything stopped. Nothing new was getting built. Things aren’t too different now unless you’re building new data centers, warehouses or small housing projects.

In Greater Cleveland, the situation is much the same. There is a short answer to the tantalizing question: what’s next big project to be built? That answer is: if you don’t already have money for big new construction projects, it’s unlikely anyone is going to lend you that money for the next six to 12 months. It means the next construction crane over Downtown Cleveland may be missing in action for a while.

Big banks aren’t lending for new construction, except for big warehouses and bigger data centers, even if developers have their project’s equity financing lined up. And the many vacant suburban office parks may put the damper on new construction. Some of the many suburban office buildings vacated for remote work may be repurposed for new computer servers or distribution centers to handle all the people working from home and ordering stuff online.

What’s frustrating for many developers is that there’s a tremendous demand for housing they’d like to meet but can’t because lending has been so tight. Most real estate developers and construction firms NEOtrans spoke with said that aren’t actively involved in any large, local construction projects with values of more than $50 million to $75 million because no one is providing construction loans for them.

By contrast, smaller banks are lending for smaller real estate construction projects. Despite that, developers don’t want to take out construction loans now because of the promise of lower interest rates later this year or next. For example, the Krueger Group and partner RHM Real Estate Group could probably get a construction loan right now for phase two of ORRIS, a city-approved, 42-unit, market-rate apartment building in Rocky River because it’s a smaller project.

But why get a construction loan for a $10 million to $15 million project now when interest rates could drop faster by the end of the year than inflation would rise? If ORRIS’s developers get a construction permit from the city, they’d have to get shovels in the ground within six months or the permit expires. So they’re waiting.

For the owners and hopeful redevelopers of the Rockefeller Building in downtown, their situation is more dire. Wolfe Investments and partner Agostino Pintus wanted to convert the 17-story former office building into apartments, shops and a few floors of updated offices. A second phase would have involved demolishing the Rockefeller’s parking garage for a new apartment tower.

Now they have put it back on the market because they can’t get a construction loan for it. And that’s not the worst part. Last month, they were hit by a foreclosure lawsuit on their Euclid Bluestone Associates which in turn owns the Lakeland Commons Apartments in Euclid. County records show they missed payments on a $6.5 million mortgage. Other foreclosures hit Wolfe in Dallas and in Oklahoma City, wrote the Real Deal earlier this month. Principal Kenny Wolfe opened an e-mail from NEOtrans seeking comment but otherwise didn’t respond.

Wolfe, which partnered with Bluelofts Inc. on The Bell — a conversion of downtown’s former Ohio Bell headquarters into apartments — is behind on construction. While pre-leasing has started on-line, there doesn’t appear to be a functioning leasing office or at least anyone answering phone calls. The problem, an article in the Real Deal suggests, is that the market has changed and younger developers like Wolfe don’t remember the lessons of 2008-10.

There are some possibilities, however. Government-funded construction projects are most secure. Last year, Cuyahoga County Council extended a countywide sales tax to pay for a new a new jail facility in Garfield Heights called the Central Services Campus as well as a new Consolidated Courthouse downtown for a combined investment totaling $1.2 billion to $1.5 billion.

