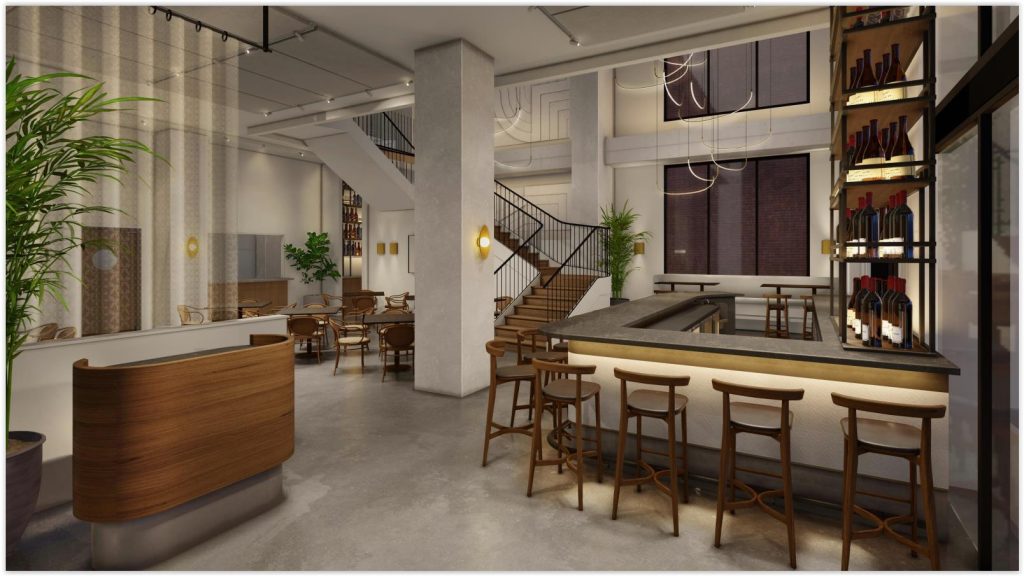

As the only application for a downtown Cleveland project, the Playhouse Square Foundation requested $1.95 million to help offset the cost of renovating three buildings it owns, pictured here. The properties start at 1317 Euclid Ave., just east of the storefront at the corner of Euclid and East 13th Street with the big Playhouse Square sign that could be strengthened to support a vertical addition of up to eight more stories (Google). CLICK IMAGES TO ENLARGE THEM

One Downtown Cleveland TMUD requested

One of the favorite past-times among some Northeast Ohioans is to complain that too much of their state tax dollars are going to the rest of the state and not enough to Northeast Ohio. But if you don’t ask for anything, you don’t get it. That’s the case when it comes to the latest round of Transformational Mixed Use Development (TMUD) tax credits. Northeast Ohio TMUD applications represent only 10.8 percent of the total dollar amount requested statewide for Ohio’s fiscal year 2024 round and only one downtown Cleveland project was submitted. Ironically, the TMUD program was the brainchild of a Cleveland developer to encourage more downtown Cleveland projects.

NEOtrans was able to secure from the Ohio Department of Development an early release of TMUD applications for the Ohio FY 2024 round. The application deadline was Sept. 8. While it shows the cities, addresses, applicant names and tax credit dollar amounts requested, there was no detailed description of the projects attached. Because the TMUD applicant list was sent on late Friday afternoon, NEOtrans was unable to get calls and e-mails returned from applicants to learn more details about their projects.

What the complete list of applicants, posted at NEOtrans’ Parlor (accessible only to NEOtrans members, sponsors and advertisers), does show is that $231.4 million in TMUD credits were requested for projects in and within 10 miles of Ohio’s six major cities having 100,000 or more population (Akron, Cincinnati, Cleveland, Columbus, Dayton and Toledo). An additional $53.9 million was requested among general projects elsewhere in Ohio. That $285.3 million total is a big drop from the $417.7 million in total credits sought in the TMUD program’s first year of 2022. Unless the General Assembly renews it, next year is the last of the four-year TMUD program.

In Northeast Ohio, $30.05 million was requested for major city projects, with none from Akron. A total of $8.9 million was sought among general applications in smaller Northeast Ohio cities, namely Canton, Medina and Youngstown. There was no request from Bedrock Real Estate to advance the rest of its riverfront development, or Bridgeworks to shore up its construction financing, or by Trebilco to advance its Westinghouse redevelopment.

Some developers have put projects on hold, including Harbor Bay which won’t seek phase two of Intro in Ohio City until interest rates fall and lenders open up again. A TMUD wouldn’t improve the fiscal calculus enough for them to proceed, said Harbor Bay Hospitality President Dan Whalen. See a complete list of Northeast Ohio TMUD applicants below.

Compare Northeast Ohio’s $39 million total of TMUD requests to the $101 million being sought for Cincinnati projects, including the only $40 million max credit application — for Portman Holdings’ new, $470 million convention center hotel. There was one general application for the rest of Southwest Ohio outside of Cincinnati — a $15.6 million request for the 50-acre East End development in Middletown. In Columbus, there were $77.6 million in TMUD applications and another $23.4 million among other Central Ohio communities more than 10 miles from Columbus.

Toledo had just one application — $18.3 million for the Four Corners project downtown. And in Dayton, an identical $18.3 million in requests were submitted, divided among two downtown Dayton projects — the Arcade and Delco Lofts redevelopments.

