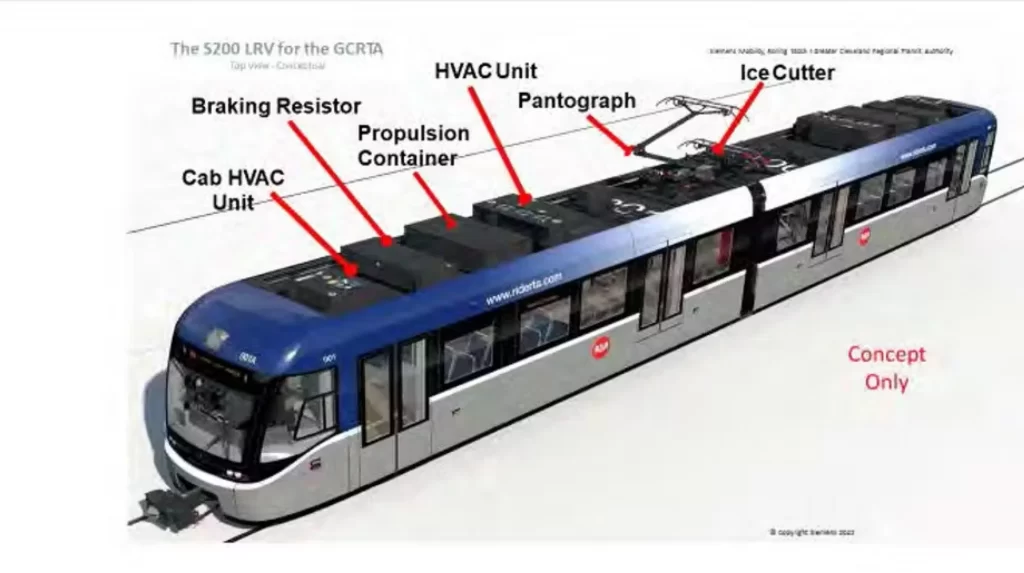

The Greater Cleveland Regional Transit Authority’s new railcars will start coming off the assembly line in California next year. But some of the components are manufactured overseas and subject to new federal tariffs, thus increasing costs of the final product. This image shows some of the Siemens railcar’s features but are not necessarily which ones are subject to tariffs (Siemens Mobility). CLICK IMAGES TO ENLARGE THEM.

Planning for rail station retrofits to start

For the first time in more than four decades, the Greater Cleveland Regional Transit Authority is replacing its rapid transit trains — the oldest fleet of railcars used by any U.S. transit agency. But that rare $450 million opportunity to modernize its rail system could end up 10 percent short of its goal.

Tomorrow, at its regularly scheduled meeting, GCRTA’s Board of Trustees is expected to vote for a resolution to exercise a $36 million option with railcar manufacturer Siemens Mobility to add another six railcars to its order. GCRTA had hoped to add 12 more railcars with this action to complete all available options and bring the order to its maximum of 60 railcars. They are due to enter service in 2027.

“A presentation was made to the Aug. 5, 2025 Committee of the Whole to take a resolution authorizing exercising an option to purchase up to 12 additional railcars,” wrote GCRTA GM and CEO India Birdsong Terry in a Sept. 18 memo to the board. “Upon further discussions, staff has decided to reduce said quantity to up to six high-floor light-rail vehicles.”

“This modification is due to pending negotiations and uncertainty regarding impacts related to tariffs and schedule, among other items,” she continued, adding that GCRTA intends to complete the 60-car order. “This action will result in a remaining quantity of six high-floor light-rail vehicle options to exercise on the contract.”

Under GCRTA’s contract with Siemens Mobility approved in 2023, the railcar builder will manufacture and deliver another six of the remaining railcars under the contractual base price of $5,166,336.00 plus an inflationary price increase based on a producer price index for transportation equipment and a national labor index.

Those will be calculated at the time of final assembly starting next year, resulting in a new estimated price per railcar of $6 million. That amount is attributable to all the railcars which are now under assembly at Siemens Mobility’s U.S. railcar manufacturing plant in Sacramento, CA.

This change order will result in a new total contract amount not to exceed $344,389,850 including railcars, spare parts and training, GCRTA staff said in a Sept. 18 summary. Roughly another $100 million will go toward planning, design, management and construction of rail infrastructure modifications — mostly stations and maintenance facilities — to accommodate the new trains.

GCRTA Public Information Office Robert Fleig did not respond to an e-mail request from NEOtrans seeking more information on how the 10 percent railcar reduction, if left unfilled, could impact the transit system and its customers. But a local transit researcher offered some insight.

“The impact of a reduced fleet may be more felt during special-event services which traditionally see a notable increase in capacity over regular services,” said researcher Noah Belli. “The reduced fleet could still supply three-car Red Line train sets and two-car Blue/Green Line train sets at existing frequencies for special event service, however the margins would likely be thinner than they are today.”

Long term, however, the reduced fleet size may be felt as reliability decreases towards the end of the vehicle’s service life sometime in the 2050s, he said. As GCRTA has experienced, the older your trains are, the more time they must spend in the shop for inspections, maintenance and repairs. But the tariff situation is a sudden change exacerbating a longstanding situation.