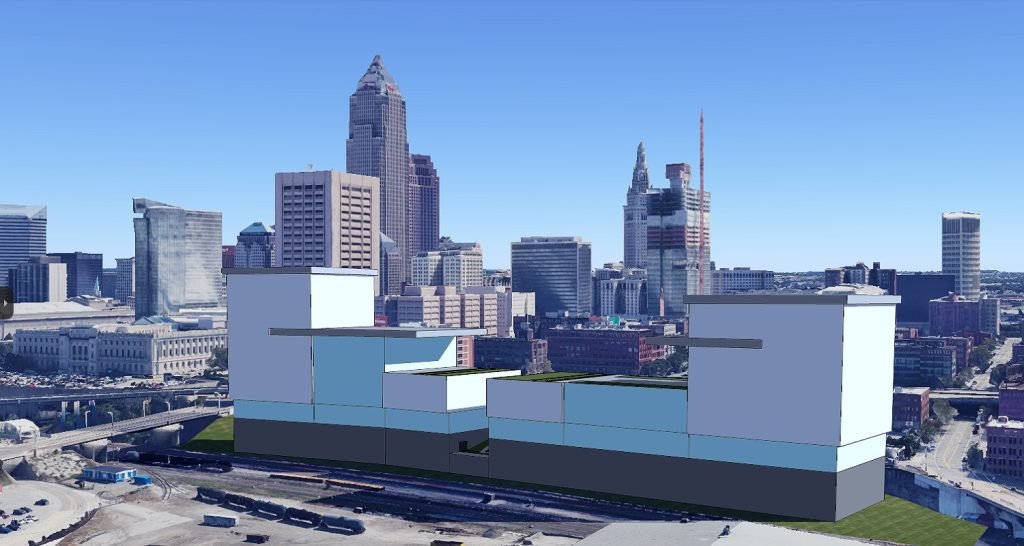

The only all-new construction proposal submitted for the new Cuyahoga County Consolidated Courthouse is a new structure to be built between the Shoreway, lakefront railroad tracks, West 3rd and West 9th streets. This is an unofficial rendering of the potential scale of that development which could meet the county’s space requirements (Ian McDaniel).

The downtown courthouse alone will total nearly 1 million square feet, either in a new building, one of two renovated historical buildings, or by staying put in a renovated and expanded Justice Center. Those county projects are virtually guaranteed to happen. The only question is where the courthouse will be located? The number of optional answers has dwindled to four sites.

Some of the lakefront and riverfront infrastructure projects — like reworked sewers, streets and highways, new riverfront bulkheads and more — may also advance thanks to public funding. One of the biggest such financial boosts was the city’s creation of an urban core tax-increment financing district. It could directly raise hundreds of millions of dollars and leverage much more in state and federal funds.

State funds have already been committed to the riverfront. Now the lakefront may see some dollars. The Ohio House of Representatives recently approved a State Capital Budget with $20 million for the $200 million North Coast Connector project to improve pedestrian access between downtown with the Lake Erie shore.

Last year, the House included $62 million in its version of the two-year operating budget for the land bridge spanning the lakefront railroad tracks and Shoreway highway but the Ohio Senate removed it entirely. It remains to be seen if the Senate will retain the funding this time. City and Cleveland Browns officials say the land bridge is needed whether the football stadium remains on the lakefront or not. The capital budget should be finalized by the start of the state fiscal year July 1.

Next up are big employers with deep pockets, like Sherwin-Williams and the Cleveland Clinic Foundation. Both are building big in Greater Cleveland and have more big projects on the horizon, despite the nationwide credit crunch.

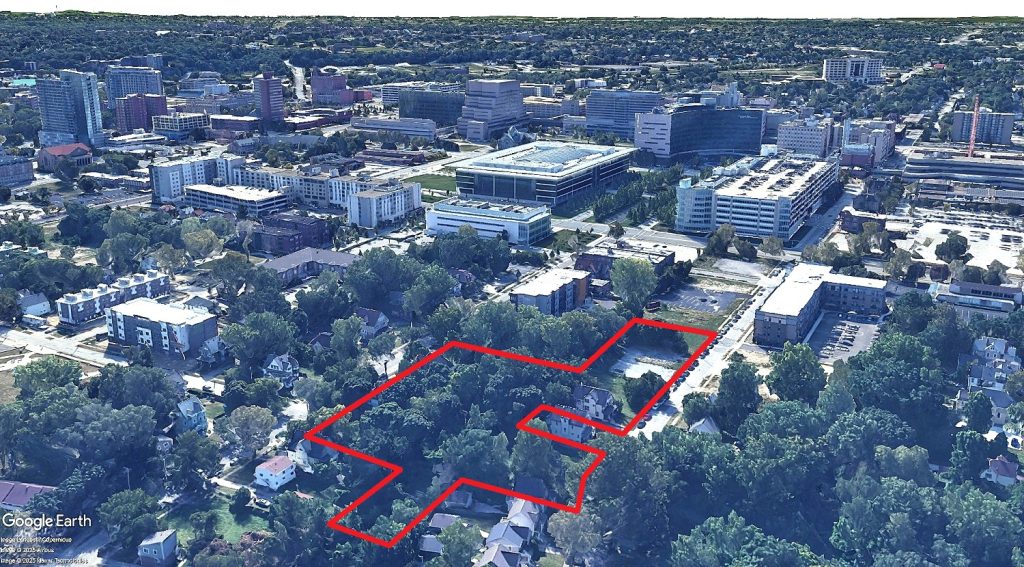

Officially, this is the only massing concept of a second headquarters tower, outlined in red, that Sherwin-Williams has publicly shared. Based on nearby buildings, it is about 20 stories and roughly 250 feet tall. But this was shared in 2021 before the company’s Cleveland office employment grew more than anticipated, adding more than 300,000 square feet of new office space for the company in downtown buildings (TV20).