A complete list of Northeast Ohio TMUD applications follows, showing the project name, city, applicant, project address(es), and credit amount requested:

MAJOR CITY PROJECTS

- Cain Park Village Transformational Mixed Use Development; Cleveland Heights.; WXZ CPV LLC; 1908 S. Taylor Rd.; $14,600,000.

- Downtown Solon; Solon; JJJ Real Estate LLC; 32811 Aurora Road; $2,000,000.

- Playhouse Square; Cleveland; Playhouse Square Foundation; 1307-1317 Euclid Avenue, 1365-1375 Euclid Avenue, 1407-1501 Euclid Avenue; $1,950,000.

- The Van Aken District; Shaker Heights; Van Aken F1 LLC; Van Aken Boulevard, Farnsleigh, Warrensville Center Road;$1,500,000.

- Valor Acres Phase I; Brecksville; VA LAND, LLC; NW Corner of the Intersection of Miller Road and Brecksville Road; $10,000,000.

GENERAL PROJECTS

- 20 Federal Place; Youngstown; 20 Federal Place LLC; 20 W. Federal Street; $6,252,872.

- Harter Bank Building/Key Bank Annex. Canton; DDC Canton LLC; 126 Central Plaza N; $660,750.

- Jefferson Medina Redevelopment; Medina Township; Jefferson Medina LLC; 4271, 4261 and 4271 Pearl Road. The 2 parcels are adjacent, running from Pearl Rd on the west end, across Jefferson ST, parallel to E. Reagan Parkway to the east; $2,000,000.

In Cleveland Heights, Cain Park Village is a mixed-use district extending for a half-mile along on South Taylor Road from Severance Town Center, through the Stadium Square Historic District to the sledding hill at Cain Park. WXZ Development of Fairview Park plans to renovate the Taylor Tudors for $37 million which received historic tax credits earlier this year, possibly to be followed by the Taylor Road Synagogue which is in foreclosure. WXZ also plans to raze and redevelop Taylor Commons as a mixed-use complex of 208 apartments, 24 townhomes, a 312-space parking deck, and 37,000 square feet of ground-floor commercial space. Total investment is estimated to approach $150 million.

Downtown Solon is a redevelopment of the vacated Liberty Ford car dealership. The development team includes RHM Real Estate Group, Pride One Construction, NORR architecture, The Krueger Group and The Passov Group. Much of the 8.9-acre site was rezoned by voters in 2019 to support mixed-use development. Downtown Solon is proposed to have 200-plus apartments above 20,300 square feet of retail and restaurants, a 14,000-square-foot food hall, a 100-room hotel and a public plaza for hosting community events. The total investment is estimated to exceed $90 million. It’s this project’s second try at a TMUD credit.

Playhouse Square Foundation plans to renovate three downtown Cleveland buildings that, while not contiguous, are all part of a continuous row of buildings it owns along the north side of Euclid Avenue. The smallest of these buildings is the two-story, 30,000-square-foot 1317 Euclid which will have all-new base building infrastructure to potentially support a vertical addition of up to eight new stories. The other buildings included in the application are the 243,035-square-foot Idea Center and the 172,362-square-foot Bulkley Building which is being renovated with apartments and modernized offices.

The purpose of the TMUD request by the Van Aken District development team is unknown. The team is led by RMS Investment Group, LLC and its President and CEO Jonathan Ratner. He and Shaker Heights Planning Director Joyce Braverman did not respond to e-mails from NEOtrans seeking more information prior to publication of this article. A TMUD was sought last year for the construction of the two high-rise Farnsleigh Apartment towers but the developers instead found their public financing salvation through the city. Projects that are already under construction are eligible for TMUD credits. Development may also expand across Warrensville Center Road to the former Qua Buick property.

In Brecksville, on the former site of the Veterans Administration Hospital near the interchange of Interstate 77 and Miller Road, Valor Acres is probably known best as the new home of Sherwin-Williams’ new 600,000-square-foot research and development center. But that facility is the anchor for a larger, mixed-use development that will have 200-plus luxury apartments, a 120-room upscale hotel, plus 150,000 square feet of restaurants, retail and entertainment. It will also feature 200,000 square feet of office space, including the new headquarters for its developer, DiGeronimo Companies and its affiliates Independence Construction and Independence Excavating. Continued development of Valor Acres depends on public financing.

The TMUD program is on Monday’s agenda for the Ohio Tax Credit Authority board which approves or rejects staff recommendations for TMUD award winners. But it’s too soon for the winners to be announced. Because the deadline for submitting the TMUD applications was only two weeks ago, it may be at least four to five months before the award winners are announced. Last year, the deadline was July 8 and the award winners were announced Dec. 7, 2022. If a similar interval occurs this round, the winners may not be announced until early February.

“Award winners will not be announced at next week’s meeting,” Megan Imwalle, public information officer at the Ohio Department of Development, told NEOtrans on Friday. “The TMUD item has been on the agenda the past several meetings to cover any third-party authorization and alternative calculation requests from prior recipients that arise.”

Up to $80 million in TMUD tax credits are available per year to major city projects and at least $20 million for general projects. To be eligible for a TMUD credit, a major city project must be valued at $50 million or more, rise at least 15 stories high or measure more than 350,000 square feet among contiguous properties under ownership by the applicant. General projects are eligible if they are new or at least 51 percent vacant and two or more stories tall or are at least 75,000 square feet among connected buildings. A TMUD cannot exceed 10 percent of the project’s costs. It is intended to fill a gap in existing project financing and the tax revenue generated by the project must exceed 10 percent of the development costs.

END