Siemens’ U.S. plant exists to meet federal Buy America laws for the German-based company as do others for foreign railcar builders like Alstom, Kawasaki, Hitachi and CRRC Corp. No U.S.-based companies have manufactured passenger railcars from scratch since the 1980s. Several U.S. companies make freight rail cars, however.

Siemens and other companies import parts for installation into trains that are assembled in the USA. The importer, typically a U.S.-based affiliate of the foreign parent company, is responsible for the payment at the point of entry to the U.S. They pass the cost on to the buyers — U.S. railroads and transit agencies — through higher prices that are permitted in a contract.

Grand View Horizon, a research firm, estimates the U.S. railroad manufacturing market generated $94 billion in revenues last year and is forecast to grow to $130 billion in 2030. It said “passenger rail is the most lucrative type segment registering the fastest growth during the forecast period.” It’s why Siemens is building a second passenger railcar and locomotive assembly plant in Lexington, NC.

But many U.S. railroads and transit agencies buy railcars in large spurts every 20 to 30 years, rather than in smaller orders every few years as is typically done in Europe and the Pacific Rim. Furthermore, each railcar type is often a unique fit to its customer’s rail system, making it more expensive for manufacturers to retool their plants for each order.

GCRTA is trying to conform to the market by ordering an off-the-shelf train design called the S-200, used in San Francisco and Calgary, Canada. That means that GCRTA has to modify the infrastructure of its two-mode light- and heavy-rail system with standardized train widths and station platform heights so the new trains can use all lines.

To that end, GCRTA’s board will consider two other resolutions tomorrow to authorize staff to hire two firms to provide architectural and engineering services to widen certain low-level light- and high-level heavy-rail station platforms.

Fourteen light-rail stations with mini-high platforms like those seen here at Farnsleigh in Shaker Heights are due to be retrofitted so they can reach the new, narrower trains that will soon by plying the rails. Another 16 light-rail stations, all within Shaker Heights, are due to have new mini-highs added (NEOtrans).

One resolution will authorize hiring R.E. Warner & Associates Inc. of North Olmsted for $586,608 worth of design work to widen the platforms at 14 light-rail stations along the Blue and Green lines linking Shaker Heights with Downtown Cleveland. That includes modifying so-called “mini-high” platforms for ADA access to the narrower trains.

This does not include 16 stations within Shaker Heights that don’t already have mini-highs but are planned to get them. Improvements at eight Blue Line stations are funded; improvements at eight Green Line station are not.

GCRTA has 34 stations along its Blue/Green lines, but three stops are shared with the Red Line which has high-level platforms. One light-rail station will be eliminated when the West 3rd and East 9th stations on the Waterfront Line are combined into a single station at a planned multimodal transportation center in the North Coast Connector project.

The other resolution will authorize the hiring of Osborn Engineering Company of Cleveland for $746,188.98. Osborn will design platform replacements at four stations along the heavy-rail Red Line between Hopkins International Airport, Downtown Cleveland and Windermere in East Cleveland.

“The objective of this project is to replace the existing platforms to match current widths and provide widened edge extensions to accommodate the new railcars at Superior, Cedar/University East, West Boulevard, and West Park Rapid Transit Stations,” the proposed resolution states.

Last spring, crews installed a new platform at the West 117th-Madison station at the Cleveland-Lakewood border. Four more stations on the Red Line are due to get new platforms and foundations in 2027 in preparation for the new railcars. The new platforms will be designed to accommodate edge extensions for the new, narrower trains (GCRTA).

The platform edge extensions will be pre-manufactured so they can be quickly anchored to all 18 of GCRTA’s existing Red Line stations. However, the resolution states that those four stations lack anchorages and foundations for accommodating the extensions. It also gave insight into how the modification work will impact services and operations.

“The work to replace and widen the platforms will be performed in a phased sequence,” the resolution noted. “The first phase is to replace the existing platforms

station-by-station using single tracking and/or a weekend shutdown. The second phase is to widen each with a pre-manufactured edge extension, with installation to occur within two nine-day shutdowns.”

Belli gave a presentation called “Reboot the Rapid” Sept. 8 to the nonprofit advocacy group All Aboard Ohio on how the new trains, if operated on 20-minute frequencies on each line routed through GCRTA’s main station Tower City downtown to different endpoints, could dramatically increase services within the existing 33-mile rail system.

“Many expanded service options, including those that would increase service by about 50 percent across the system, will still be able to be comfortably met with a slightly reduced fleet size,” Belli said. “Any reduction below a 54-vehicle fleet would begin to notably limit service expansion options.”

A third resolution on tomorrow’s board agenda will authorize the hiring of RailWorks Track Services, LLC of North Jackson, OH to rebuild the Blue Line tracks, signals and electrical systems at the Warrensville Station for $11.2 million. The station’s platform, waiting areas, lighting and landscaping were previously authorized for $6.7 million, bringing total station costs to nearly $18 million.

END