Sherwin-Williams’ new global headquarters in Downtown Cleveland is reportedly costing it tens of millions of dollars more than projected. Although an updated, detailed breakdown of costs is not available, SHW has said the total project cost of the HQ and its new research center in suburban Brecksville rose from $600 million to about $750 million due to inflation and supply constraints.

The global coatings giant reportedly sold its old and new headquarters buildings plus its old research center downtown for a combined $258.5 million. A source told NEOtrans that the sales were intended to increase its financial liquidity to pursue future development projects. The source didn’t identify which projects.

But there is increasing chatter among Sherwin-Williams’ C-Suite executives about the need for a second headquarters building and more parking at the new headquarters campus west of Public Square. Despite more than 100,000 square feet getting freed up by three law firms moving out of its old headquarters, Sherwin-Williams has had to sublease 212,000 square feet of space in the neighboring Higbee Building to accommodate its fast-growing Cleveland office workforce.

Cleveland Clinic has also endured higher construction costs in its trio of major construction projects at its Main Campus near University Circle. Those are the 1-million-square-foot Neurological Institute, the nearly 300,000-square-foot Sheikha Fatima bint Mubarak Global Center for Pathogen Research and Human Health, and the 150,000-square-foot expansion of the Jeffrey and Patricia Cole Building at Cole Eye Institute. The existing Cole Eye building will be renovated.

Next on the Clinic’s local to-do list is an expansion of Fairview Hospital onto its North Campus, across Lorain Avenue. There, it plans to build a new Moll Cancer Center and medical office building measuring anywhere from 190,000 to 220,000 square feet, plus new structured parking totaling from 450,000 to 600,000 square feet. Cost of the development is estimated at upwards of $150 million, Clinic officials say.

The Clinic and developer Bedrock Real Estate are also anticipating construction will start on the 210,000-square-foot Cleveland Clinic Global Peak Performance Center by year’s end. That will attract the Cleveland Cavaliers basketball team’s practice facility from suburban Independence to downtown’s Cuyahoga River waterfront and host the Clinic’s sports science and wellness programs.

After those projects, things get pretty iffy. Even though financing may not be forthcoming for major-new projects, that doesn’t mean that developers and investors are sitting still. Most are actively involved in getting deals ready for the moment when the market can support them, according to a recent article in the Crittenden Report.

“There will be plenty of capital in the market for construction, however, lenders will be heavily scrutinizing deals,” wrote Crittenden’s Sara Havlena. “Fewer projects, higher rates and regulatory issues have slowed the number of transactions being funded. The high cost of borrowing will also make construction lending more difficult. Banks and life companies will be in the market, although with lower leverage. Watch for more available capital from non-traditional sources to fill the gap.”

Some developers are taking things in bite-sized pieces like the Downtown Lakewood development on the site of the former city-owned hospital. Casto Communities and North Pointe Realty are taking the $100-million-plus project in chunks of $30 million or less that can be financed in this market, thanks to a significant new grocery store tenant that is interested in signing on to the project.

Keep an eye on the rest of Bedrock’s planned riverfront development which has been on hold due to the tight, unfavorable financial market. The first phase — an office building for Rocket Mortgage, a boutique hotel and new residential — was put on the shelf while the joint Clinic-Cavs facility was advanced separately as Phase 1A. The moment the financial market begins to loosen up, watch for news on Phase 1B and perhaps more.

Bedrock has received lots of interest in its proposed riverfront development, between Tower City Center and the Cuyahoga River. But that’s not the only place it has apparently received interest, sources said. To the east, in downtown’s Gateway District, the former nuCLEus site bought by Bedrock is also attracting attention by some major league players.

A new Cleveland Cliffs headquarters may not be dead either because Cliffs’ bid to acquire rival US Steel may not be dead. Both President Joe Biden and challenger Donald Trump said they would block US Steel’s acquisition by Japan-based Nippon Steel. Sources have told NEOtrans that if Cliffs is able to acquire US Steel, a new, larger headquarters would be sought by the combined company in Downtown Cleveland or possibly at a suburban campus.

END